Hotels for sale in the secondary market is not an everyday occurrence. The hotels that come up for sale are usually those that have not been performing well and their owners have failed to turn them around.

“Sometimes, the hotels are sold because their owners are ageing and looking to retire from the business. It could also be that the owners are investors rather than hotel operators; hence, after a while, they may want to realise their investment,” Carey Real Estate Sdn Bhd head of hospitality asset division Shawn Valerio tells TheEdgeProperty.com.

Although it is not that common to see existing hotels being transacted, some notable transactions were concluded in 2016. They include the Renaissance Kuala Lumpur Hotel at Jalan Sultan Ismail, which was sold in August 2016 for RM765 million or an average RM841,000 per room, while Aloft KL was sold in March 2016 for RM419 million or RM871,000 per room.

According to the National Property Information Centre’s (Napic) data, there were 12 hotel transactions recorded in 2016, including those dated in 2014 and 2015 but were only concluded in 2016, worth RM23.17 billion. KL recorded seven transactions. Besides the Renaissance and Aloft KL, other prominent hotels transacted in KL were Seri Pacific Hotel at Jalan Putra and DoubleTree at Jalan Tun Razak. Kelantan, Melaka, Perak, Sabah and Sarawak saw one hotel transaction each last year.

According to Napic, the hotel property segment recorded 23 new completions (3,713 rooms) last year, a 21.3% dip from the 40 new completions (4,716 rooms) recorded in 2015. However, there will be 121 hotels (24,443 rooms) incoming, led by KL (5,294 rooms), and another 94 hotels (18,521 rooms) in the planned supply, led by Johor (4,122 rooms).

Riding on tourism growth

Knight Frank Malaysia executive director of capital markets James Buckley says there is strong interest for hotels and the hospitality industry in Malaysia especially from overseas as the tourism industry in this region has shown consistent growth.

Buckley says Malaysia’s hotel industry holds a bright outlook as tourist arrivals have recovered in 2016 after a difficult year in 2015. Tourist arrivals and receipts last year have risen 4% and 19%, respectively, from the previous year.

“Over the last 10 years, the number of tourists and receipts to Malaysia have grown at a compounded annual growth rate of 4% and 8%, respectively,” he adds.

This year, Malaysia targets to attract 31.8 million tourists. Concerted efforts by various stakeholders in the industry via promotional campaigns, extension of e-visa to attract tourists from more countries, increased flight frequencies and introduction of more travel routes will help support this growing sector.

He notes that high-impact projects like the East Coast Rail Link connecting the east coast regions and the high-speed rail between Malaysia and Singapore will further fuel tourism growth.

According to Valerio, the weakened ringgit has also favoured the Malaysian tourism industry as well as the hospitality industry.

“Limited service and mid-scale international hotel brands are just coming into Malaysia. We are handling enquiries now from a few potential purchasers who are seeking good hotel investment opportunities in KL city centre, Penang, Langkawi and Kota Kinabalu,” he reveals.

Penang-based Elite Properties Sdn Bhd senior negotiator Season Ting says the robust growth of the tourism industry has prompted many to look for opportunities in the hotel sector particularly in Penang, which has grown in popularity as an international tourist destination.

“From the business point of view, hotel owners can gain a good premium due to the strong market demand for rooms. From an owner investor’s point of view, this might be a good time to reap some good returns from the hotel industry,” he opines.

Ting notes that the asking price for hotels located in George Town, Penang could reach about RM350,000 to RM400,000 per room. In the George Town area, there are plenty of small to mid-size hotels that offer 50 to 100 rooms.

He adds that some hoteliers or investors prefer to turn a commercial building into a hotel because this usually requires smaller investment capital.

Market offerings

Listings on TheEdgeProperty.com over the past 18 months showed 13 hotels seeking new owners and a plot of land that comes with development approval for a hotel in Johor Bahru. Some of these properties have exchanged hands while some are still in the market. Five are in KL, three in Johor, two in Penang and one each from Selangor, Pahang and Negeri Sembilan.

The highest-priced listing at RM180 million, however, was for the piece of land in Johor Bahru which has been approved for the development of a luxury hotel. According to the agent, Ignatius Charles from Carey Real Estate Sdn Bhd, the owner intends to sell the 285,000 sq ft freehold site together with the hotel development rights.

The piece of land, which has been listed on TheEdgeProperty.com website since October last year, is located in the city centre close to the Johor Bahru Customs, Immigration and Quarantine Complex.

As for the nine existing hotels that were listed for sale, they were all in ready-to-operate condition, which means new owners could directly run the business without the hassle for new licence applications.

Many of these are budget, 3-star or boutique hotels located in popular tourist destinations such as Bukit Bintang in KL and in Johor Bahru. Asking prices range between RM18 million and RM102 million.

Among the listings that are still available for sale are Hotel Geo in Petaling Street, KL, and Acapella Hotel at Section 13, Shah Alam. They are asking for RM100 million and above.

Hotel Geo, located at Jalan Hang Kasturi, is a 10-storey, 180-room hotel with a built-up size of 110,000 sq ft on a 22,000 sq ft freehold site.

Acapella Hotel is a 20-storey, 4-star business hotel with full facilities. It is built on a 46,600 sq ft leasehold site with a built-up area of 309,300 sq ft. According to Reapfield Properties (Taman SEA) Sdn Bhd negotiator Emily Lim, the hotel, which was completed end-2014, is in good condition.

The other 3-star hotels or boutique hotels that are listed for sale are a 3-star hotel in Brinchang, Cameron Highlands, Pahang; Nusajaya Hotel in Johor Bahru; a seafront resort hotel in Batu Ferringhi and a hotel in Tanjung Tokong, Penang. They are tagged between RM36 million and RM80 million.

