MBSB to see further loan provisioning ahead

Malaysia Building Society Bhd (Feb 23, RM1.16)

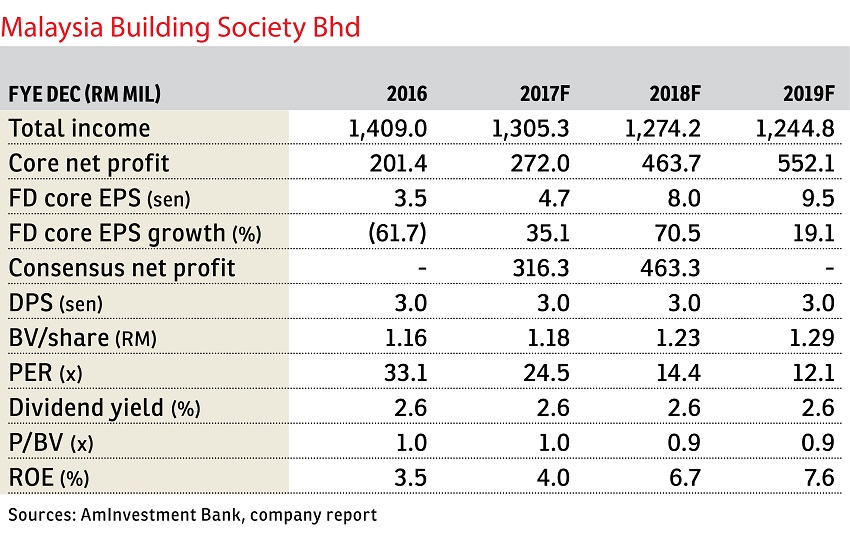

Maintain hold with a higher fair value of RM1.10: We maintain our “hold” rating on Malaysia Building Society Bhd (MBSB) with a higher fair value of RM1.10 per share (previously 98 sen per share) after rolling forward our valuation to financial year 2018 (FY18).

Our fair value is based on a return on equity (ROE) of 7.1% for FY2018 leading to a price-to-book value (P/BV) of 0.9 times.

Fourth quarter ended Dec 31, 2016 (4QFY2016) net profit declined 21.2% quarter-on-quarter (q-o-q) to RM46 million (-8.1% q-o-q), contributed by a higher tax expense while there were further provisions of RM169 million for its impairment programme.

Its cumulative 12-month (12MFY2016) net profit was RM201 million, lower by 21.8% y-o-y, largely due to higher provisions for loan impairment.

Cumulative earnings came in within expectations, accounting for 96.4% of our forecast but was below consensus estimates. It made up 63.5% of street expectations for FY2016 earnings.

To recap, the group embarked on a loan impairment programme to raise its provisions to close the gap between banking practices and standards. The impairment programme was to raise provisions for a total RM1.9 billion between FY2016 and FY2017.

In the recent analyst briefing, management revised downwards the target for total provisions to be made under the impairment programme from RM1.9 billion to RM1.7 billion. In FY2017, we understand that a further provision for loan impairment of RM700 million will be made.

Hence, significant improvement in earnings can only be expected after the impairment programme ends in FY2017. Credit cost continued to remain high at 1.9% in 4QFY2016 and 2.2% for 12MFY2016. Nevertheless, credit cost is expected to move towards its normalised level after the end of the impairment programme.

The net impaired loan ratio was 2.9% in 4QFY2016, while the loan loss coverage ratio continued to rise to 109.2% with the increase in conservative provisioning.

Growth in gross loans slipped to 3.4% y-o-y in 4QFY2016, compared with 4.6% y-o-y in the preceding quarter. Corporate, auto, mortgage loans and personal financing recorded a slower growth of 29.9% y-o-y, -11.2% y-o-y, 0.7% y-o-y and -1.5% y-o-y respectively, compared with the last quarter. — AmInvestment Bank, Feb 23

This article first appeared in The Edge Financial Daily, on Feb 24, 2017.

For more stories, download TheEdgeProperty.com pullout here for free.

Never miss out

Sign up to get breaking news, unique insights, event invites and more from EdgeProp.

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.