- According to the JLL’s study, newly-completed ESG-compliant office buildings in Greater KL command higher occupancy rates at 80% to 90%, with average achievable rents exceeding non-green buildings.

- “We estimate that by 2030, tenants will have an additional 7 million sq ft of green spaces to fulfil their requirements for sustainable, environmentally-friendly spaces. This presents an opportunity for landlords with older stocks to retrofit their properties to meet the growing demand.”

KUALA LUMPUR (Aug 9): Buildings that are not upgraded to meet sustainability requirements are at risk of losing tenants, which is a major concern for building owners.

This was pointed out by JLL Asia Pacific (Apac)’s head of asset development, Andrew Macpherson during the global real estate services firm’s presentation of its latest market insight on office buildings in Greater Kuala Lumpur and across Asia-Pacific (Apac) on Thursday.

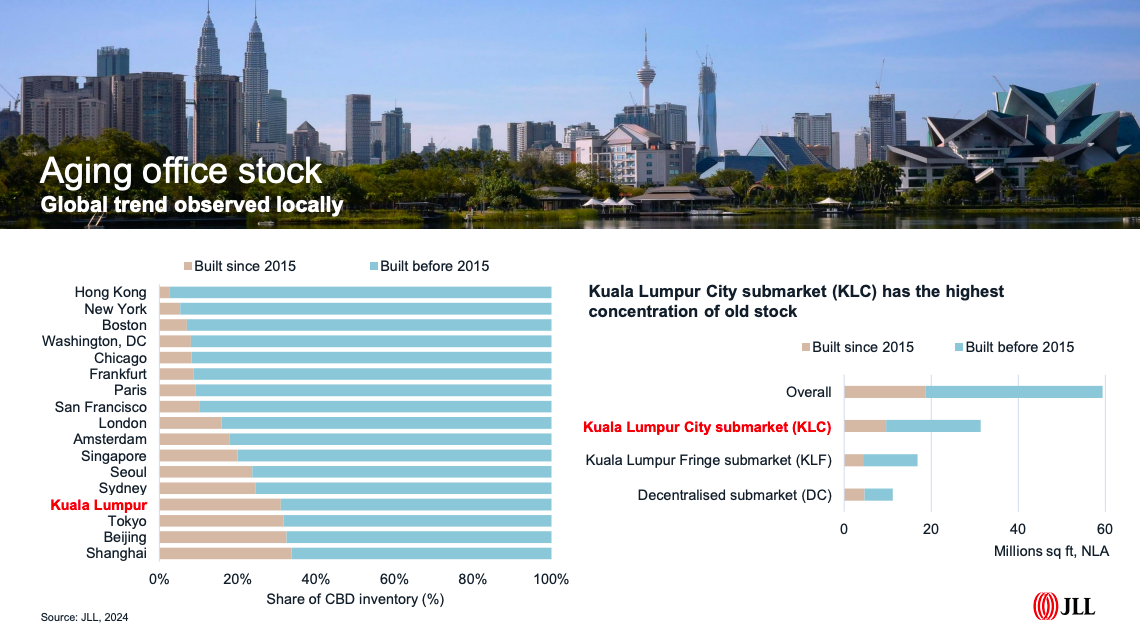

JLL Malaysia’s head of research and consultancy Yulia Nikulicheva also highlighted that a significant portion of the office stock in KL consists of older buildings built before 2015. In KL, the city submarket has the highest concentration of such older stock.

In her report entitled “Leveraging asset enhancement to unlock real estate growth”, Nikulicheva said: “Tenant priorities now lean heavily towards spaces aligned with ESG (environmental, social, governance) commitments.

“We estimate that by 2030, tenants will have an additional 7 million sq ft of green spaces to fulfil their requirements for sustainable, environmentally-friendly spaces. This presents an opportunity for landlords with older stocks to retrofit their properties to meet the growing demand”.

“Everyone talks about green premium and brown discounts," said Macpherson. "In this market, the brown discount is probably the bigger issue.”

With green, sustainable buildings gaining popularity, “brown discount” refers to buildings that are underperforming because they are environmentally-unfriendly, hence less desirable.

In Malaysia, government initiatives like the Green Technology Financing Scheme (GTFS), Green Technology Tax Incentive (GTTI) and the Energy Efficiency and Conservation Building (EECB) programme support this green transition. Meanwhile, the proposed Urban Renewal Act aims to facilitate upgrades of older buildings.

