KUALA LUMPUR: S P Setia Bhd's leadership and human capital remain the key specific issues of the company, says RHB Research.

In a note today, RHB Research said the confirmed departure of chief executive officer, Tan Sri Liew Kee Sin, has not only dampened investor sentiment on the stock, but also the work morale.

"Thus far, the management has received about 200 resignations since the beginning of 2013, and we believe it will somewhat affect the operations of the company this year," it said.

RHB Research said this has also largely explained its neutral view on the stock all the while.

It has maintained its neutral rating on S P Setia with a lower fair value of RM3.54.

HwangDBS Vickers Research said Liew may be leaving earlier than expected.

It said the exodus of staff has started, at a time when manpower was needed to realise SP Setia's record unbilled sales, heightening execution risk.

"Hence, we downgrade our call to 'hold' and cut target price to RM3.50 from RM4.10," it said. - Bernama

TOP PICKS BY EDGEPROP

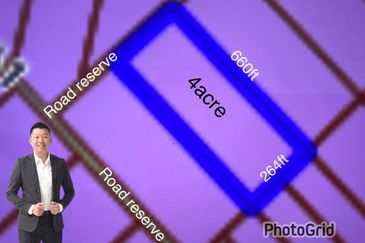

Bandar Puncak Alam

Bandar Puncak Alam, Selangor

Taman LTAT Bukit Jalil

Bukit Jalil, Kuala Lumpur

Bandar Puncak Alam

Bandar Puncak Alam, Selangor

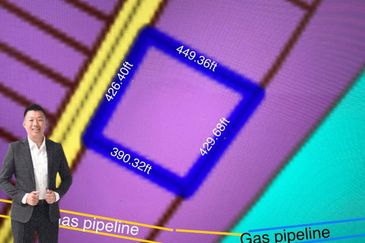

West Port, Pulau Indah

Port Klang, Selangor

Telok Panglima Garang

Telok Panglima Garang, Selangor

Telok Panglima Garang

Telok Panglima Garang, Selangor

Telok Panglima Garang

Telok Panglima Garang, Selangor

Telok Panglima Garang

Telok Panglima Garang, Selangor

Telok Panglima Garang

Telok Panglima Garang, Selangor