Tepid new sales outlook expected for Magna Prima

Magna Prima Bhd (March 22, RM1.17)

Downgrade to neutral with a lower target price (TP) of RM1.23: Magna Prima Bhd recorded new sales of RM105 million in financial year 2017 (FY17), mainly contributed by the Boulevard Business Park project in Jalan Kuching and the Desa Mentari project in Old Klang Road. Meanwhile, the new property sales outlook for FY18 is tepid due to slower-than-expected sales of The View Residences in Shah Alam, launched in the third quarter of FY17. On the other hand, we gather that planned launches for FY18 include the Kepong 2D project with a gross development value (GDV) of RM156 million. Note that Kepong 2D is located in Metro Prima Kepong, a 89-acre (36ha) township project.

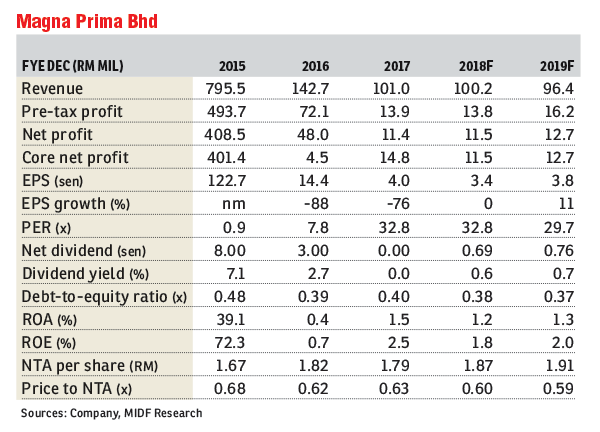

We cut our earnings forecasts for FY18 and FY19 by 39.3% and 35.3% respectively after assuming lower sales achieved for FY18 and FY19. Earnings in FY18 are expected to be mainly contributed by the Boulevard Business Park and Desa Mentari. Unbilled sales of RM40 million provide earnings visibility of less than one year.

Corresponding to our earnings revision, we revised our TP for Magna Prima to RM1.23 from RM1.59. Our TP is based on a 35% discount to fully diluted revalued net asset valuation (RNAV). We widened our discount to RNAV to 35% from 20% due to slower-than-expected sales from The View Residences and the tepid new sales outlook in the near term. Our call on Magna Prima is revised to “neutral” from “buy”. — MIDF Research, March 22

This article first appeared in The Edge Financial Daily, on March 23, 2018.

For more stories, download EdgeProp.my pullout here for free.

Never miss out

Sign up to get breaking news, unique insights, event invites and more from EdgeProp.

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.