- JB is rapidly solidifying its position as Peninsular Malaysia's prime destination for commercial land acquisition, with downtown parcels in the region now commanding prices well into four figures psf, according to a market leader.

PETALING JAYA (June 17): The tension between the great powers, China and the US, has caused some jitters in the global market, but it has also inadvertently benefitted some countries in Southeast Asia, as multinational companies flee from the two contending countries to seek more stable land sets as their new business centres in the region.

In line with this development, Malaysia has been reported as one of the beneficiaries, but has the figures proven so? In particular, has there been greater demand for vacant commercial plots? If yes, where is the focus? To get a clearer picture, we take a look at transaction activities in this sector for the past four years.

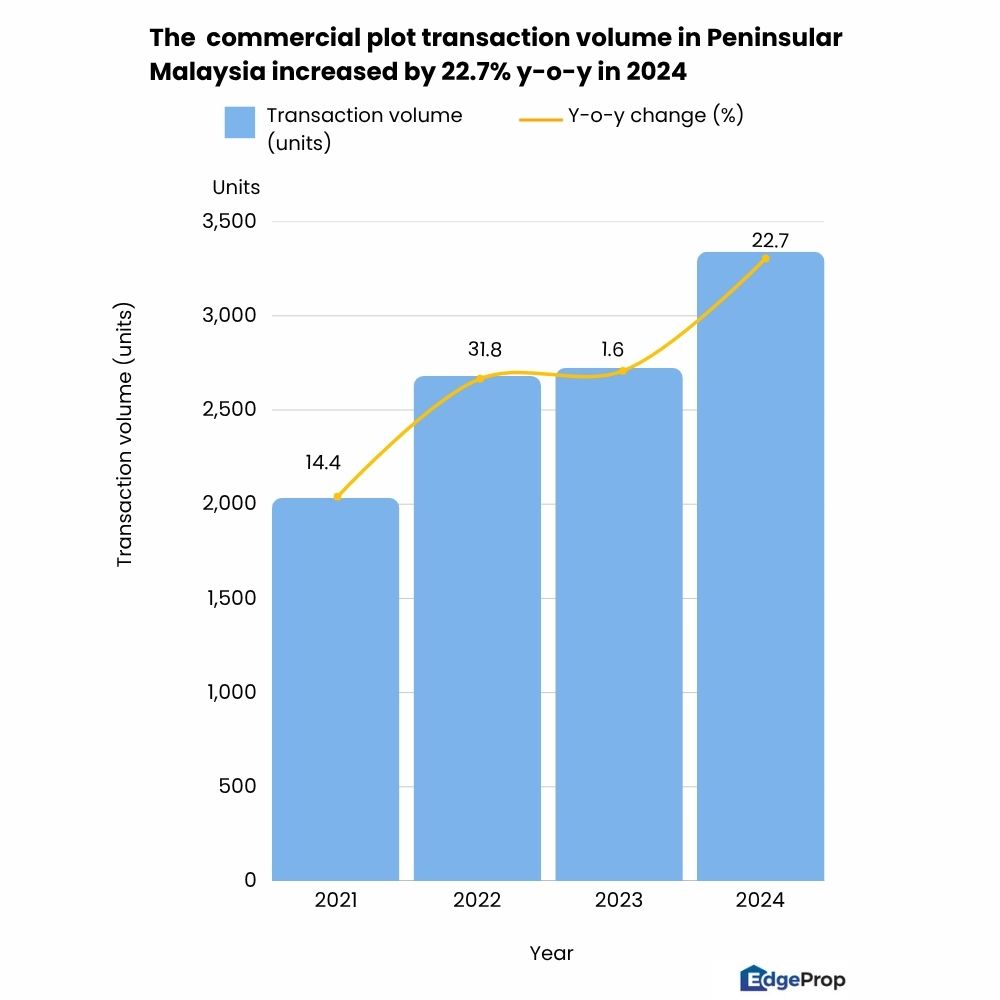

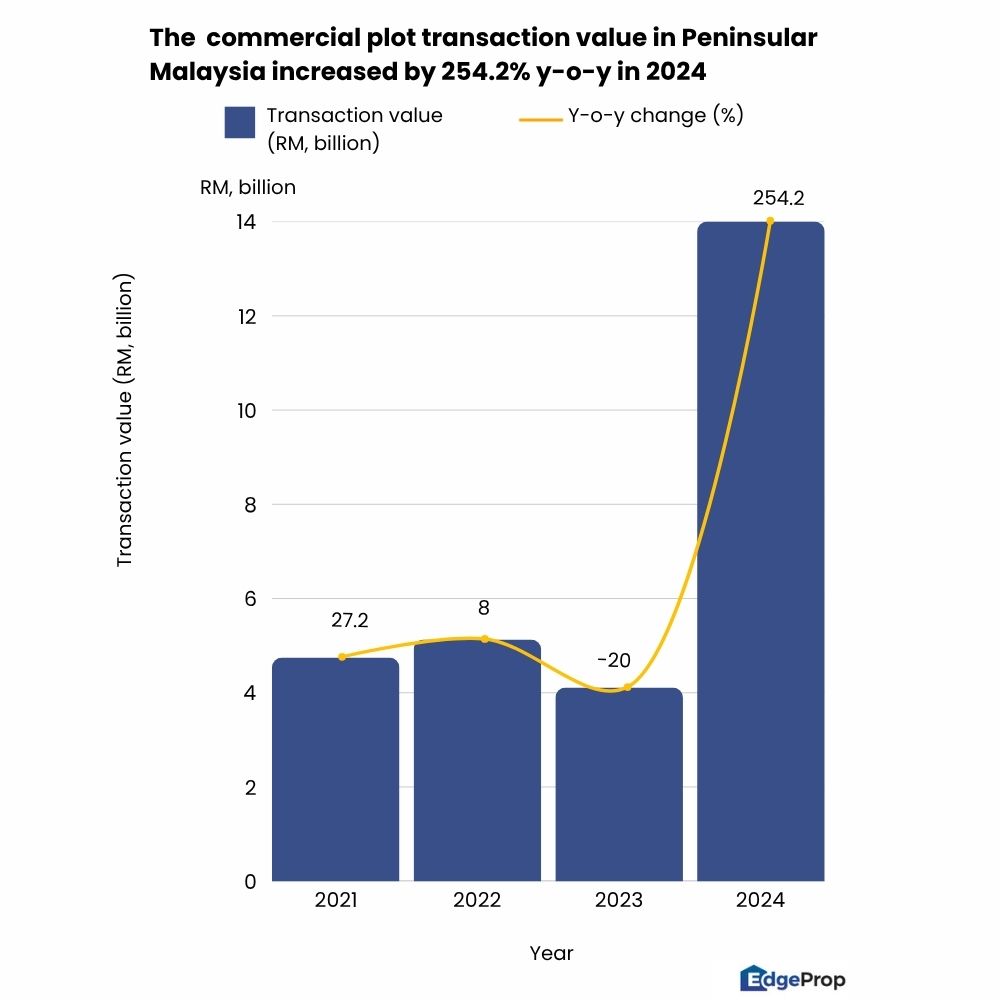

According to the National Property Information Centre (Napic)’s data, vacant commercial plot transaction volumes in Malaysia increased 22.7% to 3,340 units in 2024, while transaction values reached RM14 billion, marking an extraordinary 200% year-on-year (y-o-y) leap.

Commercial land buyers are actively sought out by local and foreign investors who are looking for well-located commercial plots with development potential, market consultants told EdgeProp.my.

