LBS Bina Group Bhd (Aug 1, RM1.60)

Maintain buy with a target price (TP) of RM1.73: We recently visited LBS Bina Group Bhd and gathered that: i) its property sales continued to be steady in spite of a sluggish property sector; and ii) plans for partial realisation of value of its 264-acre (106.84ha) Zhuhai International Circuit (ZIC) are intact. As of mid-July, the group had secured healthy property sales amounting to about RM520 million (excluding bookings amounting to RM265 million), versus its full-year sales target of RM1.2 billion.

LBS owns 60% of the ZIC, which sits on prime developable land in Zhuhai, China. It plans to further efficiently utilise land that is not being used by the racing circuit, which could make up to about 50% of its current total land size. LBS is seeking approvals from the local government to upgrade and transform the land to include businesses in the tourism, commercial and hospitality sectors, while maintaining the racing circuit. Discussions on partial monetisation of the land have been ongoing for quite some time, but slightly delayed due to changes in local government leaders. We gather that new leaders have been appointed recently, and they are quite receptive to LBS’ plans to monetise part of the land. Further outcomes of the discussions are expected to be revealed by the end of the year.

LBS has received all outstanding payments of its promissory notes that were previously due progressively up to 2017. The promissory notes came as part of the deal that it struck with Zhuhai Holdings Investment Group Ltd, a Hong Kong-listed company that acquired two land parcels from LBS back in 2013. Part of the cash of the promissory notes received prior to 2016 has been paid as special dividends amounting to six sen yearly. While the company has received all outstanding promissory note payments for the next two years, it will only pay special dividends progressively at two sen per quarter, for the next six quarters from Oct 16. Including our yearly dividend forecast, total dividend payment for LBS is about 9.5 sen per year, representing a yield of about 5.9% based on its last traded price.

The land could be worth RM425 million, based on similar transactions in 2013. We expect an outright sale of LBS’ ZIC land parcel to result in a potential special dividend. Pegging the ZIC parcel at HK$118 (RM61.27) per sq ft (similar to its 2013 transaction), LBS’ stake could be worth about RM425 million (or 45% of market capitalisation). This value is for a base-case scenario as land values could have risen significantly due to the impending completion of the Hong Kong-Macau-Zhuhai bridge that could cut travel time between Hong Kong and Zhuhai to 30 minutes (from 70 minutes currently).

Monetisation of the ZIC could be an outright sale or a joint venture (JV) with local partners. While entering into a JV would create more value for shareholders, as LBS would be able to enjoy development profits, we believe an outright land sale would also benefit shareholders. A partial outright land sale would result in dividend payments to shareholders being done over a shorter time frame, we believe. Assuming that only 50% of the ZIC could be monetised, we estimate profits — which LBS could rake in and be distributed to shareholders — to range between 5.7 sen and 9.6 sen per share yearly for a staggered period of five years.

In spite of a slowdown in the property market and a downtrend in sales recorded by most property developers, LBS managed to rake in about RM520 million as of mid-July (excluding bookings totalling RM265 million), which represents about 43% of its and our full-year sales target of RM1.2 billion.

For the rest of the year, LBS would continue to focus on launching more of its affordable apartments in Bandar Saujana Putra (average selling price: RM500,000 per unit), which has been one of the bestselling developments under its portfolio.

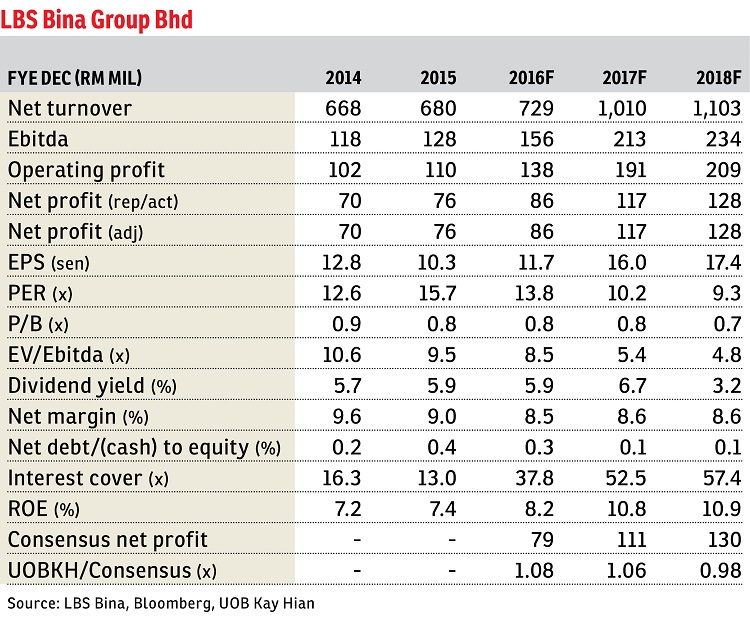

We expect LBS to deliver a three-year earnings compound annual growth rate of 14% for financial year 2016 (FY16) to FY18, driven by its ongoing property development jobs, particularly its affordable projects in the Bandar Saujana Putra township in the Klang Valley.

We maintain “buy” and our TP of RM1.73, based on a 50% discount to our fully diluted revalued net asset value of RM3.47 per share.

We like LBS for its: i) attractive dividend yield of 4.4% to 7.8%; and ii) potential unlocking of value of the ZIC.

Should LBS be able to monetise some of its ZIC land, its dividends could easily rise by an additional 5.7 sen to 9.6 sen. — UOB Kay Hian, Aug 1

This article first appeared in The Edge Financial Daily, on Aug 2, 2016. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

Residensi Hijauan (The Greens)

Shah Alam, Selangor

Taman Cheras Utama, Cheras

Cheras, Kuala Lumpur

Mayfair Residences @ Pavilion Embassy

Keramat, Kuala Lumpur