With more than 90% local buyers, E&O foresees owner-occupiers to dominate Andaman Island

- “Things have been going well, and the amount of GDV we can generate from our launches has become more consistent. Hopefully this rate of approximately RM1 billion in GDV a year can be maintained,” Yeow told EdgeProp Malaysia in an exclusive interview.

KUALA LUMPUR (Nov 28): Eastern & Oriental Bhd foresees its Andaman Island development to be largely occupied by local residents who have bought into the development.

Sited on a 760-acre man-made island off the coast of George Town, Penang, the RM60 billion township recently saw the unveiling of its phase one master plan.

(Read also: E&O unveils first phase of Andaman Island’s RM60b master plan)

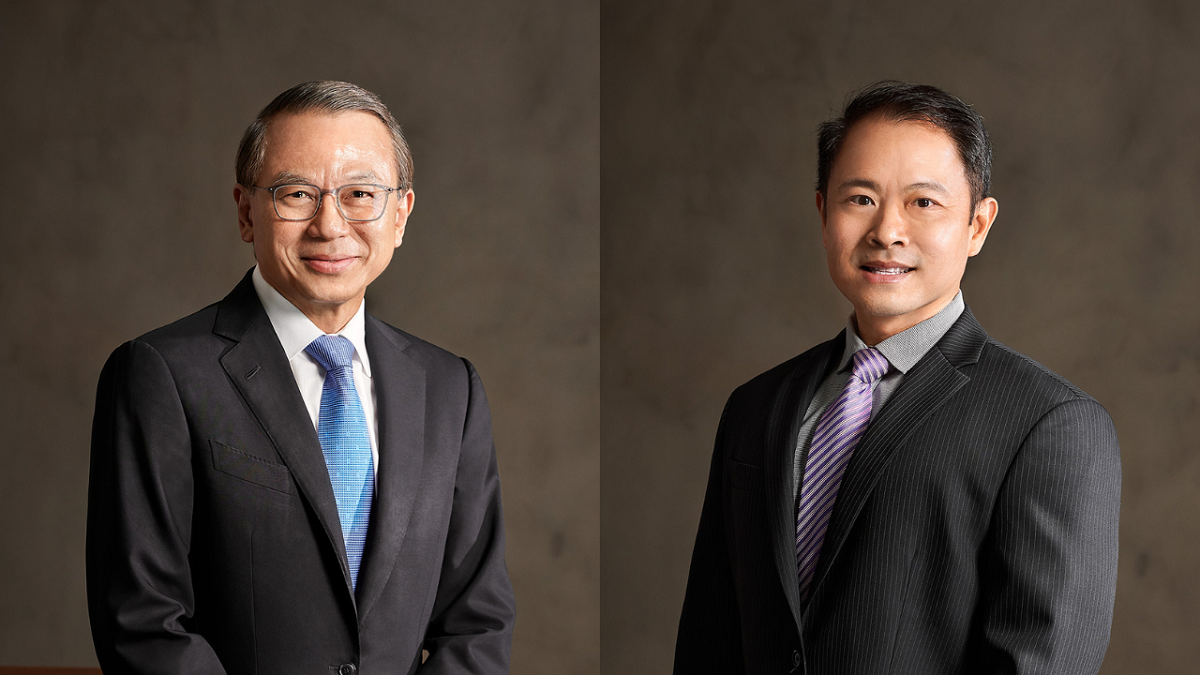

“There was a little bit of foreign interest in Arica, because it was priced more than RM1 million. So, we saw a smattering of Taiwanese, Hong Kong Chinese, and mainland Chinese buying. But foreign buyers constituted only 3% out of the 391 units, with the other 97% of the buyers being Penangnites. Some were residing in Kuala Lumpur or other parts of Malaysia, but a strong concentration of buyers were residents within Penang itself. So, I foresee a high degree of owner occupancy,” said E&O Bhd senior general manager of corporate investment and planning Yeonzon Yeow in an exclusive interview with EdgeProp Malaysia.

Arica is one of the two first high-rise serviced residences launched on Andaman Island. Fully sold, it is slated for completion in March 2027.

Explaining its popularity with Penangites, E&O Group managing director Kok Tuck Cheong told EdgeProp Malaysia: “Over the course of two decades, we have built up a strong legacy of performance. Our track record is impeccable, and the designs of our dwellings remain contemporary after all these years.

“The completion and maturation of Seri Tanjung Pinang (STP) first phase (a 240-acre sea-facing reclamation project that preceded Andaman Island) has given its residents an enduring understanding of the safety, security and serenity that an E&O township provides. This is coupled with the fact that the buyers of STP dwellings have seen capital appreciations in the homes that they bought. That is a very strong ticket to continue to buy into E&O projects, and we are fortunate to have a very loyal following of buyers”.