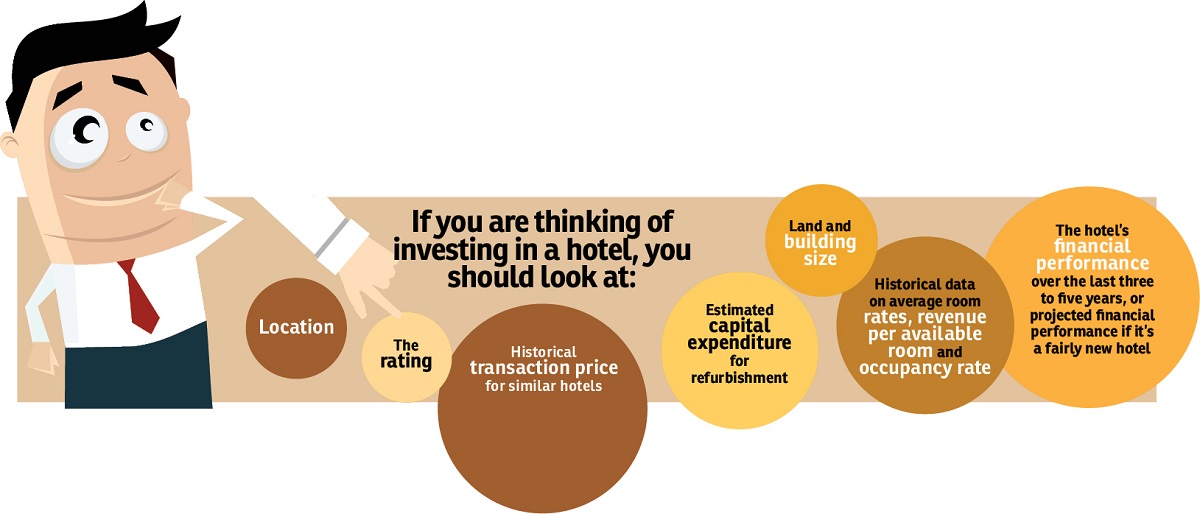

Value determiners

When it comes to hotel asset transactions, cost is still the main consideration in a purchase decision.

Buckley says hotel investors and banks often adopt these three approaches when assessing the value of a hotel: the cost of refurbishing the property, comparison of the property with similar properties sold in the market, and income capitalisation which is the forecast net income divided by the capitalisation rate.

According to him, the factors that could increase a hotel’s value include visibility, easy access and parking, proximity to retail, dining and entertainment venues, and being close to corporate and leisure demand generators.

“The bottom line is that a strong location drives revenue, impacts cash flow and exit values, and therefore returns on investment,” he stresses.

Other factors that could impact the price is a surge in new hotel inventory, especially during an economic slowdown.

However, he notes that there is often a large variance in price expectations between buyers and sellers.

“Often vendors need to be more realistic in their pricing expectations and acknowledge that any new owner will often also need to invest a large sum to upgrade the rooms and facilities,” says Buckley.

Besides pricing, international investors also look at the net yield that a hotel can offer. “There are often more reasonably- priced hotel investments in other countries. For instance, some hotels outside London can offer a net yield of between 7% and 8.5%, while the average net yield of hotels in Malaysia is around 5%,” offers Buckley.

According to Carey Real Estate’s Valerio, to seasoned hotel investors, determining the cost per key of a hotel and the required capital expenditure upon takeover are the most crucial considerations.

“A branded star-ranked hotel tends to fare better than stand-alone brand hotels simply because of their established brand presence and recognition. Hence, they tend to fetch better average room rates and occupancy rates,” he says.

“International hotel chains tend to take the ‘new built’ approach rather than to acquire an existing one as they are often cheaper than an existing one, which may come at a premium. Besides, a new space allows them to fit out the place according to their standardised specifications. Hence, we often see international hotel chains teaming up with developers of mixed or integrated developments,” he adds.

On the transaction process, Valerio says acquiring a hotel is similar to other properties except that there is an additional step of due diligence to be carried out by the potential buyer before committing to the sale and purchase agreement (SPA).

The due diligence phase varies between 30 and 90 days, depending on the size and complexity of the hotel. It’s safe to say that from the moment the buyer places the earnest deposit, the time frame to complete the sale is about four to eight months for a freehold asset. Leasehold assets would vary by state and may take an additional one to three months.

Who would buy a hotel?

“Other than international hoteliers who are seeking to have a presence in Malaysia, those who are inclined towards hotel asset acquisitions are sophisticated entrepreneurial individuals seeking to delve into the hospitality business,” Valerio says.

There are also budding entrepreneurs cum property investors who see small-size hotels, such as budget hotels, as something they can manage. On the other hand, there are high-net-worth individuals (HNWI) who may want to own a hotel as a status symbol or for personal investment.

Meanwhile, Knight Frank’s Buckley believes the boutique or independent hotel sector often presents the best investment opportunities.

“Savvy hotel investors buying from inexperienced owners with inconsistent execution can often make significant improvements and drive substantial performance,” he notes.

“Hotel investments are significantly more complex than other forms of property investments. Even the best location doesn’t guarantee good performance if service quality is lacking.

“Poor service can often generate poor reviews on the internet and negatively impact prospective guests. Thus, the bad reputation will reflect on the financial performance, causing the value of the hotel to decline,” he adds.

This story first appeared in TheEdgeProperty.com pullout on July 28, 2017. Download TheEdgeProperty.com pullout here for free.