Ekovest, Knusford shares decline after merger falls through

- Ekovest and Knusford also said that they have not ruled out the possibility of reviving merger discussions in the future.

KUALA LUMPUR (July 29): Shares of Ekovest Bhd (KL:EKOVEST) and Knusford Bhd (KL:KNUSFOR) slid on Tuesday after their proposed merger fell through following the third extended deadline.

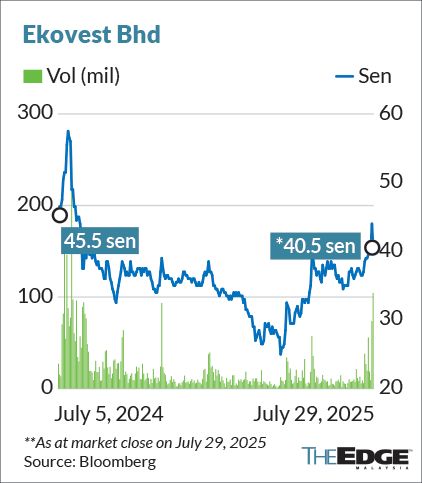

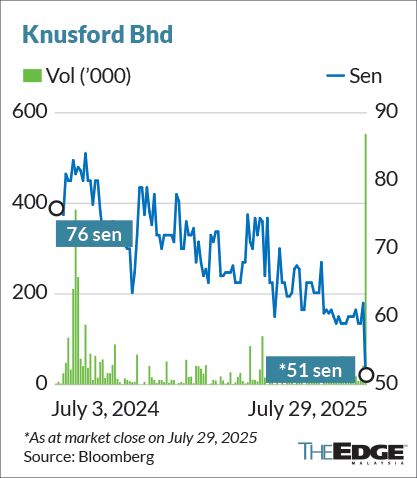

At market close, Ekovest pared losses to close down 3.5 sen or 7.95% at 40.5 sen, giving it a market capitalisation of RM1.2 billion. As for Knusford, it recouped some losses to end the day at 51 sen, still down 11 sen or 17.7%, valuing the company at RM50.82 million.

Ekovest was the second most traded stock on Bursa Malaysia, and fell as much as six sen or 13.6% before recouping losses, while Knusford dropped as much as 11.5 sen or 18.5% earlier.

Both Ekovest and Knusford separately announced on Monday that their proposed merger fell through following the lapse of its deadline extension. Details on why the RM450 million deal was not concluded within the time frame were not disclosed.

However, just after the market closed on Tuesday, both companies clarified in separate filings that they were “unable to reach an agreement on the transaction value and key terms” for the proposed merger.

However, just after the market closed on Tuesday, both companies clarified in separate filings that they were “unable to reach an agreement on the transaction value and key terms” for the proposed merger.

Ekovest and Knusford also said that they have not ruled out the possibility of reviving merger discussions in the future.

“The company remains open to revisiting the proposed merger should suitable opportunities arise in the future,” their filings read.

The lapse is not expected to have any financial, operational or legal impact on both parties.

The proposed merger, first announced to the bourse back in October 2023, would have seen Knusford acquiring Ekovest Construction Sdn Bhd, through the issuance of new Knusford shares at 60 sen apiece.

Previously, Ekovest said the merger was aimed at consolidating its major shareholder Tan Sri Lim Kang Hoo’s construction-related assets under Knusford, eliminating related party transactions, and achieving operational synergies.

Lim is a major shareholder of both Ekovest and Knusford, with a 28.01% stake in Ekovest and a 33.15% stake in Knusford. He is also executive chairman of Ekovest, while his son Lim Chen Herng is an executive director of Knusford.

Ekovest on Tuesday saw 104.44 million shares traded, over nine times its 90-day average of 11.25 million shares. Meanwhile, Knusford’s trading volume stood at 5553,400 shares over 33 times its 90-day average.

While Ekovest’s talks with Knusford over this consolidation closed unsuccessfully, Ekovest had last Friday extended the deadline to acquire a 70% stake in Credence Resources Sdn Bhd for RM1.15 billion by a month, to Aug 29.

Credence Resources owns 63.13% of Iskandar Waterfront Holdings Sdn Bhd, which in turn holds a 34.29% stake in Iskandar Waterfront City Bhd (KL:IWCITY).

Credence Resources’ shareholders are Lim (90%), Ekovest managing director Tan Sri Lim Keng Cheng (5%), and executive director Datuk Lim Hoe (5%).

Does Malaysia have what it takes to become a Blue Zone, marked by health and longevity? Download a copy of EdgeProp’s Blueprint for Wellness to check out townships that are paving the path towards that.

Never miss out

Sign up to get breaking news, unique insights, event invites and more from EdgeProp.

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.