ANTI-FOREIGNER sentiment has been simmering in Singapore amid complaints that expatriates have contributed to the rise in property prices in the island republic. But proponents of Malaysia My Second Home (MM2H) say the programme has had limited negative impact here.

MM2H was launched as the Silver Hair programme back in 1996 and was rebranded in 2002. As at August this year, it had attracted 19,488 participants.

The programme, which comes under the purview of the Ministry of Tourism, is aimed at drawing expatriates and foreign funds to the country.

It offers eligible expatriates a renewable 10-year social visit visa with multiple entries. To qualify, participants must fork out at least RM150,000 (RM300,000 for those below 50 years of age), which will be kept as a fixed deposit at any banking institution in Malaysia. They may apply to withdraw up to 60% (or 80% for those below 50) of the fixed deposit after one year for housing, children's education and medical expenses.

Among the sweeteners for MM2H participants is a tax exemption on car purchases. Upon approval, one can either buy a locally assembled vehicle or bring one from abroad duty-free.

With an increasing number of people choosing to retire in Southeast Asia, mainly because of the lower cost of living — the number of applicants for the MM2H programme had more than doubled from 818 in 2002 to 2,387 last year — some fear that Malaysia may be giving away too much for too little in return.

In Singapore, for example, the rise in property prices has been pinned on the influx of foreigners, who have crowded out the locals from the market. However, Kirby Lim, president of the MM2H Agents Association, demurs. "The negative impact of MM2H is limited. We have only about 20,000 expatriates; the number is still quite small."

James Wong, managing director of VPC Alliance (M) Sdn Bhd, a local firm of property consultants, valuers and estate agents, agrees, saying foreign buying has had little effect on property prices here.

"The number of foreign buyers of Malaysian properties is very small. Foreign investors accounted for less than 2% of total property transactions last year and about 5% in Kuala Lumpur."

Wong is also the immediate past president of the Association of Valuers, Property Managers, Estate Agents and Property Consultants in the Private Sector of Malaysia.

"Factors that contribute to an increase in property prices, in general, have very little to do with foreigners. Instead, it is due to things such as supply and demand, shortage of prime land, rising building material costs, easy lending terms and upcoming high-end property launches in the Klang Valley," Wong points out.

Lim says as foreigners are only allowed to buy properties above a certain threshold, they are not competing with the masses. The threshold for foreign homebuyers is RM500,000 in the Klang Valley, RM1 million in Penang and RM350,000 in Johor.

VPC Alliance estimates that only 8.1% of residential property transactions are priced above RM500,000.

"Yes, there may be some depletion in tax revenue owing to the import tax exemption on cars — depending on the type of car — but the participants are only allowed to sell the car after residing here for five years," Lim observes.

Furthermore, expatriates who buy homes and cars here are also investing in the local economy, says Chong Su Yi, public relations manager for Bao Fun (MM2H) Sdn Bhd, an agency licensed by the Ministry of Tourism to offer services to expatriates under the MM2H programme.

In Singapore, there has been some disquiet over the influx of foreigners as the city-state welcomes them as workers and investors to develop its economy, given the country's small population and low birth rate. About 36% of its population is now estimated to be foreigners, who have been blamed for a slew of problems, from rocketing property prices to fewer job opportunities for Singaporeans.

In Malaysia, participants of the MM2H programme were previously not allowed to work, but the rules were later relaxed to allow those aged 50 and above with specialised skills and expertise required by critical sectors of the economy to work a maximum of 20 hours a week, subject to the approval of the MM2H Special Committee. Hence, the potential to tap the talent of this pool of expatriates is small.

In contrast to the MM2H programme, the Residence Pass-Talent (RP-T) status offered to foreigners allows them to work and live here for 10 years.

More than 1,000 applications for the status have been approved for corporate leaders, foreign investors and experts with leading corporations since it was introduced last year. They include Google Malaysia's country head Sajith Sivanandran, Bank of China (Malaysia) executive director Zheng Jingbo, Legoland Malaysia general manager Siegfried Boerst, iPerintis CEO John Miller and RHB Bank Bhd executive director Miyama Akira.

Also, the MM2H programme appears to be more popular with Asians, with the Chinese topping the list of successful applications in the last 10 years, followed by the Bangladeshis and Japanese. The English came in fourth.

Mild weather, lower cost of living, cheaper housing and English and Chinese being widely spoken here are some of factors that attract them to Malaysia, says Chong. "Some Chinese MM2H participants see Malaysia as a stepping stone for their children's future education abroad."

Bangladeshis are said to be attracted to Malaysia as there are political tensions in their country. "The rich in Bangladesh worry about the instability in their own country. They like Malaysia," Lim says.

However, some feel that the government should assess and improve the 10-year-old MM2H programme. Jack Moerschbaecher, 66, an American who has been living in Perak with his wife under the programme for about three years, says there should be more clarity on the rules and regulations.

"When I wanted to sell my vehicle, I was unable to find a description of the process. It would be great if there was a definitive source, like an accumulated index of information on the MM2H."

Things like this would certainly help other participants as their numbers rise.

This story first appeared in The Edge weekly edition of Dec 10-16, 2012.

TOP PICKS BY EDGEPROP

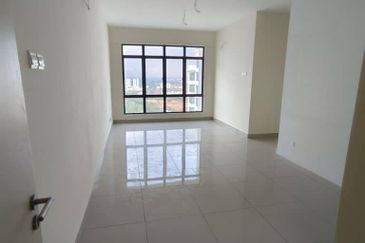

Sentrio Suites (Sentrio Pandan)

Desa Pandan, Kuala Lumpur

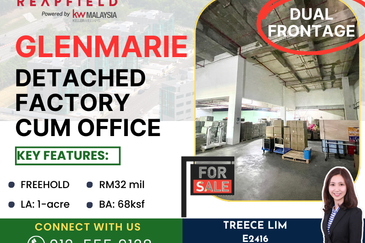

Taman Perindustrian Bukit Serdang

Seri Kembangan, Selangor

Gasing Heights (Bukit Gasing)

Jalan Klang Lama (Old Klang Road), Kuala Lumpur