ESG-compliant offices command higher occupancy and rental rates

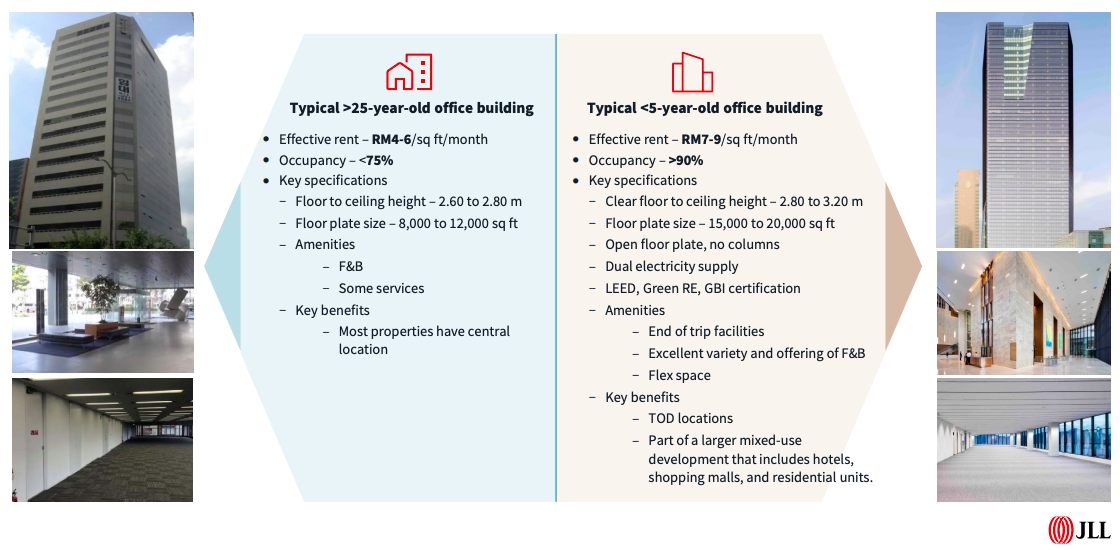

According to the JLL’s study, newly-completed ESG-compliant office buildings in Greater KL command higher occupancy rates at 80% to 90%, with average achievable rents exceeding non-green buildings.

In KL, the city centre precinct is leading the occupancy rate at 85.3% with an average monthly rent at RM7.68 per sq ft, followed by Tun Razak Exchange (TRX) and the Merdeka 118 precinct. Meanwhile, the old central business district (CBD) area shows lower occupancy and rental rates.

"Buildings like TRX and Merdeka 118 set the benchmark for what a green building looks like," Macpherson noted. "They attract tenants by offering facilities and designs that appeal to modern businesses, which then retains high occupancy levels."

Asset enhancement key to increasing property value

According to Macpherson, various levels of upgrades, from minor to major, can significantly improve building performance and tenant satisfaction.

“Landlords' incomes are affected when tenants move out and rental rates drop,” added Nikulicheva. “The good news is that successful upgrades are now showing real increases in occupancy and rental levels, giving owners more confidence."

Minor enhancements in an old office building in Singapore effectively improved monthly rent from S$7.50 (about RM25) to S$11.00 per sq ft, with occupancy at 90% to 96%, JLL’s data showed.

Similarly in Melbourne, Australia, a medium asset enhancement raised monthly office rent from AU$950 (about RM2,798)-AU$1,400 per sq ft to AU$975-1,450 psf, with occupancy increasing to 96%.

Enhancing aging offices a complicated process but ensures long-term profitability

The process of asset enhancement involves analysing current performance, developing upgrade options including smart building strategies, and managing construction to ensure compliance with safety and quality standards.

JLL Apac’s design director and asset advisor Matthew Gaal shared insights from a recent project with a client in Manila who wanted to build a residential project.

"While we did not agree that it would yield the best potential, the team went down the path with them anyway where we looked at the design, construction and costing to illustrate the poor return on investment. Financially, after we ran the numbers, an office building would be more viable.

“At JLL, we help owners understand the what, the why, and the how. As with the Manila case study, clients appreciate honesty as market-driven advice helps prevent costly mistakes,” Gaal elaborated.

Macpherson reiterated that there is no substitute for market research: “Building something without demand is pointless. There are a lot of data points, inputs and analytics on area and building performance that goes into the scope of asset enhancement. We use data to determine the best type of asset and attract the right tenants, ensuring financial viability".

Looking to buy a home? Sign up for EdgeProp START and get exclusive rewards and vouchers for ANY home purchase in Malaysia (primary or subsale)!