JB's commercial land market explodes post-JS-SEZ

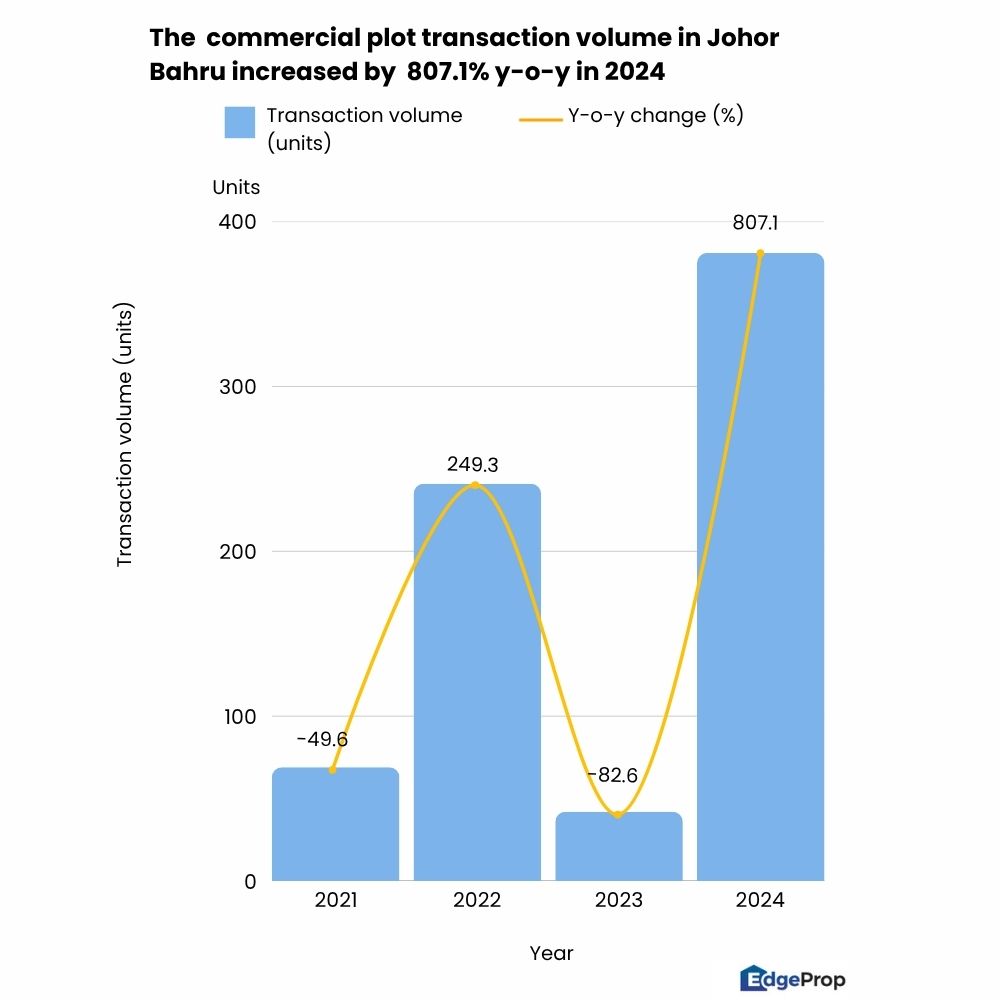

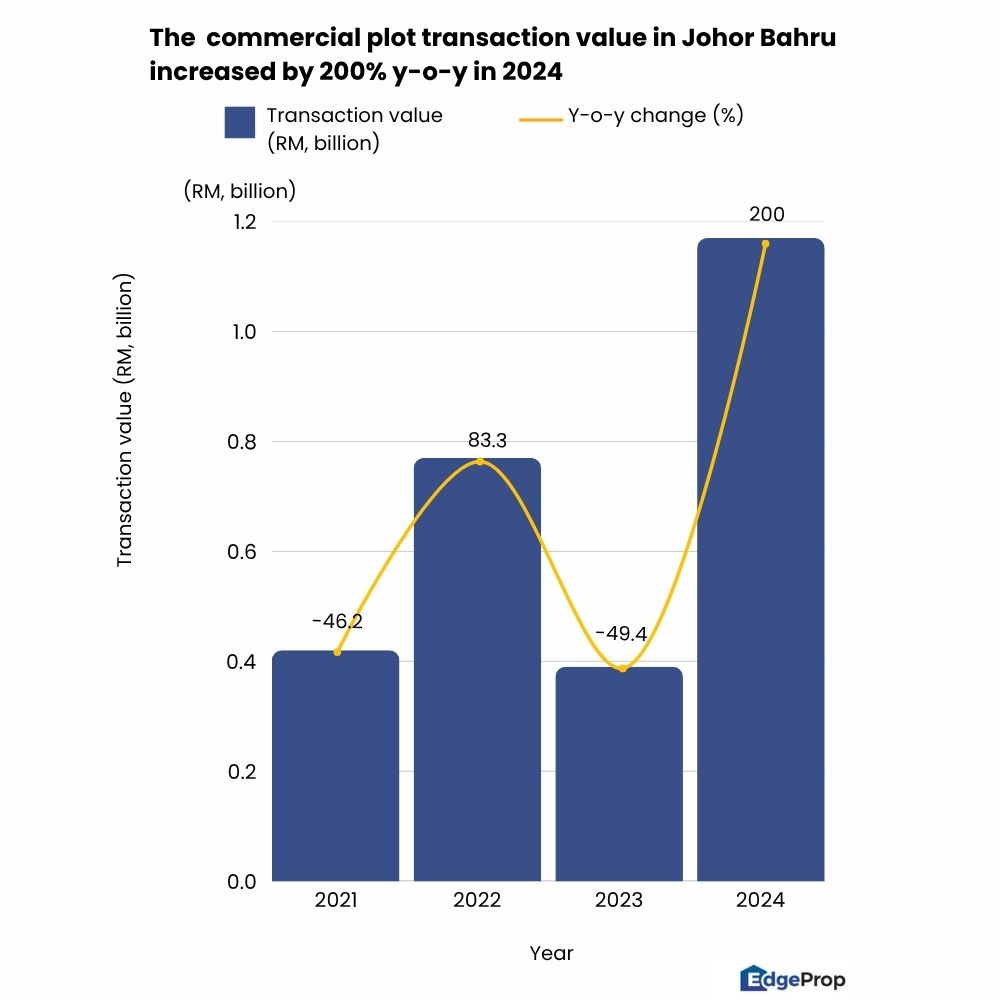

With the launch of the Johor-Singapore Special Economic Zone (JS-SEZ) last year, Johor Bahru has emerged as a prime location for property investors. Commercial land transactions in the area have since seen an unprecedented surge.

Napic data shows that vacant commercial plot transaction volume growth in this particular district increased over 800% to 381 units in 2024, while the value reached RM1.17 billion, a 200% increase compared to the previous year.

According to The Roof Realty real estate negotiator YT Liew, the commercial plot market in JB is experiencing high demand. Developers are acquiring land for land banking, eyeing future development, while foreign investors are actively seeking land to build showrooms, galleries, commercial complexes, or to show their corporate presence in the metropolitan area.

