KUALA LUMPUR: Malaysian real estate investment trusts (REITs) have proven to be resilient in times of economic and financial uncertainty, said Axis REIT Managers Bhd CEO Stewart LaBrooy.

Speaking after the launch of the Malaysian chapter of the Asia Pacific Real Estate Association (Aprea), LaBrooy said in times of market turbulence, REITs have proven their resilience.

"As REITs have low betas, meaning low risk with low returns, they are seen as a safe haven instrument," he said.

In the market sell-down that started since August, LaBrooy noted that the volume of REIT units traded has been quite low with only 200 to 300 units traded a day. In fact, investors were long in the market as they sought dividend yields.

"They were not speculative in nature," he added.

LaBrooy said REITs in Malaysia are conservatively managed coupled with the tight controls put in place by both the Securities Commission and Bank Negara Malaysia ensure stability of the market.

According to LaBrooy, the Malaysian REIT market is only a 10th of the Singaporean market, implying that it is a relatively small market.

Market capitalisation of REITs in Malaysia only amounted to US$3.7 billion (RM11.8 billion) while Singapore's REIT market has a capitalisation of US$31 billion. LaBrooy said he is bullish on Malaysian REITs given that there are plans for more listings to come. As such, Malaysia should be able to see an increase in the size and liquidity of the REIT market.

According to Aprea, there has been increasing interest amongst foreign investors in the Malaysian real estate market and major Malaysian real estate companies in investing offshore.

Aprea is a non-profit industry association that seeks to aid its members in gaining access to investors and the global network of property companies, banks and investors, as well as research and information.

Kumar Tharmalingam, CEO of Malaysia Property Inc and chapter board chairman of Aprea Malaysia, cited Middle Eastern investors as an example.

These investors see Malaysia as a stable and "boring" country to invest in, and the country as relatively insulated from volatility in other markets like Hong Kong or Singapore.

TOP PICKS BY EDGEPROP

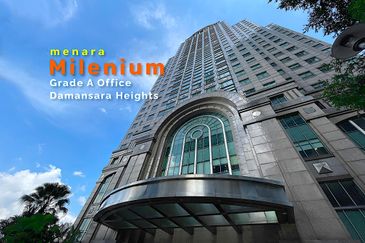

Damansara Height (Bukit Damansara)

Damansara, Kuala Lumpur

Sunsuria Forum @ 7th Avenue

Setia Alam/Alam Nusantara, Selangor