Still possible for Mah Sing to meet FY16 sales target

Mah Sing Group Bhd (Aug 26, RM1.62)

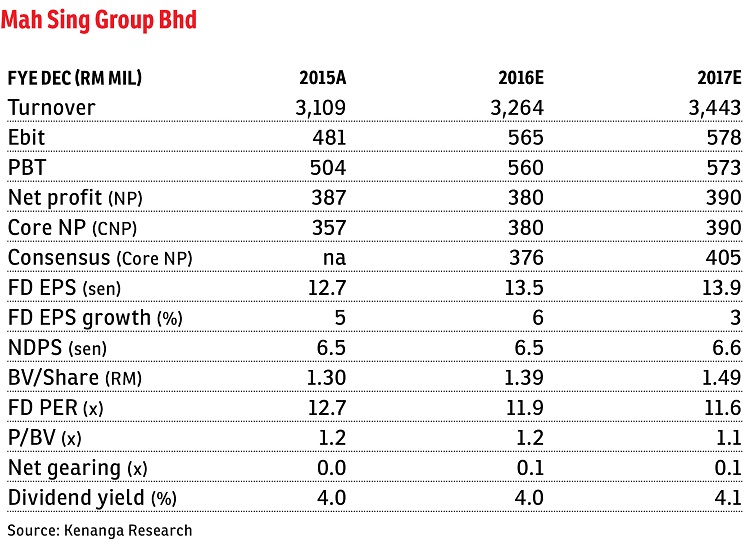

Call/target price (TP) under review pending sector update: Mah Sing Group Bhd’s first half ended June 30, 2016 (1HFY16) core net profit (CNP) of RM184 million came within expectations at 48% and 49% of our and consensus FY16 estimates respectively. Its 1HFY16 sales of RM769 million only made up 33% of management’s and our target of RM2.3 billion (flat year-on-year [y-o-y]) but sales for the seven months ended July 31, 2016, came in very strong at RM1.03 billion or 45% of management’s and our target due to the timing of launches (including Southville City @ Bangi, Lakeville Residence @ Kuala Lumpur and Meridin East @ Johor), which picked up momentum in mid-2016. While it may appear to be slightly behind schedule, we note that Mah Sing’s July sales of RM259 million were strong, and its 2HFY15 sales chalked up RM1.3 billion after a soft 1HFY15, thus it is still possible to meet its full-year target. No dividend was declared as expected.

Mah Sing’s second quarter ended June 30, 2016, CNP fell by 7% quarter-on-quarter (q-o-q) on higher selling/marketing and administrative/other expenses (+35% q-o-q) as the group ramped up launches during that quarter. 1HFY16 CNP was marginally -3% lower year-on-year (y-o-y) year to date (YTD) on lower billings given the 5% revenue decline. Nonetheless, pre-tax margin improved slightly by 0.8 percentage point to 16.6% as the abovesaid expenses (-23% y-o-y YTD) are more restrained this year. Net gearing remains healthy at 0.07 times.

Management maintains FY16 sales target of RM2.3 billion, driven by about RM2 billion worth of new launches and the rest by ongoing projects. To date, the group has launched RM1.2 billion of its pipeline launch or a remaining RM760 million to be launched for the rest of the year, including D’sara Sentral @ Sg Buloh, M Residence 2 @ Rawang and Cerrado, Southville @ Bangi, which are mainly in the affordable housing space. We also believe the group is looking for land banks in the Klang Valley, which will most likely be skewed towards the affordable housing-type land banks. Mah Sing’s unbilled sales of RM4.21 billion (-7% q-o-q) provides a 1.5-year visibility. We note that this is the second consecutive quarter that unbilled sales dropped q-o-q.

We are aware that the feel-good sentiment from the upcoming Budget 2017 will soon be translated into positive news flows, which, in turn, may separate the weak sector fundamentals from developers’ share-price performance. Risks include: i) weaker/stronger-than-expected property sales; ii) margin issues; iii) changes in real estate policies; and iv) changes in lending environments. — Kenanga Research, Aug 26

Want to know the price trends of a development? Click here.

This article first appeared in The Edge Financial Daily, on Aug 29, 2016. Subscribe to The Edge Financial Daily here.

Follow Us

Follow our channels to receive property news updates 24/7 round the clock.

Telegram

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.