IOI Properties on track to exceed RM1.8b sales target this year

IOI Properties Group Bhd July 19 (RM2.42)

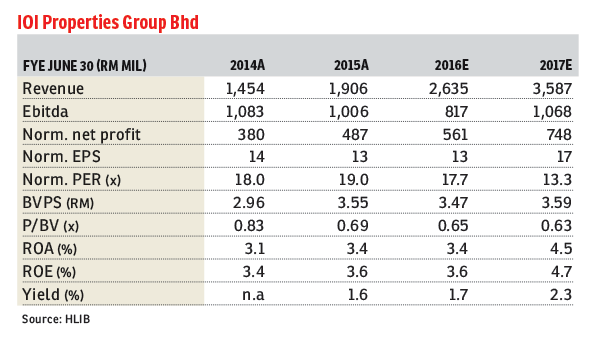

Maintain buy with an unchanged target price (TP) of RM2.77: We met up with IOI Properties Group Bhd’s management recently and walked away feeling positive. Its nine-month financial year 2016 (9MFY16) core profit after tax surged 30% year-on-year (y-o-y) to RM400 million, already exceeding FY15 full-year core earnings, mainly contributed by the Triling project in Singapore and IOI Palm City in Xiamen, China. We expect quarter-on-quarter growth for the fourth quarter of FY16 results, and it is on track to meet our full-year earnings estimate of RM560 million.

With the strong recovery in China’s property market, phase 1 and phase 2 of IOI Palm City in Xiamen are almost fully taken up. Given the encouraging response, IOI Properties is targeting to launch a 46-storey high-end condo with a total gross development value (GDV) of one billion yuan (RM597.9 million). The remaining GDV of IOI Palm City is about four billion yuan, which will sustain its sales for the next two to three years.

With nine-month sales already hitting RM1.46 billion, the company is on track to exceed its RM1.8 billion sales target for the year. IOI Properties is bullish on the prospects and targeting to increase its sales by 28% y-o-y to RM2.3 billion in FY17, with the overseas segment to contribute 40% of total sales. We maintain our forecast for IOI Properties and keep our “buy” rating. — Hong Leong Investment Bank Research, July 19

This article first appeared in The Edge Financial Daily, on July 20, 2016. Subscribe to The Edge Financial Daily here.

Never miss out

Sign up to get breaking news, unique insights, event invites and more from EdgeProp.

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.