Not all gloom and doom in the industrial property market

The Covid-19 pandemic almost paralysed Malaysia during the Movement Control Order (MCO) lockdown period for six weeks from March 18, but business owners are optimistic that the market is gradually resuming its pace especially in the current Recovery MCO. According to findings from KGV International Property Consultants (M) Sdn Bhd’s recent market survey, many expect the economy to rebound within the next 24 months.

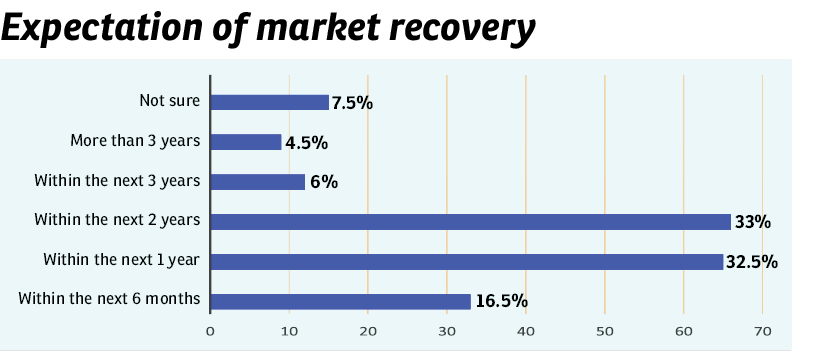

In the survey on “Behaviourial patterns of industrial property investors post-MCO” conducted in June, about 82% of the 200 respondents who are either individual potential investors or smaller corporates, said they expect the business environment to recover in less than six months to two years, whereby 16.5% expect a recovery in less than six months, 32.5% expect a recovery in a year and 33% expect it to do so in the next two years.

“Surprisingly, this is relatively optimistic and show the confidence of the potential industrial property buyers.

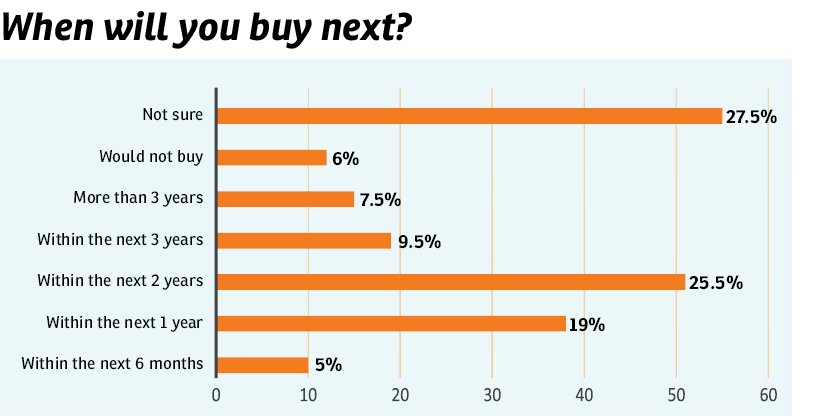

“However, it is interesting to note that even though more than 80% expect the market to recover within less than six months to two years, only about 50% are prepared to commit and buy the next factory within the next two years. This reflects the severity of the adverse macro environment that has affected the potential buyers’ ability to invest,” says KGV International Property Consultants executive director Samuel Tan.

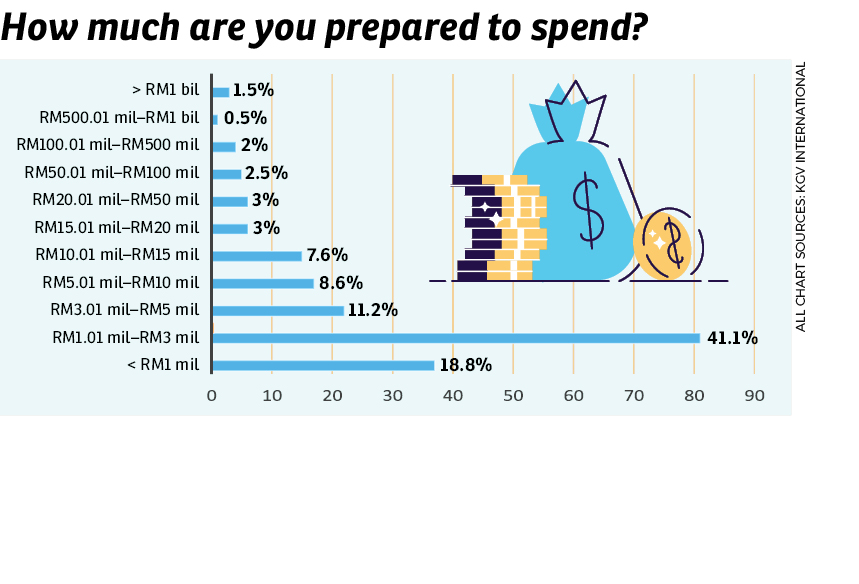

Nevertheless, of those who intend to purchase an industrial property in the next two years, 41% of the respondents are prepared to spend between RM1 million and RM3 million on it while 18% intend to spend below RM1 million. Naturally, the quantum of respondents decreases as the investment amount increases.

