KLCCP Stapled Group (Aug 16, RM7.89)

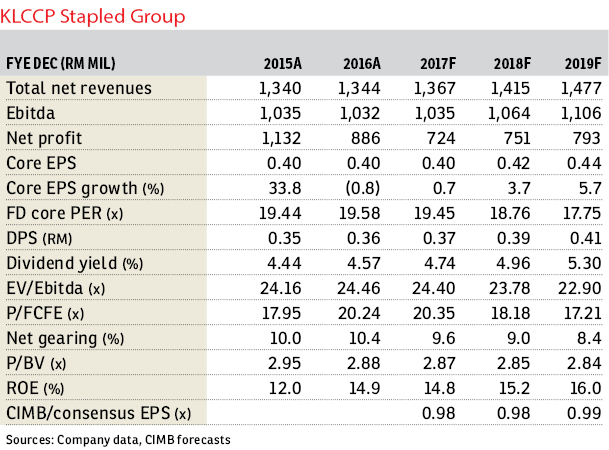

Maintain hold with an unchanged target price of RM7.69: KLCCP Stapled Group’s (KLCCS) first half of financial year 2017 (1HFY17) top line came in at RM674 million (+0.7% year-on-year [y-o-y]) as weaker revenue from the office (-0.3% y-o-y) and retail (-1.2% y-o-y) segments offset revenue growth from its hotel segment (+6.4% y-o-y) and management services (+5.6% y-o-y). However, 1HFY17 core earnings declined 0.9% y-o-y as the hotel segment reported loss before tax (LBT) of RM1.5 million (versus LBT of RM4.7 million in 1HFY16). All in, 1HFY17 core earnings of RM355 million (-0.9% y-o-y) met expectations, at 49% of our and 48% of Bloomberg consensus FY17 forecasts.

1HFY17 office revenue dipped 0.3% y-o-y as 40% of the net lettable area (NLA) of Menara Exxon-Mobil was unoccupied in February and March 2017. The NLA was taken up in April, we gather, by a single tenant from the Petronas group of companies. This is a testament to the strong backing that KLCCS gets from its major shareholder. However, office profit before tax (PBT) grew 0.5% y-o-y to RM187.1 million as the segment had interest cost savings on repayment of its borrowings in April 2017.

The 1.2% y-o-y decline in retail revenue arose from a one-off back rental recognition in 2QFY16. Recall that in 2QFY16, KLCCS saw recognition of the back charge in rental and service charge for a tenant for 21 months upon winning a court case, amounting to RM3.5 million. Excluding the one-off, 1HFY17 retail revenue and PBT would have increased 3.6% y-o-y to RM244 million and 0.9% y-o-y to RM187 million respectively, on the back of positive rental reversions.

1HFY17 hotel revenue improved 6% y-o-y from better occupancy of 46.7% (2QFY16: 42.8%) as the Mandarin Oriental saw growth in its leisure and food and beverage businesses. However, this was offset by high depreciation and interest costs, which led to 1HFY17 LBT of RM1.5 million. Notably, refurbishment of its club rooms and suites has been completed and the rooms are back in operations. Deluxe rooms and park suites are currently undergoing refurbishment on a staggered basis; KLCCS expects this to be completed by FY18.

We expect 2HFY17 earnings to improve on: i) better retail segment contribution — stronger tenant sales boosted by year-end holidays; ii) full contribution from new tenants at Menara Exxon-Mobil; and iii) a better occupancy rate at Mandarin Oriental, due to a stronger leisure market during the year-end holiday period and events such as the SEA Games, which should cushion the high operating costs in the hotel segment. We make no changes to our earnings forecasts.

We believe KLCCS deserves to trade at a premium over its peers due to its size, prime location and secured office assets (locked-in long-term, triple net leases), as well as the strong brand name of its retail assets. We think its dividend yields, backed by stable earnings, should attract investor interest, although we note that at current valuations, its FY17 and FY18 forecast yields of 4.8% and 5% have become slightly unattractive (versus the sector average of 5.2% and 5.5%). — CIMB Research, Aug 15

This article first appeared in The Edge Financial Daily, on Aug 17, 2017.

For more stories, download TheEdgeProperty.com pullout here for free.