Widening household income disparity

KUALA LUMPUR (Oct 16): The wealth gap is widening although the income growth among the middle group (M40) and low (B40) group is faster than the rich.

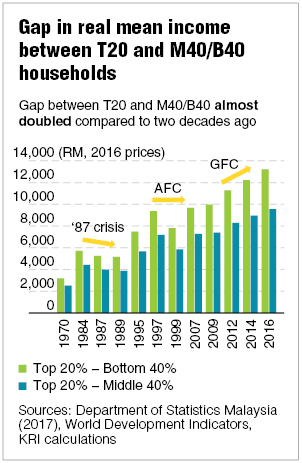

The actual differences in household income in the country (adjusted to inflation) have almost doubled between the top 20% (T20) households and M40 as well as B40 households respectively, according to the latest State of Households report by Khazanah Research Institute (KRI) titled “Different Realities”.

Allen Ng, the lead author of this third instalment of KRI’s report, said the situation is such because income levels of the T20 households in the country in 2016 continued to grow, but its growth was at a slower pace compared with five years before, in 2010. “However, because they (the T20) started at a higher base, the gap (between the T20 and M40/B40) continued to grow, and that is what you are seeing post GFC (Global Financial Crisis),” he told reporters at a press conference in conjunction with the launch of the report yesterday.

Interestingly, the wealth gap narrowed after the 1987 Black Monday stock market crash and the 1997-1998 Asian financial crisis. But it did not reduce during the 2008 GFC. ( see chart).

Although the gap between the country’s rich and poor continues to widen, income inequality has improved, judging by the decline in the Gini coefficient — which measures income inequality — from 0.513 in 1970 to 0.399 in 2016, the report noted. “A household income which starts from a lower base, for example RM1,000, could have tripled their income in one year to RM3,000. Meanwhile a household which starts from a higher base, say RM10,000, could have doubled their income to RM20,000.

“In the previous year, the high-income household earned 10 times the low income-household while in the present year, the high-income household earned only 6.7 times the low-income household. Therefore, the relative inequality between the two households have reduced.

The example cited demonstrated the increase in absolute difference between the two years while relative inequality has reduced.

The report added that the reason for a drop in Malaysia’s Gini coefficient is the rise in self- employment rates, shifts towards economic sectors, such as services with higher labour-income share and greater reliance on production.

“The share of the services sector in the Malaysian economy has been growing, particularly in the more traditional services sub-sector such as wholesale and retail trade. At the same time, the share of the manufacturing sector in the overall economy has been gradually declining, especially in high-tech manufacturing.

“Since the services sector has higher labour-income share relative to the manufacturing sector, this has led to an overall increase in the economy-wide labour income share,” said the report.

From 2005 to 2016, nearly 30% of the increase in labour-income share can be attributed to the shift, according to KRI. Meanwhile the report also stated that poverty is still rampant in Malaysia, despite the declining level of poverty rates. The report explained that growth on population size could be one factor that contributed to the drop in the poverty rate. However, it noted that the number of households living below the poverty line could be higher despite the declining poverty rate as the country’s population expands.

The report stated that while the absolute poverty rate has been steadily declining, it is estimated that an additional of about one million households lived in “relative poverty” (living below 60% of the median monthly household income of RM5,228) in 2016, compared to two decades ago.

Education key to narrowing the gap

It is high time for Malaysia to bridge its widening household income gap between its rich and poor by investing in high-quality human capital.

The report highlighted that the most important equaliser for income levels is human capital. “If we don’t address quality of education [in Malaysia], we will not be able to solve the problem of inequality [in income levels].

“This is also based on findings from the World Bank, which state that the biggest inequality in [income levels] in many countries stems from human capital and not from physical capital, so if we don’t invest in education and healthcare, we could see a further worsening of this inequality. If we do address it properly, it is a great equaliser,” said Ng.

According to Ng, the research shows that 12 years of study in the Malaysian education system is equivalent to nine years of study in Singapore’s education system. “This is an illustration of how we can move further in investing in our human capital,” he said.

This article first appeared in The Edge Financial Daily, on Oct 16, 2018.

Click here for more property stories.

Never miss out

Sign up to get breaking news, unique insights, event invites and more from EdgeProp.

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.