S P Setia seen on track to achieve sales target

S P Setia Bhd (Aug 18, RM3.34)

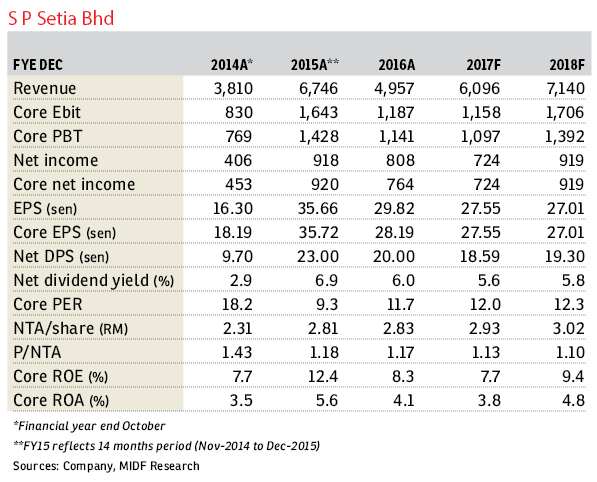

Maintain buy with an unchanged target price (TP) of RM4.13: Although S P Setia Bhd’s core figures for the first half of financial year 2017 (1HFY17) came in at only 35%/34% of our/consensus forecasts, we deem its results as within expectations due to a high revenue recognition expected from Battersea Phase One in the third quarter of FY17 (3QFY17). Note that S P Setia is expected to recognise the last six blocks in 3QFY17 (out of the total 12 in which six were delivered between 4QFY16 and 2QFY17). As expected, a four sen dividend has been announced.

2QFY17 sales were exceptionally strong at RM1.64 billion due to the strong take-up rate for its Melbourne project (Sapphire By The Gardens). Note that this project has achieved 70% take-up rate, which translates into RM799 million of sales. The 1HFY17 sales make up 52% of our and management’s target of RM4 billion. Unbilled sales of RM8 billion provide earnings visibility for 1.6 years.

We reiterate our view that the I&P Group Sdn Bhd acquisition is revalued net asset value (RNAV)- accretive as we estimate that the market value of its land bank is RM6.15 billion (against its purchase price of RM3.65 billion). Hence, we believe that the corporate exercise, which is expected to raise a total of RM3.6 billion, should be viewed positively by the market. Recall that S P Setia has proposed: i) rights issue; ii) rights issue of new class B Islamic redeemable convertible preference shares; and iii) private placement. Our earnings forecasts are maintained for FY17 and FY18. Our TP is unchanged and it is based on 10% discount to RNAV. — MIDF Research, Aug 18

This article first appeared in The Edge Financial Daily, on Aug 21, 2017.

For more stories, download TheEdgeProperty.com pullout here for free.

Never miss out

Sign up to get breaking news, unique insights, event invites and more from EdgeProp.

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.