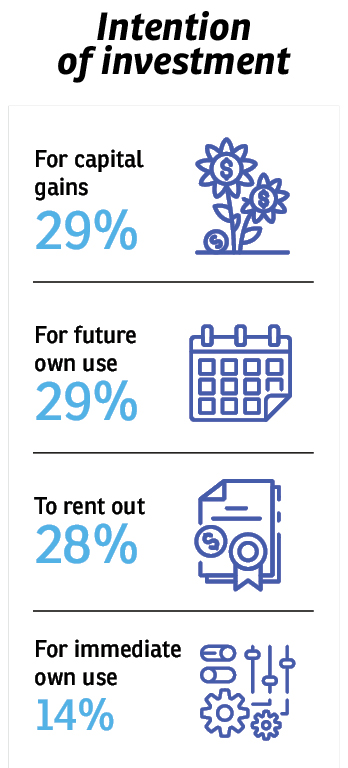

When it comes to their industrial property investment intentions, these were quite well distributed among buying for capital gains, for renting out and for future use, with each buying intention garnering about one-third of votes. Only 14% or 28 respondents said they would buy for immediate use.

“This could be attributed to the current weak market sentiment, hence the immediate demand for factories is understandably lower at this juncture,” Tan says.

Will prices drop?

Interestingly, 65% of the respondents expect the selling price for factories to drop between 10% to more than 30% while another 10% expect prices to remain the same and 11% were unsure. Only 14% expect prices to increase. In a nutshell, the market is generally anticipating industrial property prices to drop within the next two years.

In fact, according to the survey, the main motivation for investors to purchase their next factory unit in such challenging times was cheaper prices (79.5%).

Tan tells EdgeProp.my that there are a few reasons for the price drop forecast, one being the plunge of demand for goods and services on a global scale.

“The pandemic has disrupted the entire supply chain and demand for goods and services on a global scale. Manufacturers are handicapped, in that certain components are not readily available to complete the production. Problems in logistics for goods have compounded the matter.

“Besides, drop in demand due to lower consumption is another inhibiting factor. The employment market with lower income is also expected to slow down the demand. Travel restriction is another reason investors are careful with overseas property investments,” Tan shares.

He adds that the compound effects of the above mean a slowdown in manufacturing activities, and this drives caution for any new or expansion plans, which pressures the price trend of industrial properties moving forward.

“Confidence needs to be built in the market over the next two years. Among other things, the government needs to provide support such as promoting private consumption, tax incentives and human resource reform, etc. Only then will demand be totally restored in the industrial sector,” he notes.

The ideal industrial property

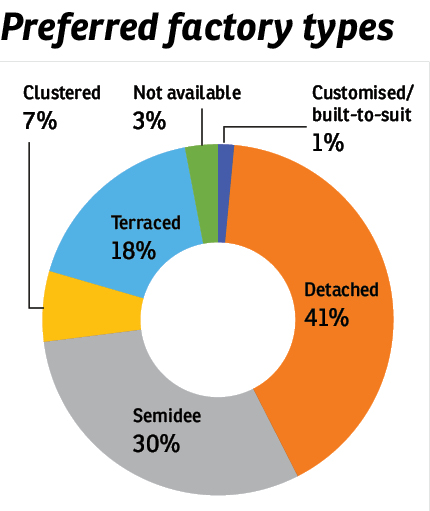

When asked to state their preferred industrial property type, a majority of the respondents in the survey chose detached (41%) units followed by 30.5% who liked semidee factories.

Meanwhile, most of the respondents (62%) preferred 1½-storey factory units, a trend which is already reflected in the current market supply.

“1½-storey factory units are the most popular. This is consistent with what we see in most of the industrial schemes where most factory units offer a ground level operations or warehouse space at the back and a double-storey office annex at the front.

“The main reason for this preference is the relatively lower land cost in Malaysia compared with other countries. Factory operators prefer a low-rise building for efficient operation flow and lower building construction cost such as foundation cost, cargo lifts, floor loading for higher floors and other reasons,” Tan points out.

The survey respondents who were mainly made up of individuals and small- and medium-enterprises (SMEs) also preferred industrial properties on land areas of five acres and below. About 40% and 44% of respondents liked something between one to five acres, and below one acre respectively. When it comes to built-up sizes, the most popular were units sized 5,001–10,000 sq ft (29%) and 10,001–20,000 sq ft (19%), which are the common floor sizes for semidee and detached factories.

