Gamuda has firm financing arrangement

Gamuda Bhd (Jan 22, RM5.16)

Maintain buy at a target price (TP) of RM5.80: In a media release last Friday, Mass Rapid Transit Corp Sdn Bhd announced that four consortiums had submitted turnkey tenders with financing for mass rapid transit 3’s (MRT3) Circle Line. To recap, MRT Corp commenced a tender for the turnkey project with financing for the MRT3 project on Nov 15, 2017, with an initial closing date of Dec 29, 2017 — this was extended to Jan 18, 2018, after receiving requests for extensions by tenderers to finalise financing proposals. MRT Corp has set a tentative timeline for the announcement of the winner by the first quarter of 2018.

Out of the four tenderers, three are local consortiums, with a single Chinese consortium rounding up the list. This did not come as a complete surprise to us, as there were fewer public expressions of interest by foreign parties for the MRT3 lead role. In comparison, there were numerous media reports on foreign parties interested in participating as the asset company for the Kuala Lumpur-Singapore high-speed rail (HSR). This could be due to the fact that the MRT3 project is more Klang Valley-centric, as opposed to the HSR, which crosses the Malaysia-Singapore border.

In contrast to the earlier two MRT lines, which used the project development partner (PDP) structure, MRT3’s lead contractor would be responsible for both the turnkey project as well as securing the financing. This is believed to be a potential obstacle for local contractors, as the financing required is significant with demanding condition, which is to fund 90% of the RM40 billion project cost for 30 years with an eight-year moratorium.

We understand that Gamuda’s consortium has in place a firm financing arrangement by a group of reputable financial institutions. We believe the consortium members would prefer the financing to be off their balance sheets, acting more as intermediaries between MRT Corp and the financial institutions. This is reasonable, in our view, as MRT Corp remains the owner of the asset and hence liabilities should be on their books instead. In terms of financing cost, we believe it would be difficult to match the 3.25% soft loan rate for the East Coast Rail Link (ECRL) project, and more likely to be between the 10-year Malaysian Government Securities rate of 3.9% and quasi government bond rates, such as of Prasarana Malaysia Bhd or Danainfra Nasional Bhd, of 4.5%.

We are not completely ruling out Gamuda’s chances of participating in the lead role of the MRT3 project. Instead, we had previously anticipated Gamuda to seek foreign partners, in particular, foreign financial institutions in order to secure a lower cost of borrowing. The iteration of its chosen consortium, however, is more formidable — consisting wholly of highly qualified and experienced domestic contractors. Combined, the consortium members have, under their belts, experience as the PDP in two prior MRT lines, the LRT3 line, as well as tunnelling works for MRT1 and MRT2. Tunnelling experience and the ownership of tunnel boring machines are key advantages of Gamuda’s consortium, in our opinion, considering that 80% of works are slated to be underground works (20% being elevated works).

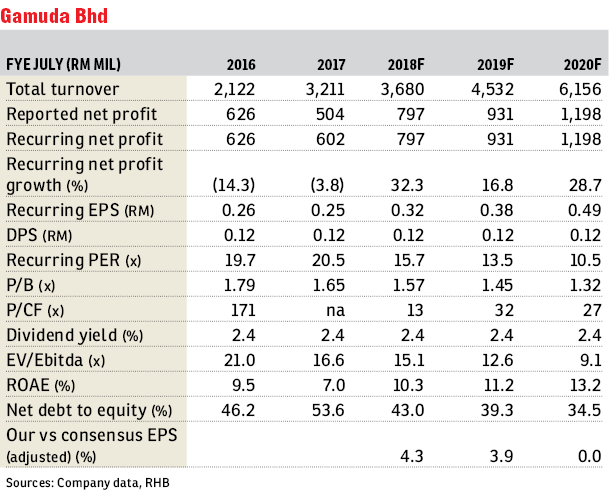

Our earnings estimates are unchanged, with an order book replenishment forecast of RM5 billion per annum for FY18 and FY19, which is in line with management’s target to add at least RM10 billion worth of new orders in FY18 and FY19. We are upbeat about Gamuda’s prospects, as we believe it has a reasonable chance in securing at least one of the three major infrastructure projects in FY18 — the ECRL, MRT3 and HSR. Hence, we maintain our “buy” rating on Gamuda, and keep our sum-of-parts-based TP of RM5.80.

A key downside risk to our “buy” call is in the company’s actual contract wins, which may fall short of our order book assumptions. — RHB Research, Jan 22

This article first appeared in The Edge Financial Daily, on Jan 24, 2018.

For more stories, download EdgeProp.my pullout here for free.

Never miss out

Sign up to get breaking news, unique insights, event invites and more from EdgeProp.

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.