“In JB downtown area, near the RTS link (JB–Singapore Rapid Transit System), land prices now range RM1,000–RM1,400 psf,” Liew said.

Alternatively, with land becoming expensive downtown, Liew said investors should consider turning their attention to Iskandar Puteri and Permas Jaya.

Iskandar Puteri, located to the west of the downtown area, is emerging as a significant data centre hub in the southern region, and also home to the Special Financial Zone (SFZ).

Meanwhile, Permas Jaya, situated to the east of downtown, is a popular residential area, especially appealing to middle-class professionals and business people, who commute frequently to the downtown area.

“The commercial land prices for these regions (Iskandar Puteri and Permas Jaya) are around RM200–RM400 psf, which is significantly cheaper compared to the downtown area,” he said.

KL suburbs emerge as new commercial land hot spots

Klang Valley has been one of the region's business hubs for decades, showcasing its presence in the city.

However, commercial land transactions in Kuala Lumpur have not been as active there compared to the rest of Selangor, as land has become increasingly scarce and expensive.

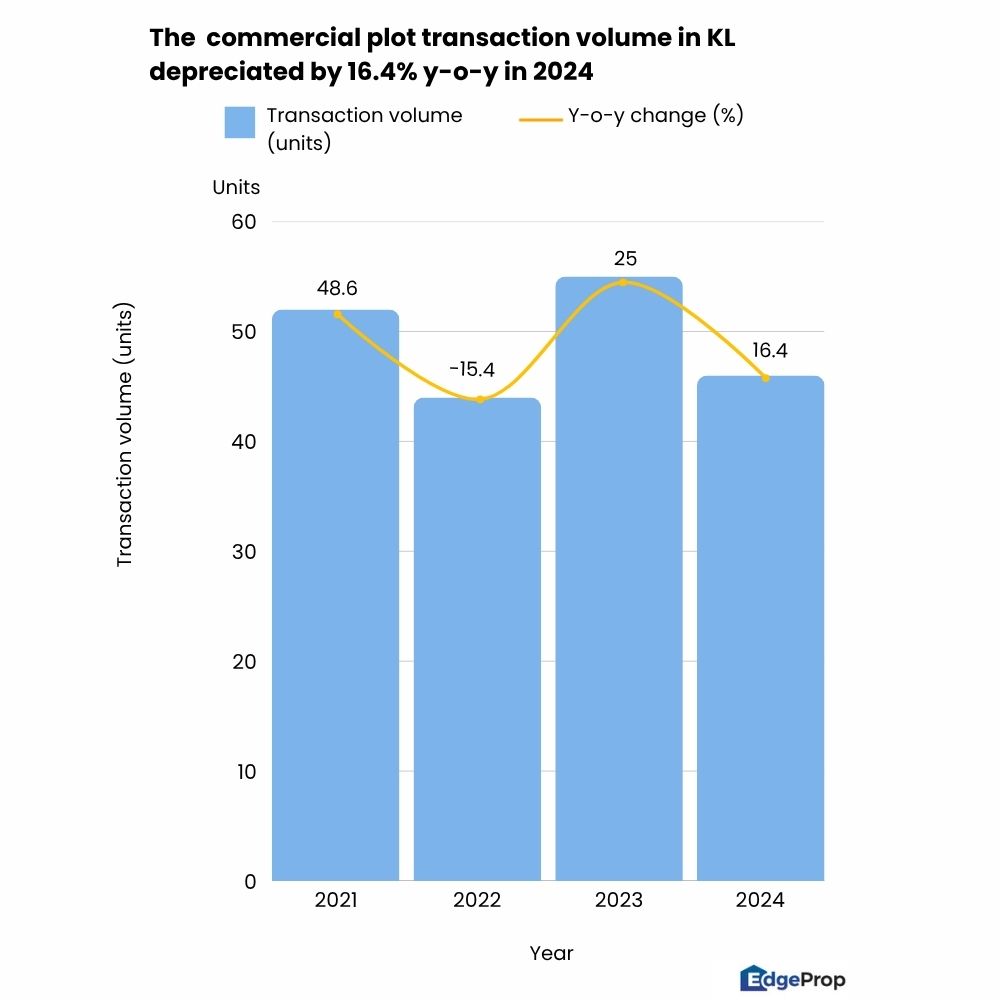

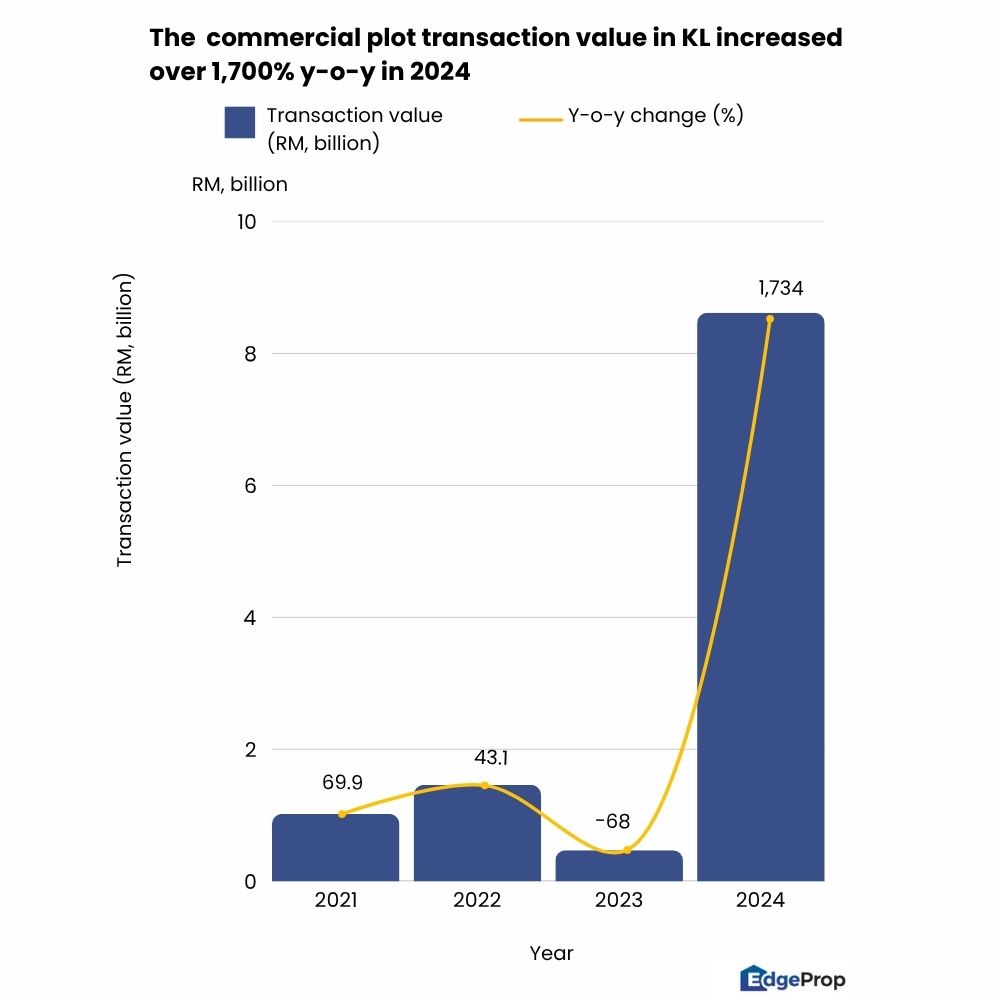

According to Napic’s data, the transaction volume of commercial plots in KL decreased by 16.4% to 46 units in 2024, but the total value increased by a staggering 1,734% to RM8.62 billion.

Of these, one notable land deal in KL involves 16 vacant commercial plots located at Jalan Sungai Besi, valued at up to RM4 billion. This is believed to be one of the phases where KLCC (Holdings) Sdn Bhd acquired parcels within Bandar Malaysia, an acquisition that was announced last year.

