Beyond just yields: What is the rental trend for KL city centre today?

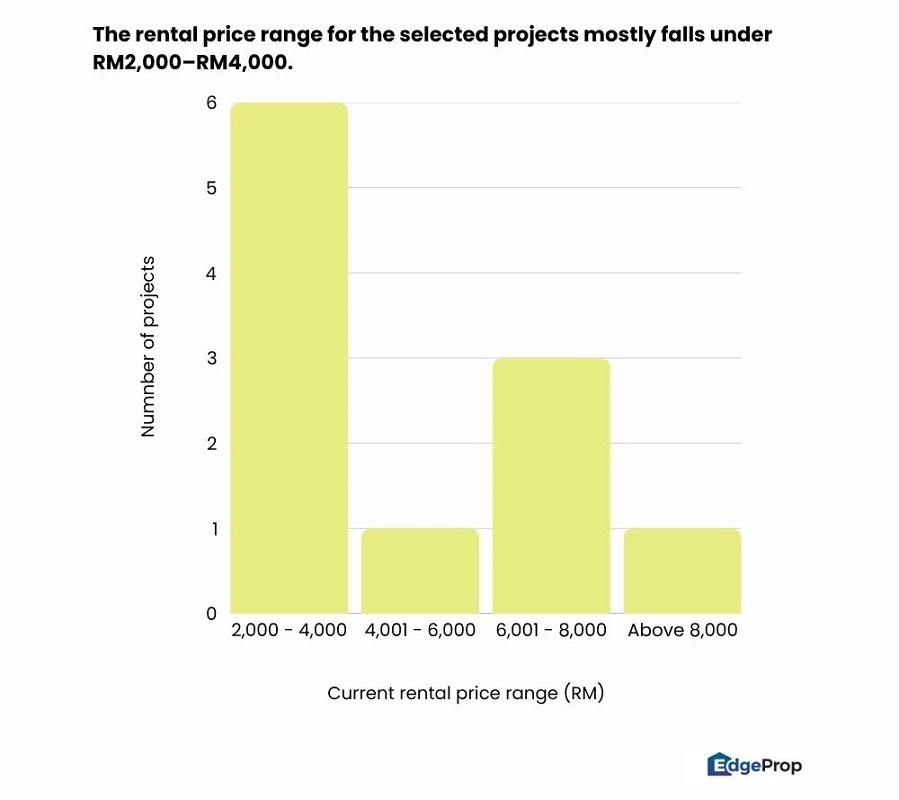

- Among the analysed projects, six have median asking rental prices that mostly fall under RM2,000–RM4,000, while three projects feature median asking rental prices ranging RM6,001–RM8,000.

PETALING JAYA (July 10): The Kuala Lumpur city centre (KLCC), being the heart of the nation’s capital city, has naturally drawn strong demand for its properties. Deemed as a "blue-chip" property investment in Malaysia, it promises both capital growth and high rental income. Hosting not only the iconic Petronas Twin Towers but also multiple luxury hotels, prime shopping malls, and top-tier corporate offices, the area symbolises exclusivity and prestige.

But does this remain an unbeatable proposition today? What is the current market trend in the KLCC area? What kind of rates are rentals going for and what unit sizes fetch the best yields? Is high rental return an accurate marker for high appreciation value here?

