Cahya Mata Sarawak Bhd (May 21, RM1.92)

Maintain buy with a target price (TP) of RM4.57: Cahya Mata Sarawak Bhd (CMSB) shares hit limit down last Friday, but management views the steep selldown as mainly due to a few factors — these include the Bruno Manser Fund’s (BMF) offer to share information and Democratic Action Party’s (DAP) statement on road maintenance concessions in Sarawak. The group believes that even if legal action is taken against Tun Abdul Taib Mahmud and his family, that is unlikely to impinge on the group’s operations. This is because CMSB is professionally and independently managed. Management also remains confident that its state road concessions will be renewed. We believe the sell-off on the shares has been overdone and is only temporary. This is because we think CMSB’s traditional businesses are backed by its expertise and heavy investments in these units.

CMSB shares hit limit down last Friday, with shares falling 29.75%. In an email statement to investors and analysts, management said the steep sell-down was mainly due to the:

i) Bruno Manser Fund’s offer to share information and the unblocking of the Sarawak Report website, which has been known to post news that is negative towards former Sarawak chief minister Abdul Taib and his family. This information is now widely available for the general public to access;

ii) Statement by the Democratic Action Party on Sarawak’s road maintenance concessions, which was posted on the Borneo Post’s online portal. This statement suggests that concessions be awarded via open tenders and given to up to 10 companies, which would enable the state government to compare the work of various firms before contracts are awarded; and

iii) General market sentiment against stocks linked to the previous federal government and uncertainties over future policies.

Management’s internal take on the three events is as follows:

a) The allegations against Tun Abdul Taib and his family — who collectively own a 33.35% stake in CMSB — have been in the public domain for a long time. Management believes that even if legal action is taken, that is unlikely to impinge on its operations. This is because the group is professionally and independently managed;

b) CMSB remains confident that its state road concession will be renewed. It has an inventory of road maintenance equipment worth about RM100 million and much of these are also state-of-the-art. The group also employs more than 800 Sarawakians; and

c) CMSB is not a high-profile recipient in recent years of new big federal or state government contracts. The group’s only contracts with the federal government involves one of the 11 packages of the Pan Borneo Highway project and maintenance for some 200km of the state’s federal roads — this expires in the third quarter of 2018 and is not expected to be renewed, at present.

We believe the sell-off on the shares is overdone and will only be temporary. This is because we think CMSB’s traditional businesses are backed by its expertise and heavy investments in these units. We also believe that the group’s business model remains intact. Its income is also well diversified, with the state road maintenance segment only contributing RM26 million or 7.8% of its 2017 profit before tax.

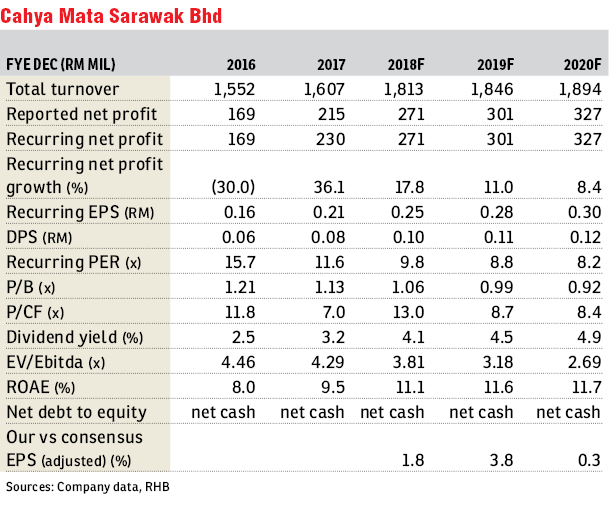

In addition, we believe CMSB’ investments in energy-intensive industries — for example, OM Material (Sarawak) — are expected to reduce its dependency on the Sarawak state government’s economic activities. As such, we maintain our “buy” recommendation and TP of RM4.57, 84% upside. — RHB Research, May 21

This article first appeared in The Edge Financial Daily, on May 22, 2018.

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

KAWASAN PERINDUSTRIAN SUNGAI RASAU

Klang, Selangor

Petaling Jaya Industrial

Petaling Jaya, Selangor

Apartment Tanjung Puteri Resort

Pasir Gudang, Johor

D'Carlton Seaview Residences (Seri Mega)

Masai, Johor

Bangunan Duta Impian (The Embassy Suites)

Johor Bahru, Johor

D'Ambience Residences (Ikatan Flora), Bandar Baru Permas Jaya

Permas Jaya/Senibong, Johor

D'Carlton Seaview Residences (Seri Mega)

Masai, Johor