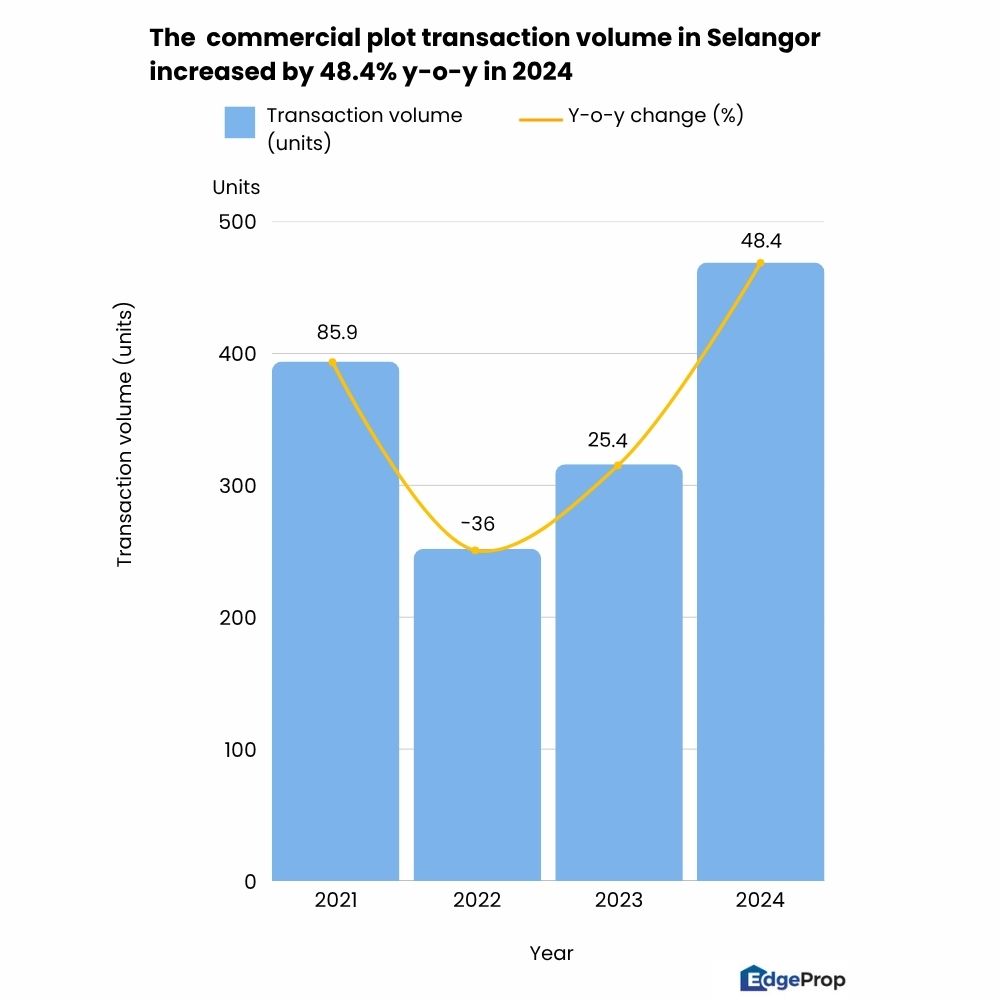

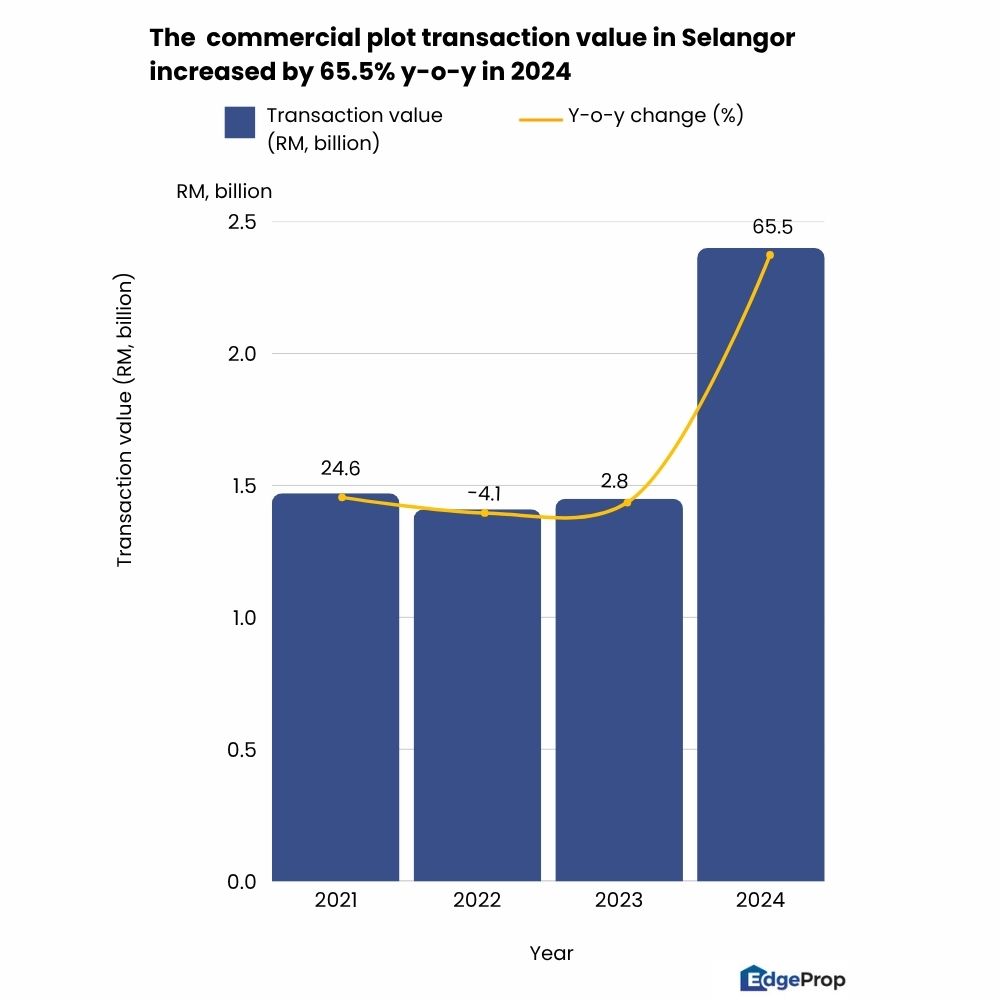

Meanwhile, Selangor’s commercial plots' transaction volume increased by 48.4% to 469 units in 2024, bringing the total transaction value to RM2.4 billion, a 65.5% increase.

