Checking your loan eligibility is as easy as 1-2-3 with EdgeProp’s tool

- Find out your loan eligibility without the extra hassle

- Check your borrowing capacity from 17 different banks, all in a single site

Now that you’ve decided on the property to buy, the next step is getting a housing loan. Though it may sound like a straightforward process of picking any mortgage plan out there, you’ll be surprised to find that it’s not as simple as that.

There are many factors to consider, and each bank offers different interest rates for their loans. So, how do you decide which mortgage is the best for you?

Unlike the pre-internet days, where you have to make several trips to different banks to find the best match for your needs, shopping for a loan now is certainly less a hassle.

However, you can easily still get lost in a screen with an unending list of options if you don’t have a certain direction.

So, to make your navigation as easy as 1-2-3, just click on EdgeProp’s Quick Loan Check tool. Within this single site, you will get to check your borrowing capacity from 17 different banks. Once you enter the necessary information, the tool will show you a comprehensive report outlining your eligibility to each available financing option in the market.

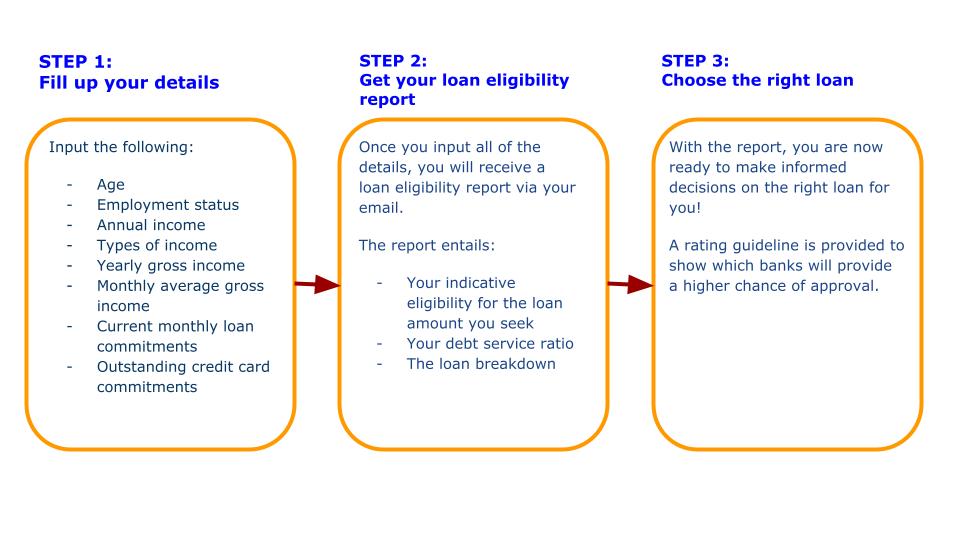

Here is a step-by-step guide on using EdgeProp’s Quick Loan Check:

Step 1: Fill up your details

The following input is needed to churn out an accurate report for you:

- Age

- Employment status

- Annual income

- Types of income

- Yearly gross income

- Monthly average gross income

- Current monthly commitments for the loans you have

- Outstanding commitments for your credit cards

Step 2: Get your loan eligibility report

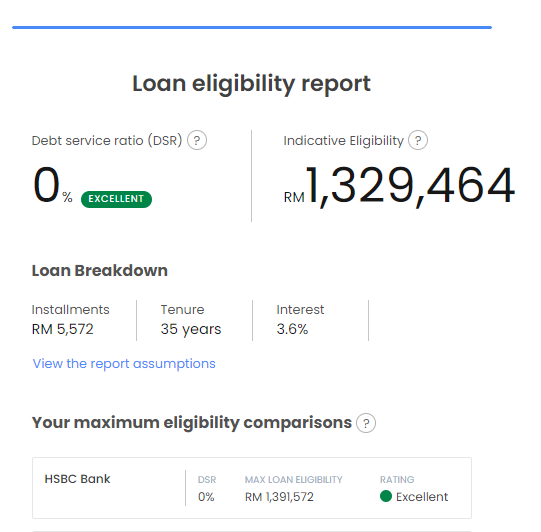

Once you have included all the information needed, you will then receive a report by email containing an overview of your eligibility for the loans. Through this report, you will get a better idea of what to expect from the banks, such as your indicative eligibility for the loan amount you seek, your debt service ratio, as well as the loan breakdown.

Step 3: Choose the right loan

With the report at your fingertips, all that’s left to do is choosing which banks you think could meet your present needs. A rating guideline is provided to show which banks will allow you a higher chance of approval.

As an extra perk, at the end of the report is a list of more property options within your budget.

Never miss out

Sign up to get breaking news, unique insights, event invites and more from EdgeProp.

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.