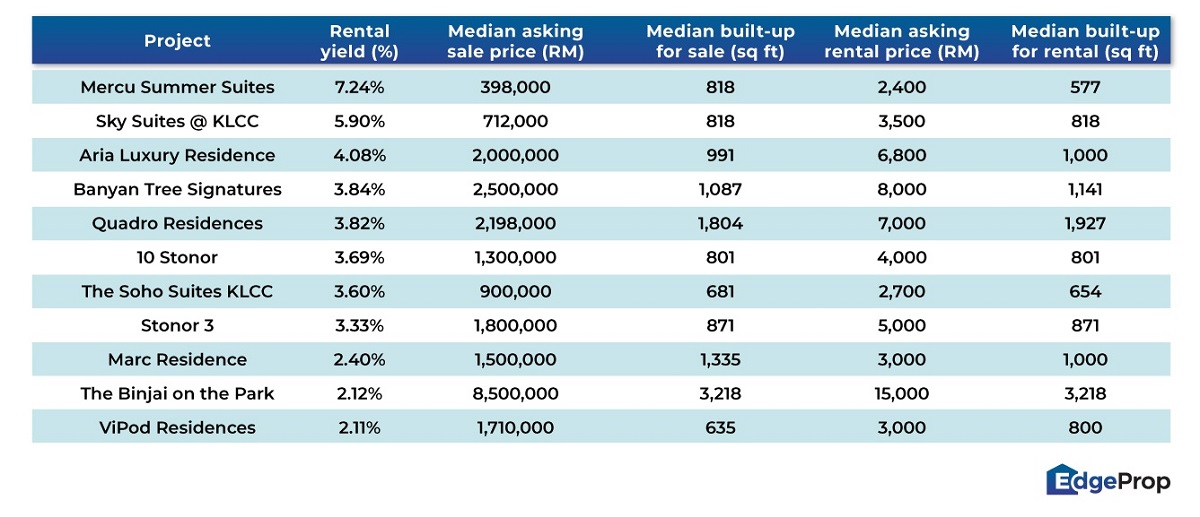

Utilising EdgeProp EPIQ tools, we have analysed the rental yields* of 11 projects. These projects were selected because their active sale listings (a minimum of 100) as of May 31 achieved the highest viewer percentages, as measured by EdgeProp's tools. We also identified transaction price changes using data recorded from 2021 to 2024 to understand each project's valuation.

Mercu Summer Suites leads rental yields* in KLCC

Topping the rental yield* list is Mercu Summer Suites, a leasehold high-rise development completed in 2015 by UEM Sunrise Bhd. It comprises a total of 400 residential units, alongside a mix of commercial office suites. The units cater to various needs, primarily offering studio, one-bedroom, and two-bedroom layouts, with built-up areas typically ranging from 469 to 1,347 sq ft.

With a median sale price of RM398,000 and a median asking rental of RM2,400, this serviced apartment boasts a rental yield* of more than 7%.

Meanwhile, at the bottom of the rental yield* list is ViPod Residences. Developed by Monoland Corporation Sdn Bhd, this high-rise development, completed in 2013, comprises a total of 440 units, with built-up areas ranging from 635 to 1,350 sq ft.

This freehold condominium offers a 2.11% rental yield*, based on a median sale price of RM1,710,000 and a median asking rental of RM3,000.

