Australasia region seen as key growth driver of Sime Darby industrial ops

Sime Darby Bhd (June 20, RM2.47)

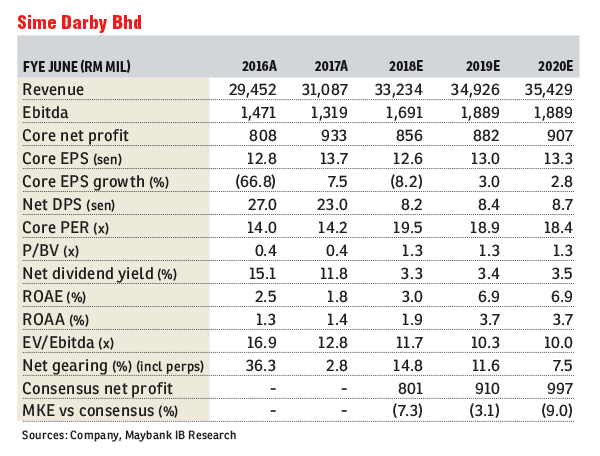

Upgrade to hold with an unchanged target price (TP) of RM2.45: Recent developments post the 14th general election (GE14) are positive for Sime Darby Bhd’s motor division in the near term but uncertain for its industrial division over the longer term. While the former should benefit from higher volumes due to lower car prices from the zero-rating of the goods and services tax (GST) in Malaysia, the latter could be affected by slower construction works due to cancellation of major infrastructure projects such as the Kuala Lumpur-Singapore high-speed rail (HSR) and Klang Valley mass rapid transit Line 3 (KVMRT3). No change to our forecasts and sum-of-parts-(SOP)-based TP of MYR2.45. Valuations are now fair; upgrade to “hold”.

The zero-rated GST, effective June 1 2018, has resulted in new car prices falling by about 6%. We, however, do not see any significant impact in the fourth financial quarter ending June 30, 2018 as car buyers would likely defer taking deliveries from May to June to enjoy lower car prices. Pending the reintroduction of the sales and services tax on Sept 1, 2018, we believe that car sales would see a three-month spike; our recent channel checks suggest an around three-month waiting list for mainstream models (that is, B/C-segment models such as Toyota Vios, Honda Civic). For Sime Darby, we believe that its Malaysian operations would be boosted in this period, especially for the BMW and Hyundai marques. Recall that Sime Darby’s Malaysian motor operations account for 17% to 20% of motor revenue and 11% to 12% of group revenue.

The cancellation/deferment of major infrastructure projects such as the HSR and KVMRT3 and uncertainties surrounding the East Coast Rail Link were major hits for the construction sector. The tapering of the work pace of existing major projects such as the KVMRT2 and Klang Valley light rail transit Line 3 in two to three years would translate into softer demand for Sime Darby’s industrial equipment.

Sime Darby’s Malaysian industrial operations account for 8% to 11% of industrial revenue and around 3% of group revenue. The key growth driver of the division going forward will be the Australasia region where equipment demand has returned on higher coal prices. Sime Darby’s industrial order book has improved 5% quarter-on-quarter to RM2.3 billion by end-March 2018.

We keep our earnings forecasts unchanged for now as we see limited impact on Sime Darby from the recent developments post GE14. — Maybank IB Research, June 20

This article first appeared in The Edge Financial Daily, on June 21, 2018.

For more stories, download EdgeProp.my pullout here for free.

Follow Us

Follow our channels to receive property news updates 24/7 round the clock.

Telegram

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.