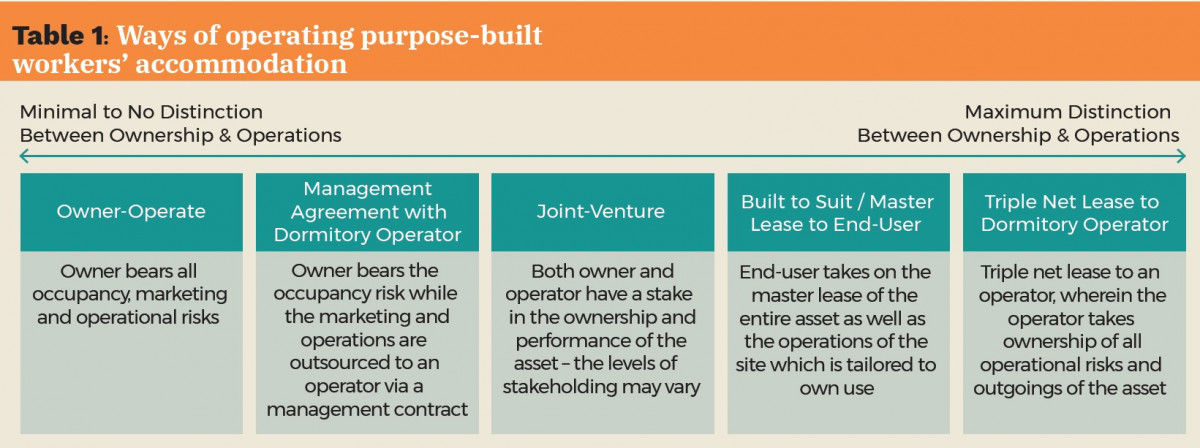

According to Knight Frank Malaysia’s “The changing landscape of workers’ accommodations” report, which was released on Nov 18, 2021, professionally-managed purpose-built workers’ accommodations (PBWA) is a niche, non-traditional and a relatively new asset class in Malaysia. The majority of such existing establishments are concentrated in Johor and Penang and they are mostly owner-operated (refer Table 1).

Whilst the existing PBWAs are predominantly owner-operated, there are a myriad of potential partnership models that industry players can explore as the asset class continues on its path of maturity. New developments of PBWA can be facilitated via various forms, depending on the preferences for level of distinction between the ownership and operation of the assets.

According to the findings by Knight Frank Malaysia, the rental of workers’ accommodation could be as low as RM155 per bed a month, up to RM300 per bed a month, depending on the service packages (including utilities, transportation, food caterings and periodic health screenings), location of PBWA and adherence to local or international standards.

Knight Frank Malaysia anticipates the asking and achievable rentals for PBWAs to continue to rise in the immediate to short term, mainly due to the growing demand fueled by regulation compliance outstripping existing and incoming supply.

“Furthermore, the existing supply of PBWAs is also effectively reduced with certain operational dormitories (prior to the enforcement of the new Department of Labour guidelines) having to adjust downwards their bedding capacities to comply with the minimum density requirements,” says the report.

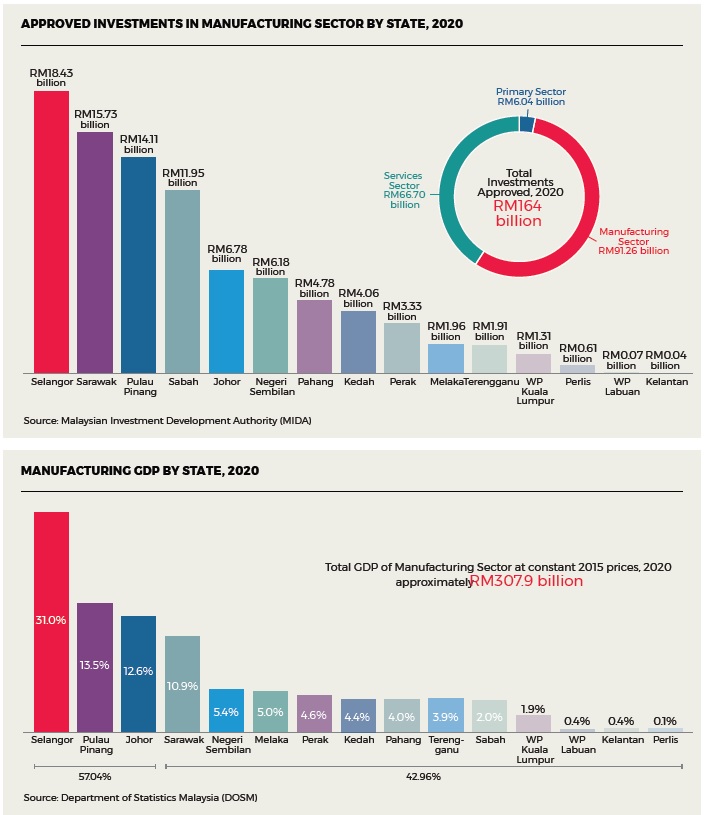

In terms of location, high economic growth regions such as Selangor, Johor and Penang are expected to champion the key locations for this alternative asset class.

Along with the highest number of existing workforces, these regions are also the major contributors to the national economy (Malaysia’s gross domestic product (GDP)) and approved investments, which in turn generate high employment opportunities and workforce.

States with high manufacturing activities

The manufacturing sector dominated the number of foreign workers, charting about 35% of the country’s estimated two million-strong foreign workforce in 2019, based on data from the Immigration Department of Malaysia.

The report says granular observation of the statistics revealed that Selangor, Johor and Penang emerged as the top three states with the highest number of foreign workers in the manufacturing sector. Correlatively, these states demonstrate high manufacturing activities, collectively accounting for about 57% of the nation’s overall manufacturing GDP.

“Moving forward, we expect the workers’ accommodation market to grow rapidly, underpinned by regulatory shifts and structural capacity gaps that are increasing the demand for compliant workers’ accommodation,” says the report.

The firm also anticipates the changing landscape of the sector to further drive structural shifts towards investment-grade supply as tactical investors seek to diversify and de-risk through defensive alternative assets that are typically less exposed to economic and political risks.

While the investment activity in the market is rather muted due to a lack of investible supply, the sector is poised to see long-term expansion as the space progresses towards maturity, it says.

Knight Frank Malaysia also notes that with the robust development moving towards high-value manufacturing industry and global services, the workers’ accommodation market is set to place greater emphasis on better quality offerings which will add value to and accentuate both the structural compliance and soft services expended by professional operators in managing the operations.

By integrating this asset class, master industrial developments can be efficiently planned as a complete industrial ecosystem that is self-sustaining in healthy integration with its surroundings. Addressing the needs and demands of various industries for sustainable human capital, the sector is set to create a direct positive impact on the industrial real estate segment and a resultant larger multiplier effect on the residential and commercial asset classes.

Get the latest news @ www.EdgeProp.my

Subscribe to our Telegram channel for the latest stories and updates