The land deal culture in the Klang Valley is distinct due to the city's unique address representation.

“Prime areas in KL, such as Bukit Bintang, Mont’Kiara, and Old Klang Road, remain top destinations for land buyers,” The Roof Realty assistant branch leader Leon Lee said.

These locations particularly appeal to those seeking to establish a prominent presence or capitalise on the city's vibrant activity.

"Land in Bukit Bintang is scarce," Lee said. "Yet, investors, especially foreigners, continue to inquire about vacant plots there, with asking prices reaching up to RM2,700 psf."

However, there is a rising trend in the southern and southwest regions of the Klang Valley, and Lee said that the demand for commercial plots in Setia Alam, Semenyih, and Teluk Panglima Garang is increasing, as investors focus on the spending power of the increasing populations in these regions.

Semenyih, once a quiet town, has undergone significant transformation into a flourishing residential and commercial hub in Selangor. It has seen immense interest from major developers like Eco World Development Group Bhd and S P Setia Bhd, which are developing large-scale townships that have led to a surge in residential and commercial projects.

Meanwhile, Telok Panglima Garang, situated between Banting and Klang, is a free- trade zone (FTZ) that caters to industrial businesses locally and globally.

“These newly developed regions' prices are between RM120–RM160 psf, which are cheap if compared to the heart of KL,” Lee said.

BKIP drives Batu Kawan's investment appeal

Penang is another region that investors are eyeing. Upcoming infrastructures like the LRT (Light Rail Transit) Mutiara line and the Penang International Airport expansion are pushing it to become a logistics hub in the northern region.

