Infrastructure the key driver in a subdued market

DUE to the overall weak ringgit and uncertain economic landscape, the property market in Malaysia will continue to be very challenging, says Foo Gee Jen, managing director of property consultancy CBRE|WTW.

Focusing on the residential sector across three major cities — the Klang Valley, Penang and Iskandar Malaysia — he adds that the subdued market continues from 2014.

“To me, this is something very healthy,” he says in presenting the Malaysia series of CBRE|WTW’s Asia Pacific Real Estate Market Outlook at its Kuala Lumpur office on Jan 18.

“Before 2014, the double-digit growth of 13% to 18% every other year was not sustainable. I always maintain that although the market is flattish, it is good for it to have a price correction to make the levels more sustainable, which I think is what’s happening at the moment.”

According to Foo, the domestic economy has been very much driven by domestic consumption, particularly of infrastructure by the government. “During the previous recession, building the North-South Expressway spurred activity. Similarly, now, when things are slowing down, investing in infrastructure is always the right thing to do and will definitely bring new growth.”

He says the upcoming Kuala Lumpur-Singapore High-Speed Rail will have a spillover effect and improve connectivity for areas where the proposed HSR stations are situated, such as Bandar Malaysia, Seremban, Ayer Keroh, Muar, Batu Pahat and Nusajaya, as well as Jurong East in Singapore.

Due to the improved connectivity, residential property hotspots to look out for include Selangor Vision City (under Malaysian Vision Valley), Nilai/Pajam, Semenyih/Kajang, Putrajaya/Cyberjaya, Rawang/Ijok/Kuang, Sungai Buloh and Kuala Selangor.

“A spin-off from the HSR project, the Malaysian Vision Valley will be a new growth area. This project will also see an upgrade to the Port Dickson-Seremban railway, which will definitely open up big land banks of close to 30,000ha in the area,” Foo says

Property prices in Klang Valley to stabilise

The Klang Valley residential market will see more launches in the affordable price range, while rents of condominiums in the city will compress further because of increasing supply, according to the CBRE|WTW Real Estate Market Outlook 2017.

Due to the high stock levels in the market, Foo sees a price correction of 10% to 15% for high-end stratified residential properties this year, and not more than 10% for landed properties.

“As property will continue to be a main driver of development, affordable housing developments will be the priority. People will be looking at prices below RM400,000 in general, and in the Klang Valley, below RM500,000. The property market is expected to cool and prices will become more realistic in line with inflation and wage growth,” he says.

The government has initiated affordable housing schemes such as Rumah SelangorKu, PR1MA, First House Financing Scheme and Rent-to-Own schemes. This was because typical double-storey terrace houses in the primary market priced at RM250 to 440 psf, or about a million ringgit each, are out of reach for many. “I think the initiatives are commendable but the only concern now is how to accelerate these schemes,” Foo says.

And while stringent loan requirements and increasing property prices have dampened demand, he notes that these measures have reduced speculative buying and the overall market now consists of more genuine purchasers. He also believes developers will continue to offer plans such as guaranteed return schemes due to the high housing stock.

A total supply of 793,718 landed residential units were recorded in the Klang Valley as at 3Q2016 while 10,462 new houses were added to the existing supply by the end of last year, according to the market report.

According to National Property Information Centre (Napic) statistics, the most popular landed residential development in the Klang Valley continues to be two and three-storey terraced houses. For this property type, there were a total of 88,955 incoming units and 35,257 in the pipeline as at 3Q2016.

Beyond the fringes of KL, Foo says residential development continues to be active, supported by rapid infrastructure development. The market outlook report shows that the average price of terraced houses in KL/Petaling Jaya rose 1% to RM915,000 in 2016, from RM906,000 in 2015, while in Subang Jaya/Shah Alam, it dropped 4% to RM741,000 in 2016, from RM774,000 in 2015. For 2-storey semi-detached houses, prices rose 2% in KL/PJ to RM3.1 million in 2016, from RM3.03 million in 2015, while prices in Subang Jaya/Shah Alam remained unchanged year on year.

Demand remains high for landed properties priced from RM250,000 to RM500,000, which made up the biggest market segment in terms of transaction volume for the landed segment.

As for high-rises, Foo observes that developments trended towards the high-end properties priced above RM500,000. “I had previously expected high-end developments to drop in terms of supply but it did not. It has actually increased, and it defies logic why developers are still pushing for high-end properties over RM750,000.”

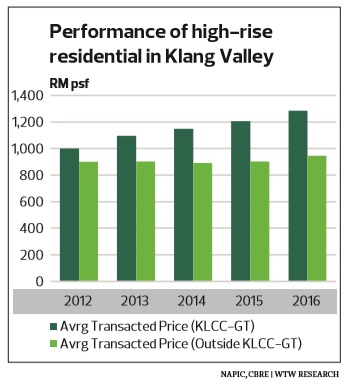

As at end-2016, there were a total of 37,824 luxury condominiums in KL, 86% of which are priced from RM700 to RM1,000 psf, but this could decline to 64% by 2019, Foo says. Upscale condominiums ranging from RM1,001 to RM1,500 psf are expected to see the greatest growth in total supply, averaging 4,000 units per year, to make up 23% of total condominiums by 2019.

Foo notes that rental transactions in the luxury condominium market were less active in 2016, but average transacted prices were still climbing, albeit at a slower rate. “Condominium rentals saw a slight decrease, particularly in Central KL due to the current oversupply, coupled with the downturn in the oil and gas sector.”

