90% respondents say ESG considerations shape corporate real estate strategies – Knight Frank survey

- More than 50% of respondents are taking tangible steps towards ESG integration, either by establishing ESG plans or net-zero carbon targets.

- 40% of organisations aim to achieve their targets by 2030, while another one-fifth have set their sights on longer term plans, extending beyond 2030 to 2050.

- While “financial considerations continue to remain on the radar, the adoption of ESG practices is increasingly playing a key role in long-term planning”.

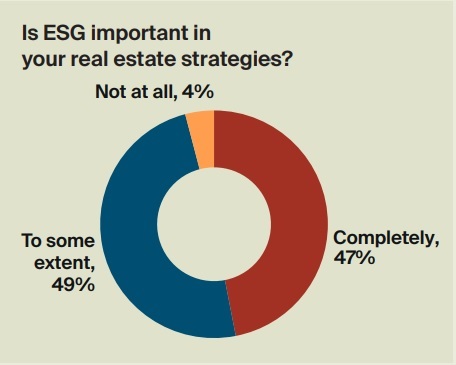

KUALA LUMPUR (July 3): More than 90% of respondents have indicated that environmental, social and governance (ESG) considerations play a role, either fully or partially, in shaping their corporate real estate strategies, a survey by Knight Frank Malaysia revealed.

In its second white paper survey entitled “The Age of ESG: Futureproofing Corporate Real Estate with Sustainability”, Knight Frank Malaysia also found that more than 50% of respondents within the corporate real estate community are taking tangible steps towards ESG integration, either by establishing ESG plans or net-zero carbon targets.

Of these, 40% of organisations aim to achieve their targets by 2030, while another one-fifth have set their sights on longer term plans, extending beyond 2030 to 2050.

An interesting note is that less than 20% of occupiers claimed that ESG features have no impact on their decisions when choosing a workspace, whereas the remaining 80% expressed that ESG features influence their preference for a workspace.

“This influence may manifest in various ways, such as a willingness to pay a premium for ESG-compliant buildings, seeking a discount for non-compliant ‘brown’ buildings, or outright rejecting such buildings. Key green offices desired by both occupiers and landlords typically prioritise features that contribute to environmental sustainability, resource efficiency, occupant well-being, and transparent management practices,” stated the paper.

The findings of the survey “accentuate a significant and robust embrace of the ESG agenda among the corporate real estate community in Malaysia”. A majority of respondents demonstrate “a profound recognition of the importance of ESG principles, with nearly half considering it an integral component of their overarching business strategies”.

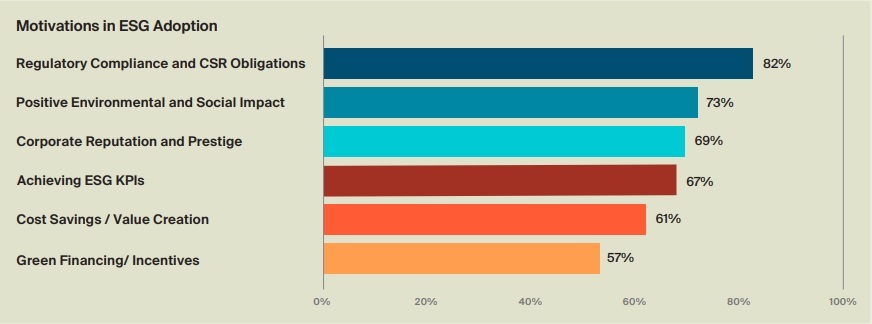

Knight Frank stated that while “financial considerations continue to remain on the radar, the adoption of ESG practices is increasingly playing a key role in long-term planning”. Organisations are “cognisant of the potential financial benefits but understand that these gains may take time to materialise. This is a testament to their strategic outlook and recognition of the wider societal and environmental implications”.

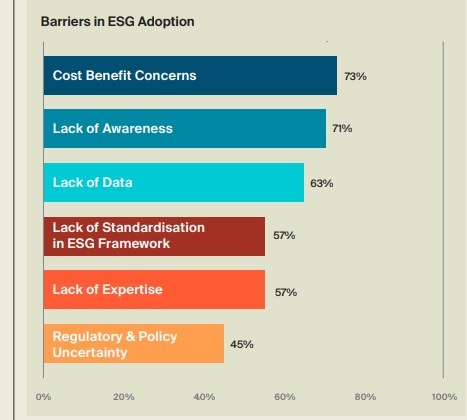

But there are still challenges ahead. Cost concerns, lack of awareness and insufficient data are key obstacles hampering wider adoption. “Corporate real estate stakeholders recognise the importance of comprehending the financial implications and gaining a deeper understanding of ESG principles to overcome these barriers successfully,” it states.

Lukewarm interest in green lease

A green lease is a lease agreement that incorporates specific clauses, wherein the owner and occupier mutually undertake distinct responsibilities and obligations concerning the sustainable operation and occupation of a property. “Only 20% of respondents expressed interest in adopting green leases, indicating lukewarm enthusiasm for the concept despite its potential for long-term financial and environmental benefits through reduced operating expenses, improved occupant health and productivity, and enhanced value of the building,” Knight Frank revealed.

“Challenges to adopt green leases include lack of awareness and understanding, differing priorities between tenants and landlords, and perceived uncompetitive first costs. Education and exchange of best practices will be necessary to narrow the awareness gap and align expectations regarding the costs and benefits of green leases,” it added.

Sustainable fit-outs trending

Sustainable fit-outs are “trending as occupiers become increasingly aware that sustainable building practices necessitate collective efforts at all levels".

Knight Frank Malaysia highlighted its office relocation in mid-2022 to Menara Southpoint, “a GBI-certified MSC-status office building in Mid Valley City" that incorporates various ESG elements throughout the fit-out process.

“The new workplace design prioritises sustainability, health and well-being, by incorporating elements such as biophilia, acoustics, air quality, natural lighting and layout.

“The office utilises a thoughtful selection of interior finishes, furnishings and workspace equipment that are made from recyclable materials, aligning with principles of the circular economy and sustainable resource management.”

It added that these “interior elements are certified to ensure low chemical emissions and have been verified for their environmental and sustainability performance. Notably, the office features a preserved moss feature wall and a green 'boulevard' at the entrance, enhancing indoor air quality, mental energy, and aesthetic appeal”.

Decarbonising through retrofits

ESG principles are progressively becoming an integral part of business operations. “We anticipate that ESG agenda will propel sustainable building practices within corporate real estate strategies, spanning beyond new constructions to include retrofits and fit-outs,” stated Knight Frank.

According Knight Frank, retrofitting “not only addresses the reduction of carbon emissions but also inherently embraces the principles of the circular economy. By repurposing and optimising existing structures, retrofitting prolongs the life cycle of the embodied carbon within existing buildings”.

“Despite prevailing challenges like limited awareness and data availability, forward-thinking organisations that embrace ESG principles proactively will secure a distinct competitive advantage,” it said.

A promising trend

“The willingness of occupiers to pay a premium for sustainable workspaces indicates a promising trend, while the nascent concept of green leases requires greater awareness to gain traction in the industry,” said Knight Frank Malaysia group managing director Keith Ooi.

“The industry's shift towards green building practices further emphasises the need to prioritise energy efficiency, sustainable certifications and effective resource management. By leveraging these findings, stakeholders can navigate the challenges, capitalise on the opportunities and drive the industry towards a future where ESG integration becomes the standard practice in the real estate sector,” he added.

Follow Us

Follow our channels to receive property news updates 24/7 round the clock.

Telegram

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.