Long-term value in EcoWorld

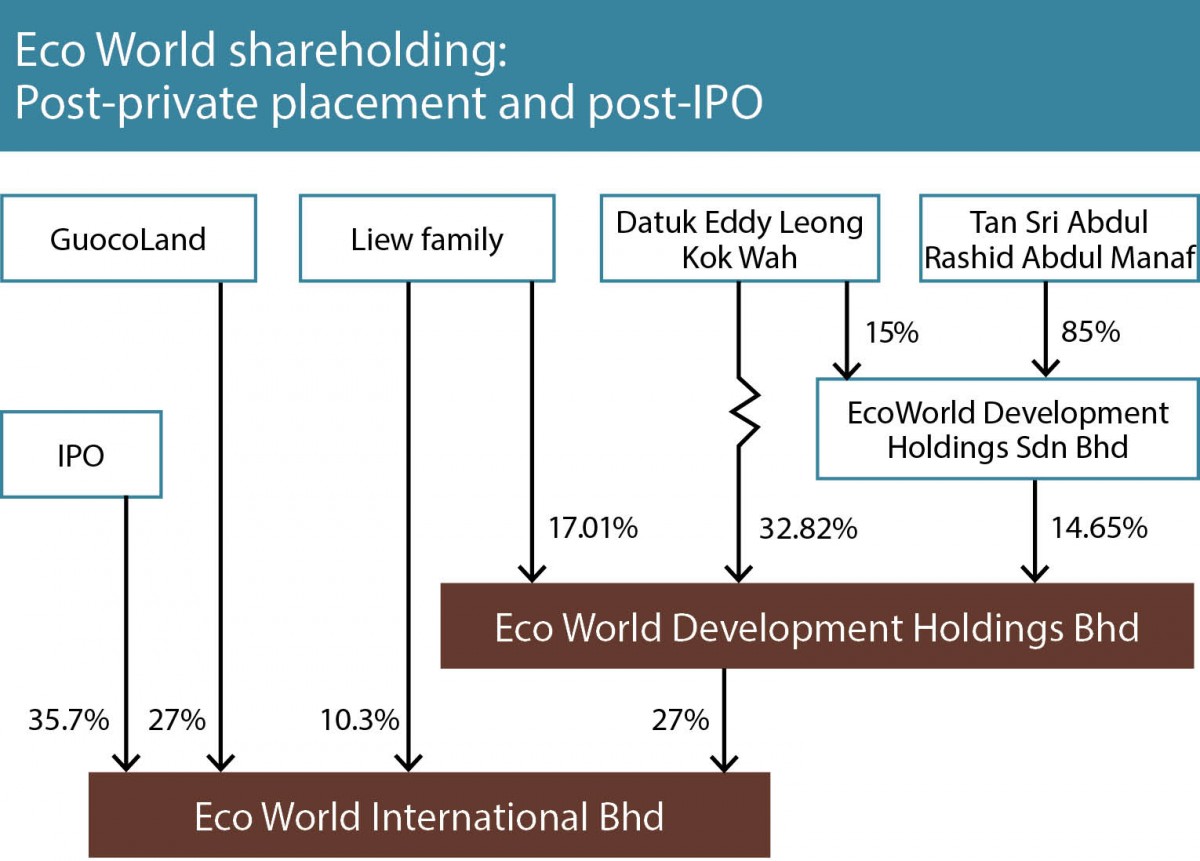

TAN Sri Liew Kee Sin can breathe a sigh of relief. The listing of his overseas property development outfit, Eco World International Bhd (EWI), is now on firm footing with Tan Sri Quek Leng Chan’s GuocoLand Ltd set to take up a strategic 27% stake.

The implications for Eco World Development Group Bhd (ECW), however, are less obvious. ECW does not have any direct exposure to EWI at present. But with Liew as a common shareholder and the driving force behind both companies, their fates are entwined — for better or worse.

However, the market does not appear to be thrilled over ECW’s move to take up the 27% stake in EWI. At least, not while Brexit stokes uncertainties around the UK’s economic future.

Coupled with a bearish outlook of the domestic property market, ECW’s share price has been lacklustre — hovering around RM1.34 apiece. It does not seem to matter that the company has racked up a phenomenal RM6.2 billion in cumulative sales since Liew launched the EcoWorld brand slightly over two years ago.

This year alone, the company is well underway to secure RM3 billion in sales, making it among the top three in the country.

The trouble is ECW’s meteoric rise has been financed by debts. The subsequent cash-calls have been a turn-off for investors. Just last month, ECW completed the first phase of a 25% private placement that injected RM501.05 million into the company. The balance of RM267.33 million of the placement is due in the coming months.

The bulk of the placement, about 76% (19% of ECW’s enlarged share base), was subscribed by parties acting in concert with Liew — his son Liew Tian Xiong and Datuk Eddy Leong Kok Wah — at RM1.30 a share.

