Good earnings visibility for Gabungan AQRS; order book prospects good

Gabungan AQRS Bhd (Jan 17, RM1.93)

Downgrade to hold with a reduced target price (TP) of RM2.14: Bernard Lim, the chief financial officer (CFO) of Gabungan AQRS Bhd, sold his 11.5% stake in Ganjaran Gembira Sdn Bhd, which holds an 11.8% stake in AQRS, to Datuk Azizan Jaafar, but he retains a 2.1% direct stake in the company. He left to pursue other business interests. Following the sale, Azizan owns a 97% stake in Ganjaran Gembira. Paul Ow, chief operating officer of Gabungan AQRS, disposed of his stake in Ganjaran Gembira on Aug 21, 2017 to Azizan. Paul retains a 7.4% direct stake in the company.

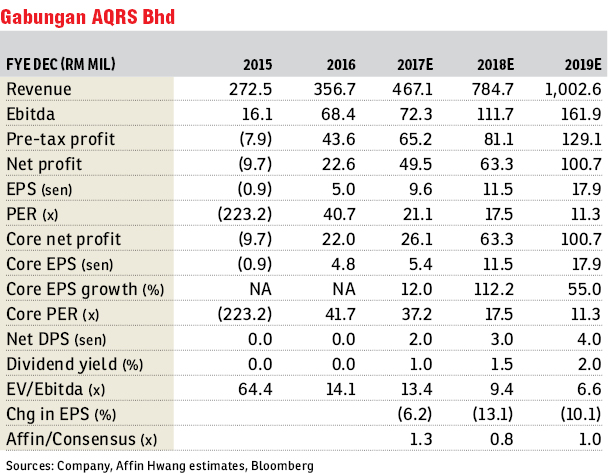

Gabungan AQRS and Tera Capital Ltd have mutually agreed to further extend the expiry date of the memorandum of understanding signed to jointly develop the One Jesselton Waterfront mixed development project in Kota Kinabalu to May 31, 2018 from Jan 17, 2018. This could lead to a delay in the implementation of the project. We cut our earnings forecasts by 6% to 13% for financial year 2017 (FY17) to FY19. Assuming the project kicks off in the fourth quarter of 2018, we estimate that the One Jesselton project will contribute 4%/9% of earnings before interest and tax in FY18/FY19.

The outstanding order book of RM2.6 billion is equivalent to 11.8 times FY16 construction revenue, providing good earnings visibility. Prospects to grow the order book is good as Gabungan AQRS plans to tender for the Pan Borneo Highway Sabah and East Coast Rail Link projects.

We trim our revalued net asset valuation (RNAV)/share estimate to RM2.38 from RM2.40 to reflect the lower discounted cash flow valuation for the One Jesselton project, partly offset by a lower net debt with a delay in capital expenditure for the project. The strong outperformance of Gabungan AQRS’ share price has narrowed the potential upside to 6%. — Affin Hwang Capital, Jan 17

This article first appeared in The Edge Financial Daily, on Jan 18, 2018.

For more stories, download EdgeProp.my pullout here for free.

Never miss out

Sign up to get breaking news, unique insights, event invites and more from EdgeProp.

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.