ADVERTISEMENT

All Property News

Stay updated with the latest real estate and finance news, including property market trends, housing insights, and valuable information.

SD Guthrie, Selangor govt explore massive 5,000-acre development on Carey Island

5 hours ago

Astaka ventures into healthtech as new growth driver, signs exclusive deal with Evergrown

6 hours ago

YTL Hospitality REIT eyes RM99 mil private placement for debt repayment

7 hours ago

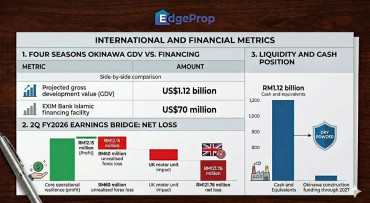

YTL 1HFY2026 earnings hit by lower power prices, Malayan Cement bright spot

7 hours ago

UEM Sunrise FY2025 revenue rises 27% to RM1.7b, proposes higher 1.43 sen dividend

7 hours ago

Chin Hin 4Q net profit up 5% to RM38 mil on turnaround in property business

8 hours ago

Legally Speaking

Govt seeks to forfeit funds in Ilham Tower, individual accounts linked to Daim case

Guide to Homebuying

Find the best location for your home

Legally Speaking

KL High Court rules developer’s ‘contra arrangements’ with landowner invalid in K Residence condo case; Duta Yap’s son held personally liable

Trending narratives

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.

![[Branded] The Residences IV, The Glades—final 2-storey waterfront resort-style bungalows with comprehensive conveniences](https://media.edgeprop.my/s3fs-public/styles/markoneeditorspick/public/tr_b3_entrancefoyer(1).jpg?TpL_ttjdYIp9ZNGwHTv4CIE73gaKe4Vk&itok=Yo-NojCt)

![[Branded] 6 signs you may be overpaying for a property (and how to avoid costly mistakes)](https://media.edgeprop.my/s3fs-public/styles/markoneeditorspick/public/malaysiaklaerialviewtheedgemarkets.jpg?wcF2nB8b.K1_MpIZRHZqFK8ARi9_l9f9&itok=loopOsxK)

.jpg?KpT57Dw7Y_UzSKH8HsHP9pRQ_peOr_KV)