More jobs, higher margin seen for Kerjaya Prospek

Kerjaya Prospek Group Bhd (April 13, RM1.60)

Maintain market perform with an unchanged target price (TP) of RM1.55: Kerjaya announced that they had secured a building contract worth RM357.3 million from BBCC Development Sdn Bhd. The project called ‘Lucentia’ located at the intersection of Jalan Hang Tuah and Jalan Pudu in Kuala Lumpur comprise construction works for two towers of high-rise (666 units) where one tower is built above an eight-storey car park podium and the other tower is on a six-storey car park. The project is slated for completion by April 21, 2021 (36 months).

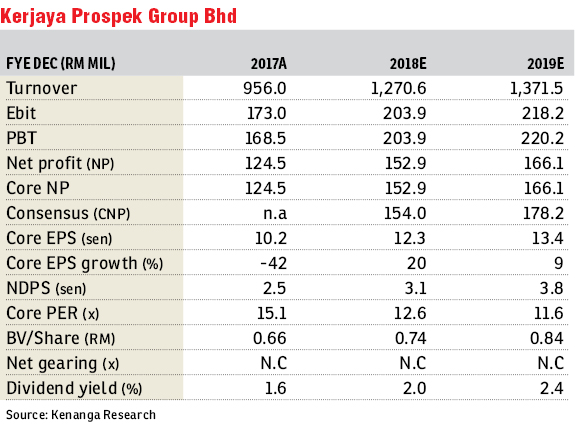

We are “neutral” on the award as Kerjaya’s first win is within our financial year 2018 (FY18) targeted replenishment of RM1.2 billion accounting for 30% of our full-year target. Assuming profit before tax (PBT) margin of 15%, the contract is expected to contribute around RM13.4 million to Kerjaya’s bottom line per annum for the next three years.

Currently, Kerjaya’s outstanding order book stands at RM3.1 billion giving them visibility of around 2.5 years to three years. Meanwhile, its tender book stands at around RM1.5 billion consisting of mainly building works. We believe further FY18 wins could be from Datuk Tee Eng Ho’s (Kerjaya’s major shareholder) private property arm that is planning to launch a mixed development project in Old Klang Road with gross development value (GDV) of RM1 billion translating into around RM400 million worth of construction work. Unbilled sales for Vista Genting stood at RM71 million (as of FY17) with take-up rate of 76% and project progress at 58% level. We note that Kerjaya plans to launch their Monterez Shah Alam (GDV: RM300 million) project in FY19.

We maintain our FY18 to FY19 earnings of RM153 million to RM166 million based on replenishment target of RM1.2 billion to RM1.2 billion.

Note that we upgraded Kerjaya from “up” to “market perform” (MP) in our last sector report (dated 4/4/18) as Kerjaya’s share price then had declined 14% year to date (YTD) even though their earnings and outlook remained intact. While our ascribed FY18 construction valuation of 13 times for Kerjaya is at the higher end of our small-to-mid cap contractor universe’s range of eight times to 13 times, we remain comfortable given stronger margins against peers (FY18 profit after tax [PAT] margins of 12% versus peers’ average of 9%), and resilient earnings from timely delivery of projects with little risks of cost overruns as showcased by their excellent track record. We believe further rerating catalyst for Kerjaya could be higher-than expected replenishment or profit margin. — Kenanga Research, April 13

This article first appeared in The Edge Financial Daily, on April 16, 2018.

For more stories, download EdgeProp.my pullout here for free.

Never miss out

Sign up to get breaking news, unique insights, event invites and more from EdgeProp.

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.