Order backlogs likely to keep Sunway Construction busy over next two years

Sunway Construction Group Bhd (Nov 21, RM1.60)

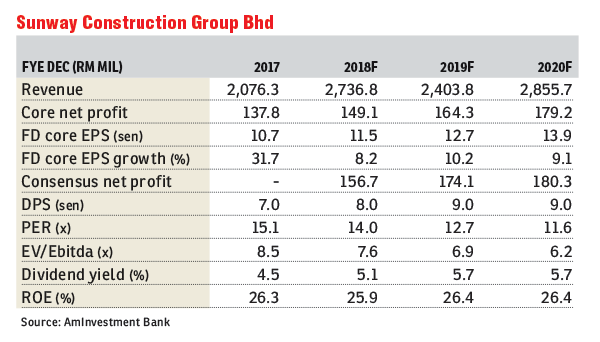

Maintain underweight with a fair value of RM1.27: Sunway Construction Group Bhd’s (SunCon) cumulative nine months ended Sept 30, 2018 (9MFY18) net profit came in within our expectations at 73% of our full-year forecast but missed market expectations at only 69% of the full-year consensus estimate.

Its 9MFY18 net profit grew 5% year-on-year (y-o-y) driven by higher construction profits (arising from the Parcel F building job in Putrajaya, Package V201 of the mass rapid transit Line 2 and International School of Kuala Lumpur building contract in Ampang), partially offset by lower precast profits (due to the completion of several projects coupled with higher rebar prices).

Year to date (YTD), SunCon has secured new jobs worth a total of RM1.22 billion while its outstanding construction order book stands at RM5.38 billion.

SunCon told us during a recent meeting that it is eyeing a third-party superstructure job (for which it stands a very good chance by virtue of it being the piling contractor for the project) as well as parent Sunway Bhd’s various new hospital and shopping mall projects.

Our forecasts assume construction job wins of RM1.5 billion annually in FY18 forecast (FY18F) to FY20F. Meanwhile, for its precast segment, the YTD new job wins stand at RM130 million while the order backlog stands at RM226 million.

We remain cautious on the outlook for the local construction sector.

As the government scales back on public projects, local contractors will be competing for a shrinking pool of new jobs in the market.

Severe undercutting among the players will result in razor-thin margins for the successful bidders.

On the other hand, the introduction of a more transparent public procurement system under the new administration should weed out rent-seekers, paving the way for healthier competition within the local construction sector.

We believe SunCon is mitigated by its substantial order backlogs that should keep it busy over the next one to two years, coupled with its proven ability to compete under an open bidding system.

However, valuations are unattractive at 12 to14 times forward earnings on muted sector prospects. — AmInvestment Bank, Nov 21

This article first appeared in The Edge Financial Daily, on Nov 22, 2018.

Never miss out

Sign up to get breaking news, unique insights, event invites and more from EdgeProp.

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.