WCT Holdings Bhd (April 1, RM1.73)

Maintain buy with an unchanged target price (TP) of RM2.15: WCT Holdings Bhd has been awarded a RM133.9 million contract from Mass Rapid Transit Corp Sdn Bhd (MRT Corp) to redevelop the police quarters in Gombak.

The scope of works include demolishing the existing quarters, building a block of 20-storey new quarters comprising 300 units, external infrastructure works and interior works to be completed in 28 months.

The contract represents WCT’s first job win for the year.

WCT managed to amass a record RM3 billion in new job wins last year.

We estimate its order book to currently stand at RM4.3 billion, an all-time high. This translates into a healthy cover ratio of 3.3 times on financial year 2015 (FY15) construction revenue.

This year, WCT is gunning for RM2 billion in new job wins against our more conservative assumption of RM1 billion.

This year, WCT is gunning for RM2 billion in new job wins against our more conservative assumption of RM1 billion.

Via a joint venture with KKB Engineering Bhd, WCT is one of the 17 pre-qualified consortiums for the 10 packages of the Sarawak Pan Borneo Highway project (RM16 billion).

WCT is also targeting for i) external infrastructure works at the Tun Razak Exchange; ii) smaller Refinery and Petrochemical Integrated Development packages; and iii) highway jobs such as West Coast Expressway, Damansara-Shah Alam Elevated Expressway and Sungai Besi-Ulu Kelang Elevated Expressway.

It has also been pre-qualified for the Light Rail Transit 3 (RM9 billion), Mass Rapid Transit Line 2 (RM28 billion) and Menara KL118 infrastructure works.

We expect WCT’s earnings to see a reversal of fortunes this year, underpinned by its mammoth order book.

The impending listings of its REIT and construction arm are telltale signs that a positive earnings momentum is forthcoming.

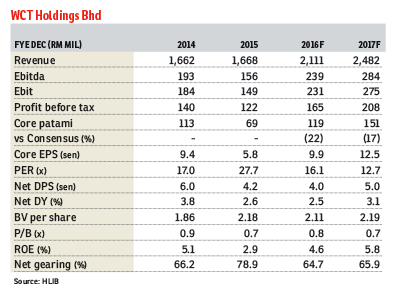

Our sum-of-parts-based TP implies FY16 price-earnings of 22 times, but this reduces to 17 times in FY17 once earnings kick in.

Valuation is also backed by RM1.7 billion in net surplus value of its land (RM1.39 per share). — Hong Leong Investment Bank, April 1

This article first appeared in The Edge Financial Daily, on April 4, 2016. Subscribe to The Edge Financial Daily here.