Yeow added the location of Andaman Island also bodes well for its upcoming commercial launches.

“The location of this island, just outside of George Town, complements the established UNESCO heritage zone, where development is limited. So, the township can be an escape valve for new commercial and high-end developments to service the area,” explained Yeow.

Hoping to maintain RM1 billion GDV per year

E&O’s management also recounted the triumphant emergence from challenges brought about by the global effects of the pandemic and the subsequent two to three years’ slump in Malaysia’s property market.

“Since December 2021, we started launching fairly aggressively, and that has enabled us to demonstrate to the investing public, our shareholders, potential buyers, and critically, to our financiers, that there is demand for properties on the Andaman Island. Our track record with STP helped to set a benchmark with pricing and customer expectation, so it gave us some confidence that we could create and sell on Andaman Island, with a fairly high take-up rate,” Yeow said.

“Our ability to keep up with these new launches, and keep the metaphorical engine running, which is impacted by the banks financing [us], the take-up rates of the existing launches that [we] have, and how fast the authorities can approve the new launches [have contributed to the success].

“Things have been going well, and the amount of gross development value (GDV) we can generate from our launches has become more consistent. Hopefully this rate of approximately RM1 billion in GDV a year can be maintained,” added Yeow.

Riding on wave of improved sentiments

Kok said that the lifestyle property developer plans to take a cautiously optimistic approach to its projects in the foreseeable future, with the developer’s primary focus remaining on its prized Andaman Island.

Hoping to ride the wave of what Kok deemed to be a “resurgence of positive sentiments” towards the Malaysian property sector, E&O’s major projects in Penang are projected to see success due to an influx of foreign direct investments (FDIs) into Malaysia’s northern region.

“The market goes in cycles, and it is also contingent upon economic growth, support from financial institutions on mortgage extension, as well as investments. In Malaysia’s southern region, we’re seeing investments being channeled into data centres and industrial parks, while in the north, FDIs have been pledged by major players in the semiconductor industry, and other larger multi-national corporations from around the world,’’ said Kok.

“All these factors have given new impetus to demand for workers. With that level of job creation, it will certainly lead to more demand for roofs over the heads of people coming from differing geographic footprints.

“Essentially, the demand arising from all these new investments into different property hubs have created an encouraging response to homebuying,” added Kok.

Priority on Andaman Island

When discussing the company’s plans for the next three to five years, Kok and Yeow said that the group plans to maintain its steady performance, by consolidating its efforts into Andaman Island.

“Our driving focus is on the continuous development and launches of the projects on Andaman Island. We have taken huge financing arrangements to create this island, and our priority is to ensure that we can monetise or generate sufficient cash flow to meet our investor demands,” explained Kok.

“We do have properties and land banks to develop in the south and the Klang Valley — that will be an ongoing process. In the international space, we have assets in London, which includes The Lincoln Suites — 54 units of serviced apartments, which have been fully developed and are operating very nicely for us. We have a land bank somewhere in London, with all the relevant approvals, but with the state of the market there, we are currently keeping it on hold for the moment. Our main focus as a whole is still Andaman Island,” said Kok.

Beyond 2024 and beyond Penang

2025 will be an important year for E&O in other regions of Malaysia as well, with two ongoing projects with global Japanese property developer, Mitsui Fudosan, in KL, as well as planned launches for Elmina, Selangor, and Johor.

“We are almost ready to hand over The Conlay, Kuala Lumpur, and more than 200 out of the 491 units have been sold. As for The Peak, Damansara Heights, we have sold 52 out of 54 units, and that project is slated for completion at the end of 2025. We still have 65 acres of land in Elmina, Selangor, and we have plans to launch stratified and landed homes there, some time in the middle of next year,” Yeow said, in regards to the status of their other ongoing and upcoming projects.

“In Johor, we have completed all 458 units of terrace homes for Avira. We still have a remainder of 10 acres of land there, which we are planning to use for construction of serviced apartments. That project is currently being planned, and we are almost ready to submit the plans for development order (DO) and planning permission (PP). If we get all the approvals in place on time, at the earliest rate, that particular project in Johor will be launched at the end of 2025,” added Yeow.

Looking to buy a home? Sign up for EdgeProp START and get exclusive rewards and vouchers for ANY home purchase in Malaysia (primary or subsale)!

Follow Us

Follow our channels to receive property news updates 24/7 round the clock.

Telegram

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.