China investors shifting focus to domestic market

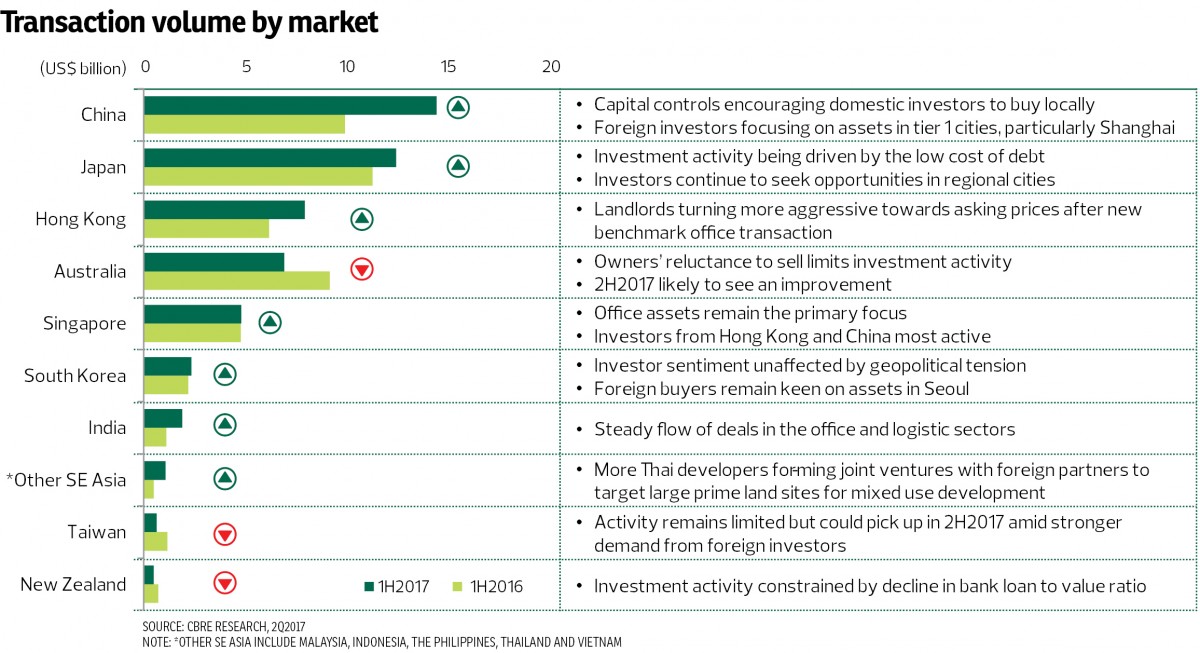

The Asia-Pacific region has been impacted by China’s capital outflow control with China’s outbound investment in Asia Pacific in the first half of this year (1H2017) having slumped 59% y-o-y, according to CBRE Research’s Asia Pacific Marketview 2Q2017 report.

China investors have instead turned their investment focus to the domestic market, which has seen transaction volume in China increase 46% y-o-y in 1H2017 to US$14.5 billion (RM61.9 billion), of which 79% of the transactions were done by locals.

Notable transactions recorded in China during 2Q2017 include Chongqing Tiandi, a mixed development owned by China Vanke Co Ltd sold to Shui On Land Ltd at a price tag of US$604 million, while Metropolitan Plaza which is owned by Link REIT was sold at US$592 million to GAW Capital and Morgan Stanley.

Overall, Asia-Pacific commercial real estate investment turnover increased by 11.5% y-o-y to US$53.2 billion in 1H2017. Most activities are focused on China, Japan and Hong Kong, which collectively accounted for 66% of the total investment turnover across the region.

Activity in Hong Kong remained robust, supported by the commercial land market that saw local investor transaction volume of US$8 billion in 1H2017.

In terms of outbound investment, regional investment by Hong Kong buyers surged 300% y-o-y in 1H2017 amid a wave of deals in Singapore.

For instance, FWD Group, owned by Hong Kong businessman Richard Li — the youngest son of Li Ka-shing — has bought a 50% stake of One George Street in Singapore from CapitaLand for US$425 million.