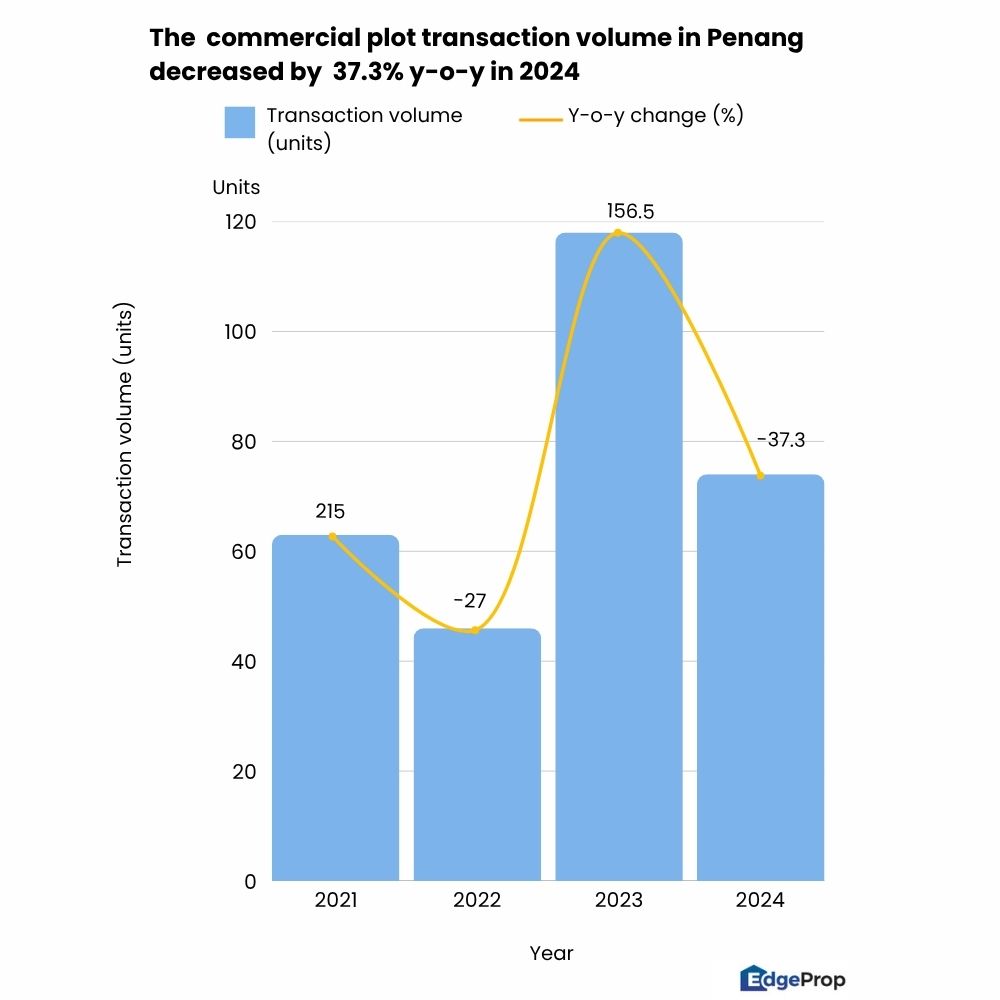

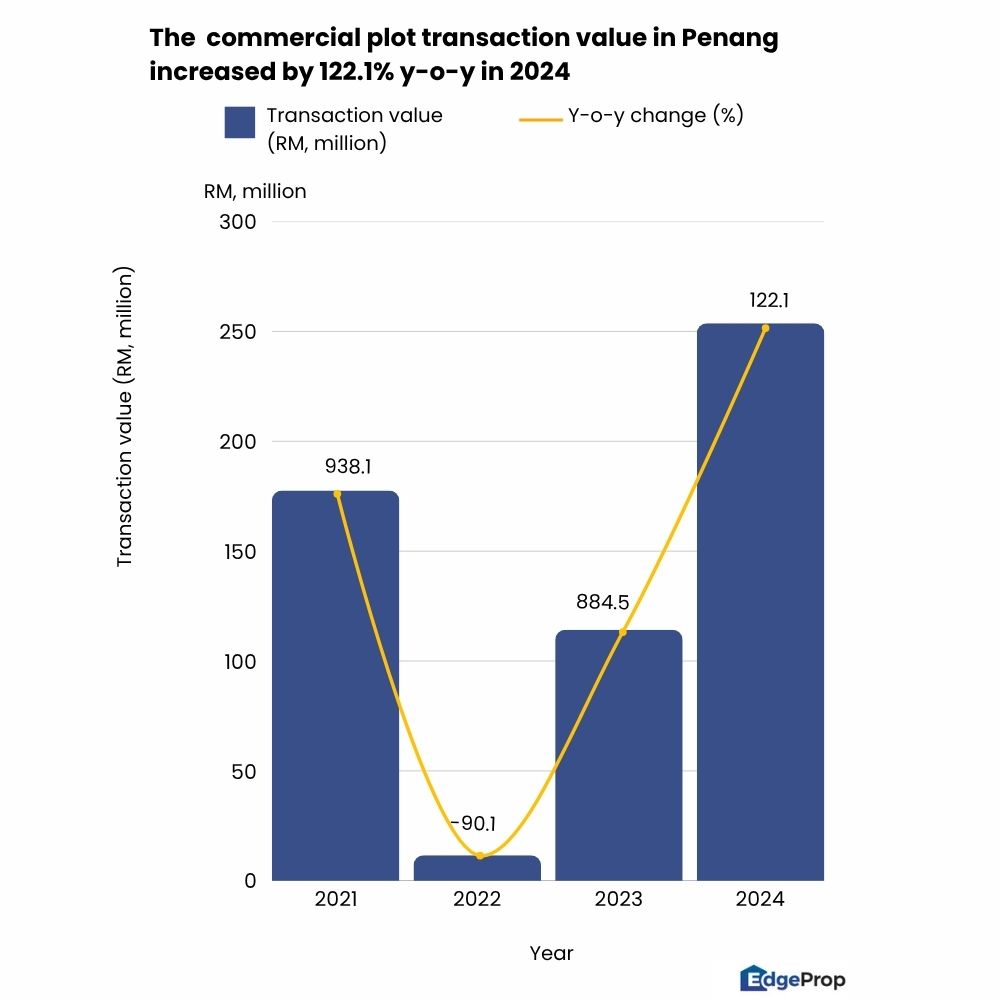

Napic data shows that in 2024, the total transaction volume of vacant commercial plots dropped by 37.3% to 74 units, but the total transaction values showed a second consecutive year-on-year jump of 122.1% to RM253.7 million.

“Despite a drop in commercial plot transaction activities last year, there's still a strong trend of commercial land buyers shifting towards future-proof investments. They're no longer just holding land, but considering how it fits into upcoming infrastructure projects, zoning potential, and long-term urban planning,” managing partner of PropNex Realty, Ryan Ng said.

One of the prominent areas for commercial land deals is the “Silicon Valley of the East”—Batu Kawan.

Located in Seberang Perai on Penang mainland, it has transformed into a major industrial, commercial, and residential hub.

Undoubtedly, Batu Kawan Industrial Park (BKIP), which spans over 1,151 acres, has continuously attracted numerous multinational corporations (MNCs) in high-tech sectors to establish their presence there.

“This area (Batu Kawan) offers opportunities for long-term investors because of its large land plots and incoming factories and companies.

“Commercial land prices here range RM200–RM500 psf,” Ng said.

Meanwhile, the bustling Penang island is still the sweet spot for many. Prime areas like Jelutong and Gurney are attractive, especially given the influx of tourists and international schools.

“Commercial land on Penang island ranges RM700–RM1,000 psf, with prime areas like George Town easily reaching RM1,000 psf,” he said.

Does Malaysia have what it takes to become a Blue Zone, marked by health and longevity? Download a copy of EdgeProp’s Blueprint for Wellness to check out townships that are paving the path towards that.