Ideal unit sizes and pricing strategies in KLCC rentals

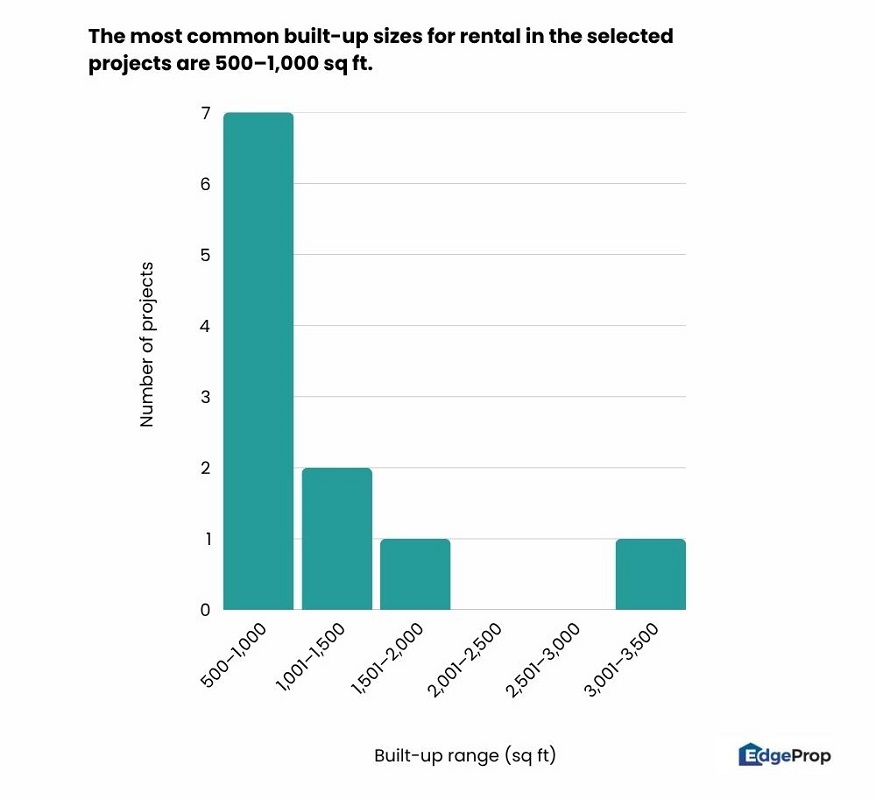

You might be wondering what the typical rented unit size and pricing strategy is in KLCC. According to the selected projects, most of the units for rent in KLCC fall within 500 to 1,000 sq ft, with studio or one- to two-bedroom unit types primarily accounting for the bulk of the rental listings.

Listings for units with spacious sizes exceeding 2,000 sq ft in this area are few. The only exception is The Binjai on the Park, which boasts a median built-up area of 3,218 sq ft and a median asking rental price of RM15,000.

Among the analysed projects, six have median asking rental prices that mostly fall under RM2,000–RM4,000, while three projects feature median asking rental prices ranging RM6,001–RM8,000.

It is worth noting that the top two projects with the highest rental yields* in the list, Mercu Summer Suites and Sky Suites @ KLCC, post among the lowest median rental rates at RM2,000–RM4,000. Both also show the lowest median asking sale prices with relatively smaller built-up areas.

High yield doesn't always mean high appreciation

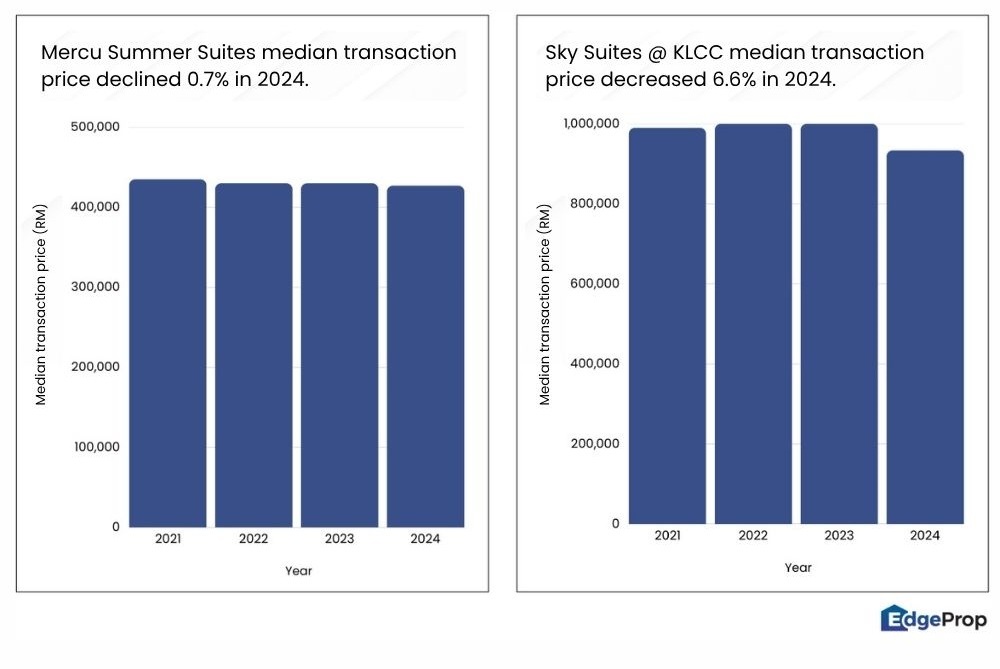

Interestingly, a high rental yield* doesn't guarantee significant appreciation in property values. The transacted prices for properties with high rental yields* in the list show minimal changes in capital appreciation compared to those with lower yields.

The median transaction prices for Mercu Summer Suites have remained relatively stable over the past few years. In 2020, the price was RM429,000. It saw a slight increase to RM435,000 in 2021, before experiencing a minor dip and stabilising at RM430,000 in both 2022 and 2023.