“Despite the sluggish market, property investment will continue to be relatively more popular than other forms of investments and the strong demographics will continue to support demand for residential properties,” he says. The property market will see more demand for affordable housing and that genuine demand will lead.

Areas with good transport connectivity near the MRT1 and 2, the upcoming HSR and highways such as the West Coast Expressway, DASH and SKVE will continue to be hotspots.

In the current soft market, Foo says developers with deep pockets have the opportunity to accumulate land bank. Among them are Hap Seng Land, which signed a deal to purchase a vacant residential plot at Naza TTDI’s KL Metropolis for RM467.83 million, as well as a 36-acre plantation in Kuala Selangor for RM28.75 million, while S P Setia bought a 1,600-acre tract in Penang. “When the market is slow, it is a good opportunity for developers with deep pockets to look into land that previously been asking for a high price. These tracts are for the next cycle of development, which will take another 5 to 10 years,” Foo says.

Penang a buyers’ market

CBRE|WTW director Peh Seng Yee says the downtrend in the overall market in Penang, seen since 2015, continues due to stringent loan requirements, inflationary factors and the depreciating ringgit.

“The acquisition of development land by developers has been less pronounced in the past two years,” he says, but adds that landed properties as well as those in prime locations are still in demand by owner occupiers or long-term investors.

In terms of landed properties, more residential projects are being developed and planned on the mainland due to the availability of land at relatively low cost.

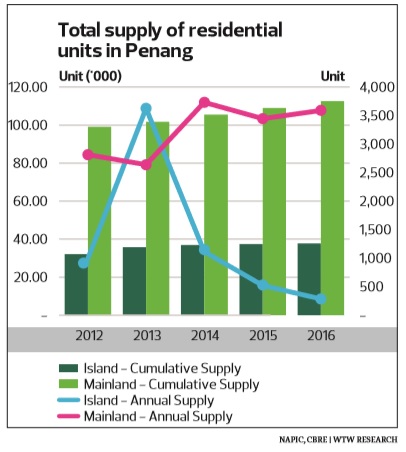

The cumulative supply of landed units in Penang totalled 150,307, up 2.5% from 146,430 units in 2015, 25% of which were on the island and 75% on the mainland.

In his presentation, Peh notes that landed residential properties in Penang are experiencing slower growth, with fewer new launches observed. New launches on the island mostly tapped the niche and high-end market, while those launched on the mainland were priced higher than the secondary market. Prices of properties in the sub-sale market were generally stable or have increased marginally, he says.

He expects demand for landed properties to stay firm as houses are still the preferred accommodation for Penangites.

As for high-rise properties, Peh notes that 2016 had been a challenging year for Penang developers. “The high-rise residential market is a buyers’ market and demand has lost momentum, coupled with tighter lending regulations.”

The cumulative supply of high-rise units on the island is 46,853, an increase of 4% compared with 45,137 units in 2015, while on the mainland, there were 7,766 units, a 9% rise from 7,134 units in 2015.

Peh says the high-rise residential market will continue to be a buyer’s market with the completion of more new supply, while existing and upcoming developments priced in the affordable range should continue to be in demand.

Slow momentum in Iskandar Malaysia

According to CBRE|WTW director Tan Ka Leong, the Iskandar Malaysia market continues to experience slow momentum in terms of volume and value of transactions, attributed to the overall slowdown in the global market.

Napic statistics from 1Q to 3Q2016 show the value of transactions in Iskandar Malaysia decreasing 5.3% to RM10.57 billion, while transaction volume dropped 20.1% to 15,119 units.

“There were fewer transaction activities and slower take-up for new developments,” says Tan. However, demand for quality and affordable properties and those in prime locations remain key drivers, he says.

For the landed residential segment, Tan says affordably priced terraced houses remain a favourable product.

Of the total of 294,694 landed residential units in Iskandar Malaysia, 83% are terraced houses. Tan estimates there will be an additional supply of 13,584 units in the next two years, 91% of which will be terraced houses.

In the sub-sale market for terraced houses and semi-detached units, he notes that the transaction volume has fallen 40% while transaction value dropped 5% to 10% in 2016 from the previous year.

In 2016, the market report observed a downward adjustment in prices for landed properties in Iskandar Malaysia. Prices of 2-storey terraced houses fell 5.8% to RM700,000 from RM743,000 in 2015, while the prices of 2-storey semi-detached units dropped 5.4% to RM1.32 million from RM1.39 million for the same period.

As for high-rise residential properties, Tan says the high-rise residential market in Iskandar Malaysia further softened and posed challenges in 2016.

The existing supply of high-rise residential units in Iskandar Malaysia stood at 43,898 in 2016, an increase of 16% from a year earlier. Tan adds that an additional 19,000 units are set to be completed in 2017, bringing the total supply to 63,000 units.

According to CBRE|WTW research, 15 developments have been completed since 2H2015 with 9,025 units, 50% of which were in Iskandar Puteri. The total occupancy rate was only about 30%. In 2016, there were 6,000 newly completed units.

According to Tan, the Forest City project has contributed to the supply of high-rise residential units in Iskandar Malaysia. Consisting of four man-made islands totalling 1,386 ha, 15,000 units have been sold on the first island, with selling prices starting at RM1,200 psf.

Nonetheless, Foo believes the property market in Johor will improve once the infrastructure and connectivity are available.

This article first appeared in City & Country, a pullout of The Edge Malaysia Weekly, on Jan 30, 2017.

For more stories, download TheEdgeproperty.com pullout here for free.

Never miss out

Sign up to get breaking news, unique insights, event invites and more from EdgeProp.

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.