Hua Yang sales in Penang, Johor, Klang Valley seen on track

Hua Yang Bhd (Oct 24, 33 sen)

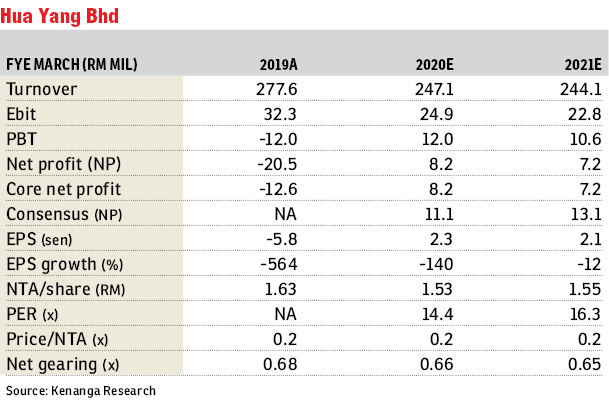

Maintain market perform with a lower target price (TP) of 33 sen: The first half of financial year 2020 (1HFY20) core net profit (CNP) of RM4.6 million makes up 57% of our estimate which we deem as broadly in line as we expect slower progress billings in the coming quarters. However, the result is below consensus expectations at 41% of the full-year estimate. Property sales of RM120.6 million are on track to meet our full-year target of RM251.7 million. No dividends were declared as expected.

1HFY20 CNP surged by 60% year-on-year to RM4.6 million, compared with RM2.9 million for 1HFY19, mainly due to: i) higher revenue achieved in 1HFY20, contributed by smooth construction progress of Meritus Residence, Penang and Astetica Residence, Seri Kembangan; and ii) a slightly better margin of 7%, compared with 5% in 1HFY19. However, the improved performance was partly offset by losses shared from its associate company of RM4.4 million, compared to a profit of RM2.1 million a year ago. Quarter-on-quarter, the second quarter (2Q) of FY20 registered a CNP of RM1 million (-73%), compared with RM3.7 million for the preceding quarter, largely due to: i) a decrease in revenue to RM68 million (-17%) from RM82.2 million; ii) a deteriorated performance of Magna Prima Bhd, where losses increased close to three times compared to 1Q; and iii) a higher effective tax rate of 67%, compared with 47% in 1QFY20.

Despite the challenging operating landscape in the property sector, we believe Hua Yang Bhd is on the right track as it continues to derive sales from Penang, Johor and the Klang Valley, backed by unbilled sales of RM182.9 million (as at September 2019) with a year’s visibility and lower inventory of completed properties at RM34.3 million. In terms of net gearing, it is down marginally from 0.67 times to 0.61 times, and the management remains optimistic about lowering it to the 0.5x level, backed by certain projects that are nearing completion.

Post-results, there are no changes to our FY20-21 earnings estimates. Despite its improving outlook, we reiterate our “market perform” call on Hua Yang due to its short earnings visibility, coupled with uncertainty over earnings from its associate Magna, which could continue to be a drag. We reduce our TP to 33 sen (from 33.5 sen) based on an implied 85% discount (close to the historical high level) to its revised net asset value/share of RM2.22 mainly due to a revised TP for Magna at 71 sen (from 74 sen) in our previous report on Magna. At the current TP, our valuation implies forward FY20-21 estimated price-to-book value of 0.2-0.2 times, which is still at its historical trough levels. Risks to our call include: i) higher-than-expected sales; ii) lower than-expected administrative costs; iii) changes in real estate policies; and iv) changes in the lending environment. — Kenanga Research, Oct 24

This article first appeared in The Edge Financial Daily, on Oct 25, 2019.

Click here for more property stories.

Follow Us

Follow our channels to receive property news updates 24/7 round the clock.

Telegram

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.