Interestingly, institutional investors are still interested in buying into ECW.

Fund managers tell The Edge that interested funds are having trouble getting their desired allotment of the remaining 24% of the placement (6% of ECW’s enlarged share base). Furthermore, the institutional portion of the placement is expected to subscribe for the 6% block at a slight premium to the first phase’s price of RM1.30 a share.

Keep in mind that 60.9% of the placement’s proceeds or RM468 million is slated for taking up the 27% equity stake in EWI.

In other words, some institutional investors are still prepared to buy into ECW at this level, despite the negative overhang on the company. However, they are going to have to take a long-term view.

What is in EWI?

At face value, listing EWI is a tough sell. It is a company with high gearing. Furthermore, it is not expected to book in profits till 2H2018. Top it off with Brexit-fuelled uncertainty, a falling pound and a less-than bullish equity market, and Liew’s plan to float 89.7% or raise about RM2.6 billion is ambitious.

Nonetheless, he is fully committed following the RM307.35 million that he recently pumped into the company via his son Tian Xiong in the private placement.

It is no secret that Liew’s EcoWorld companies are heavily geared, and the listing is critical. EWI alone has racked up over RM1 billion in debt as of Oct 31, 2015. But that was one year ago. By now, the borrowings would be even higher.

In fact, Liew had planned to list EWI in June. Unfortunately, Brexit jitters put those plans on hold. But, luckily, EWI did not list before the UK’s surprise vote to leave the EU on June 23; it would have been monumentally disastrous.

Going forward, Brexit has been a huge game changer for the listing. Firstly, it undermines the sentiment for property sales in the UK as its implications on the UK’s economy are still uncertain.

Keep in mind that property buyers in the UK only lock in their purchases six months before the property is ready for handover. Prior to it, they may burn their deposit and walk away. If the property market takes a turn for the worse, sceptics are worried that buyers may pull out, leaving EWI with the deposits.

This also means that EWI now has virtually no operational cash flow and must bear the construction cost till completion. The first profits are only expected in 2H2018 when the group completes its first project and begins to hand over the units.

But the good news is that EWI has managed to penetrate the London property market. In just 1½ years, it had racked up a cumulative £1,058 million (RM5.5 million) in sales as at

Oct 3, 2016 (including pre-sales). Of this amount, a commendable £472 million of sales were booked post-Brexit.

Note that EWI’s sole Australian project is much less of a concern. For one, the Aussie dollar has been relatively stable against the ringgit, gaining slightly over 4% y-o-y to close at 3.19 against the ringgit last week.

The West Village project in Parramatta, Sydney, has also booked in an 84.9% take-up rate with 338 of the 398 launch units sold (see table).

In contrast, the take-up rate for the London projects ranges from as low as 28.4% to as high as 63.3%.

However, the strong sales and take-up rates are worth much less today in ringgit terms. Liew cannot overlook the fact that EWI is raising funds in a ringgit-denominated market. When Liew pitched the EWI listing to investors earlier this year, the pound was trading at between 6.3 and 6.4 against the ringgit. The weak pound is a double-edged sword as the funds raised on Bursa Malaysia may now have strong purchasing power in the UK.

At press time, the pound was trading at 5.16 against the ringgit — a 21% y-o-y depreciation.

This throws most of EWI’s valuations out of the window. The London land bank has a gross development value of £2.19 billion (EWI has a 75% stake in the London projects, or £1.64 billion). Combined with the Australian land bank’s GDV of A$318.4 million, EWI’s total GDV is worth RM9.49 billion today.

In contrast, when the pound was at 6.4 against the ringgit, the same land bank was worth RM12.38 billion in GDV (see table). While this is not positive for Liew, it could play to ECW’s advantage.

Ultimately, it boils down to EWI’s IPO valuations.

It is understood that Liew was looking to value EWI at around RM3 billion earlier in the year, based on a share base of about 2.4 billion and an offer price of around RM1.25. But now, Quek is in the equation.

GuocoLand does introduce some synergies — EWI will be able to tap the former’s network of sales offices in Singapore and China to sell its properties, for example. The Chinese are now big property buyers around the world.

But the cut and dry of the matter is that Liew needs Quek’s cash to give the EWI listing a decent chance. Quek may not be well known for his property development prowess, but he certainly has a reputation as a shrewd businessman. And given EWI’s circumstances, it is difficult to see Quek forking out a large premium for his 27% stake.

On that basis, ECW’s 27% buy-in into EWI might not be so bad after all. The earnings contribution will probably only kick in 1½ years later, but it would be a welcome boost at a time the domestic property market is stagnating.

This article first appeared in The Edge Malaysia on Nov 7, 2016. Subscribe here for your personal copy.

Never miss out

Sign up to get breaking news, unique insights, event invites and more from EdgeProp.

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.