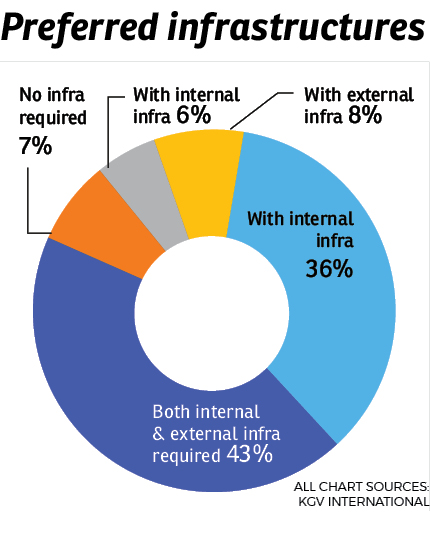

Industrial property investors (43.5% of respondents) are also more likely to buy a property with both internal and external infrastructures, or at least with the internal infrastructure such as water, electricity and internal access roads, ready to be used or connected.

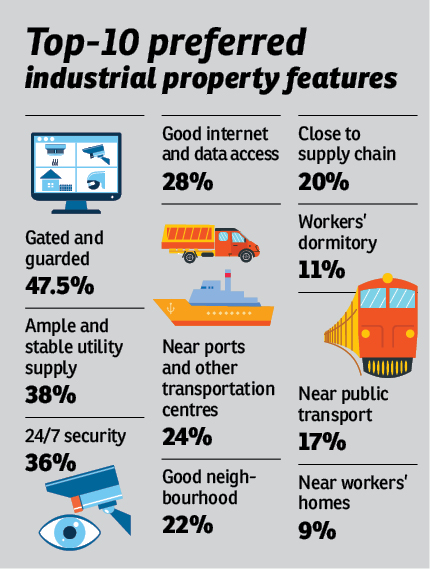

Hence, gated-and-guarded industrial parks came out top of the respondents’ list (47.5%) of industrial property features.The next most preferred feature was ample and stable utility supply (38%) followed closely by 24/7 security service (36%).

“It shows factory buyers/operators are very concerned about the security and stability of utility supply. These two factors precede the other features that are secondary,” says Tan.

Key considerations for next purchase

In buying their next factories, the key criteria for the purchasers ranked as follows: location (81%), rentability (43%), selling price (42.5%), security of the area (37%) and capital appreciation (35%).

“Location remains the key criterion. This is understandable as the location factor is the utmost crucial factor affecting selling price, rental, capital growth and the security of the premises and vicinity,” Tan says.

Meanwhile, the top factors that will motivate investors to acquire their next factory units are: cheaper prices (79.5%), more choices (53%), recurring income (50%), new or future business expansion (49%) and capital growth (47.5%).

“From the list above, we can deduce that it is indeed a buyers’ market now with most potential buyers expecting prices to be lowered. There are also ample choices in the market.

“About half are looking at recurring income and capital growth. Some are planning for future expansion. It is noted that only 29% are looking at immediate business expansion. This is a sign of the challenging times we are in now,” Tan shares.

Downward risks

The KGV International survey also found that moving forward, there will be three factors that can discourage industrial property investments and purchases, namely poor business conditions and sentiments (75%), difficulty in obtaining financing (52%) and budget constraints (50%).

“Poor business conditions and weak sentiments as a result of a confluence of factors such as the Covid-19 pandemic, US-China trade war and risks posed by the political uncertainty in the country have wide-ranging negative effects on the economy,” Tan points out.

Meanwhile, difficulties in obtaining financing and budget constraints are related and are not new issues plaguing investors and business owners. Many have been complaining about the stringent stance adopted by financial institutions amidst the increasingly challenging and risky environment.

Besides these deterrents, lack of government incentives, shortage of the preferred property types and workers’ shortage are the main concerns that will deter industrial property investors from making their next purchase.

Profile of respondents

KGV International Property Consultants (M) Sdn Bhd’s “Behaviourial patterns of industrial property investors post-MCO” survey was conducted from June 15 to 30, 2020. Responses were gathered from 45 corporate respondents and 155 individual respondents in Malaysia.

Most of the corporate respondents were small- and medium-enterprises (SMEs) in the manufacturing sector (about 52.4%) with an issued capital of more than RM1 million (65.9%) and an annual turnover of more than RM25 million (68.2%).

As for the individual respondents, more than 60% of them earn more than RM100,000 per year with about 15% earning more than RM500,000 per year. The individual respondents may not be actual industrial property investors but could be assumed to be prospective investors.

The objective of the online survey was to better understand the trends in the industrial property sector (specifically factory) following the Movement Control Order lockdown period in Malaysia brought on by the Covid-19 outbreak.

“It is hoped that this survey and our analysis will assist developers, property owners, investors, bankers, property agents and other stakeholders in their planning and decision-making in a more informed manner,” says KGV International.

This story first appeared in the EdgeProp.my e-Pub on Aug 14, 2020. You can access back issues here.

EdgeProp Malaysia Virtual Property Expo 2020 (VPEX 2020) is happening now! Find out more exclusive projects and exciting deals here

Stay safe. Keep updated on the latest news at www.EdgeProp.my

Follow Us

Follow our channels to receive property news updates 24/7 round the clock.

Telegram

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.