Tokyo continued to attract the bulk of investor interest with more transactions concluded in Yokohama and Osaka, which collectively accounted for 26.9% (an increase of 19% y-o-y) of the total turnover, said CBRE Research.

Meanwhile, CBRE Research observed that despite investors’ strong interest, owners in Australia were reluctant to sell, limiting the investment activities, and as a result the investment turnover in Australia declined in 1H2017.

CBRE Research anticipates the full-year transaction volume to be flat compared with last year, with Hong Kong and China remaining upbeat while Singapore will see less activity as availability is tight following the completion of several major deals.

Robust office leasing demand in China and India

According to CBRE Research, the net absorption of office space has improved 26% y-o-y to 14.5 million sq ft net floor area in 2Q2017, supported by robust leasing demand in China and India.

In China, tier 1 cities registered solid net absorption from domestic companies. However, CBRE Research expects the leasing momentum to moderate gradually as service sector sentiment softens.

In India, the expanding financial and manufacturing sectors have provided support to the leasing market, but the weakened performance in the IT and outsourcing sectors might impact the office market.

CBRE Research also noted that co-working adoptees are emerging as an important new source of office leasing demand. In Singapore, one company plans to move about 100 of its employees to co-working spaces to test the concept before adopting it at its new headquarters.

Overall, rental growth in Asia-Pacific commercial space remained weak in 2Q2017 at just 0.5% growth q-o-q. India, Australia and China have seen steady rental growth while Singapore’s office rental market has finally reached the bottom after eight consecutive quarterly declines.

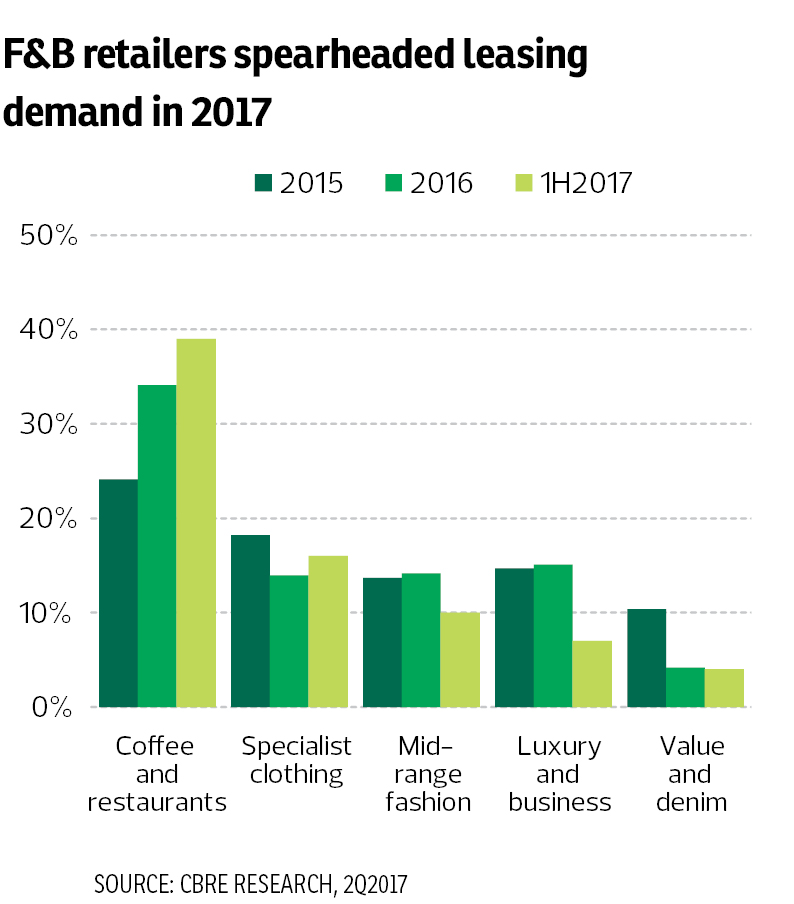

Retail: F&B retailers take the lead

Food and beverage (F&B) retailers have spearheaded retail leasing demand in 2Q2017 due to relocation activities, among other reasons.