The latest data for 2024 shows a marginal decrease of 0,7% to RM427,000, indicating a consistent trend with minimal variance in transaction price changes over the past years.

Sky Suites @ KLCC, with a rental yield* of 5.9% also shows a similar trend. Developed by Monoland, this freehold serviced apartment was completed in 2019. It comprises a total of 986 units, with built-ups ranging from 649 to 887 sq ft.

Its median transaction price remained relatively stable from 2021 to 2023, with only a 1% increase during those years. However, in 2024, the property's transaction price dropped 6.6% to RM934,000.

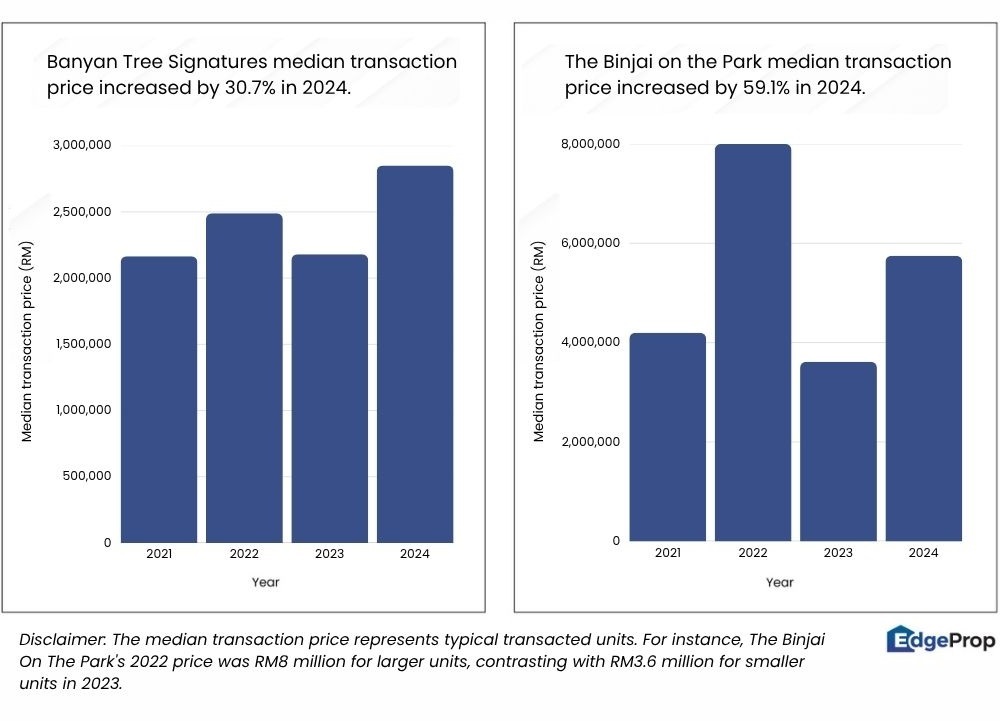

Meanwhile, Banyan Tree Signatures, with a lower rental yield* of 3.84%, shows a different trend. The luxury freehold serviced residence, developed by Pavillion Group, features a total of 542 units, with built-ups ranging from 1,051 to 3,379 sq ft.

Median transaction prices of this project saw an increase of 30.7% last year to RM2,850,000, which is also a new high in the past four years.

Meanwhile, the ultra-luxury condominium, The Binjai on the Park, developed by Layar Intan Sdn Bhd (a subsidiary of KLCC Holdings), also shows a similar trend.

This exclusive project comprises a limited 171 units, with sizes varying significantly from standard units (typically 2,228 to 3,757 sq ft) to super penthouses (approximately 4,230 to 19,180 sq ft). Despite a median rental yield* of only 2.12%, its median transaction price saw a 59.1% increase in 2024.

* Please note that the rental yield is calculated based on the median rental rates and sale prices derived from the respective listings, which may not necessarily be of equal data points nor of the same unit size. Nevertheless, it represents a close estimate.

Does Malaysia have what it takes to become a Blue Zone, marked by health and longevity? Download a copy of EdgeProp’s Blueprint for Wellness to check out townships that are paving the path towards that.

Never miss out

Sign up to get breaking news, unique insights, event invites and more from EdgeProp.

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.