BRI opportunities from JV with PowerChina expected for EcoWorld

Eco World Development Group Bhd (June 17, 87.5 sen)

Maintain buy with a target price (TP) of RM1.25: Eco World Development Group (EcoWorld) has signed a conditional joint-venture (JV) with PowerChina Group to jointly develop the 117.35-acre (47.49ha) Eco Business Park V, Phase 2.

The JV company, known as Eco World PowerChina Business Park Sdn Bhd, will purchase 117.35 acres of industrial land from Paragon Pinnacle Sdn Bhd (60%-owned by EcoWorld and 40%-owned by the Employees Provident Fund) and jointly develop the land into an industrial project. Eco World PowerChina Business Park will be 60%-owned by PowerChina and 40% by Paragon Pinnacle.

EcoWorld has also inked a memorandum of understanding (MoU) with PowerChina Group to jointly bid for infrastructure projects in Malaysia. The MoU may enable EcoWorld to take advantage of and leverage on the connectivity available and creating new business opportunities under China’s Belt and Road Initiative (BRI).

We are positive about the proposed JV with PowerChina Group as the JV could benefit business park project of EcoWorld by leveraging on extensive network of PowerChina’s clients who may be interested in investing in industrial real estate projects in Malaysia.

Note that Eco Business Park V, Phase 2 is complementary to the overall 518-acre Eco Business Park V (gross development value: RM3.7 billion) located in Puncak Alam which is EcoWorld’s first business park in the Klang Valley.

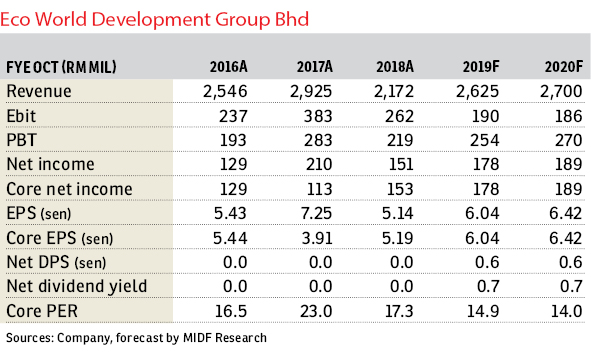

We make no changes to our earnings forecasts. Our TP is maintained at RM1.25, based on 45% discount to realisable net asset value. We maintain our “buy” recommendation on EcoWorld as valuation of EcoWorld is attractive at 43% discount to latest book value of RM1.48 per share. — MIDF Research, June 17

This article first appeared in The Edge Financial Daily, on June 18, 2019.

Click here for more property stories.

Follow Us

Follow our channels to receive property news updates 24/7 round the clock.

Telegram

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.