For instance, the recent ban on liquor in hotels and restaurants within 500m of national highways in India has caused a wave of relocations.

In Japan, some restaurants that were located in struggling department stores have moved to other places.

The F&B sector, however, is gaining momentum and CBRE Research noted that several cosmetics retailers are jumping on the trend by opening pop-up cafes either attached to their stores or as separate entities, to strengthen their competitiveness.

For instance, Chanel’s COCO café has opened a new branch in Hong Kong, following the launch of branches in Tokyo, Seoul, Singapore and Shanghai.

However, department stores are still struggling in many markets but mall operators are taking action to revive their business through renovations and working on the tenant mix by offering new brands/products.

CBRE Research expects retail rents to remain flat in 2H2017 as the slow recovery in consumer demand will continue to constrain retailer in brick-and-mortar stores.

Logistics: Tapping on the strong growth of e-commerce

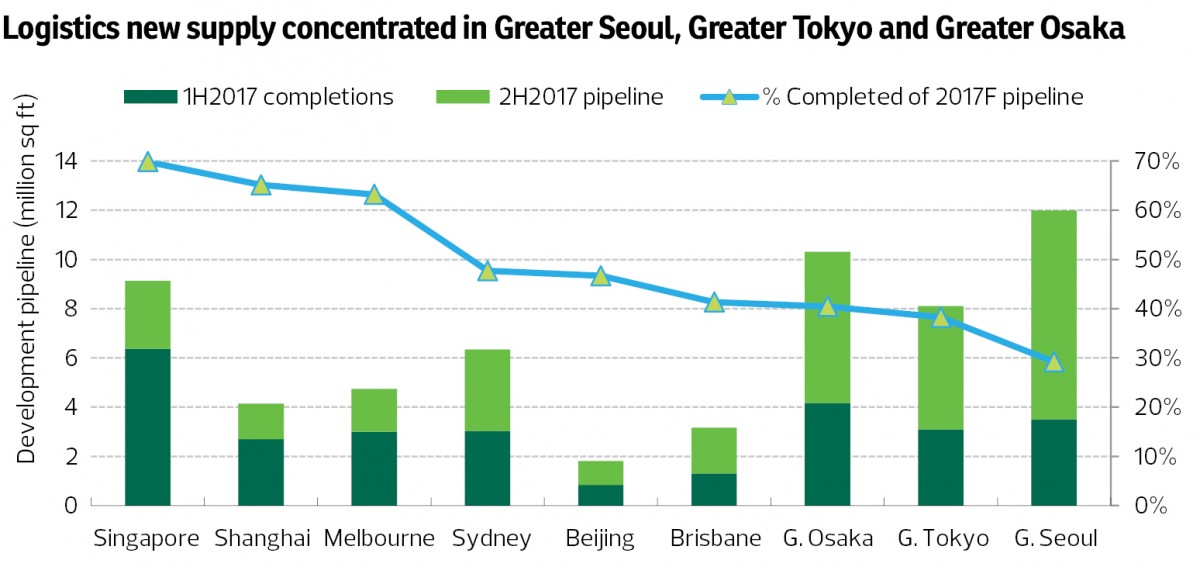

CBRE Research said investor demand for logistics assets remained strong amid continued growth in e-commerce, thus supply in Asia Pacific is rising with 72.9 million sq ft of logistics space expected to be delivered before end-2017.

Most of the new supply is concentrated in Greater Seoul, Greater Tokyo, Greater Osaka and Western China but the increasing supply will put pressure on rental growth — for instance, Greater Seoul has seen landlords trying to reduce rental to attract tenants.

In 2H2017, Greater Seoul, Greater Tokyo and Greater Osaka are expected to see the completion of 8.5 million, 6.1 million and 5 million sq ft of new supply respectively.

“New supply comprises mainly high-spec modern facilities and will attract e-commerce firms. Lower-grade warehouses are therefore likely to be the most vulnerable to falling rents and higher vacancy,” said CBRE Research.

This story first appeared in TheEdgeProperty.com pullout on Sept 8, 2017. Download TheEdgeProperty.com pullout here for free.

Follow Us

Follow our channels to receive property news updates 24/7 round the clock.

Telegram

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.