Malaysia Airports Holdings Bhd (June 8, RM8.85)

Maintain buy with an unchanged target price (TP) of RM9.88: We visited Mitsui Outlet Park (pictured) recently, meeting the management of both Mitsui and Malaysia Airports Holdings Bhd (MAHB). We wanted to learn more about the non-aeronautical side of MAHB’s business and its prospects moving forward. This time around, the focus was on the development of outlet malls in Malaysia and we believe MAHB’s venture into this category could be another enhancement to its long-term strategic plan of becoming an airport city.

Mitsui Oulet Park is a project under MFMA Development Sdn Bhd. It is a joint venture where MAHB owns 30% and is responsible for the construction of the outlet store buildings and management of lease tenants. The other shareholder is Mitsui Fudosan Co Ltd, which owns 70%. It is located 6km from Kuala Lumpur International Airport (KLIA), which is about eight minute-drive away.

The development of Mitsui Outlet Park is carried out in three phases. Upon completion, total site area will be around 178,900 sq m (1,925,664 sq ft), with retail space of 44,000 sq m. In terms of retail space, it will be 18.4% bigger in comparison with its nearest competitor and the current biggest outlet mall, Genting Premium Outlet. According to the plan, Mitsui Outlet Park is expected to offer 250 lettable outlet shops by 2021. According to the management, average rental rate stood at RM19/sq ft.

Currently, the overall occupancy rate stands at 97% and is expected to ease to 95% following the completion of overall development. The tenant mix comprises luxury, international and local brands in fashion, cosmetics, sports and accessories. More offerings will be included for entertainment and amusement.

The management mentioned that average footfall on weekdays/day stood at 7,000, which will double on weekends and major public holidays. As far as promotional campaigns are concerned, shops on average will offer 50% discount off the original price on weekdays, and could go up to 90% on major public holidays.

Given Mitsui’s long experience in operating outlet malls, the management remains effective in providing modern facilities to visitors as well as tenants. Its primary facilities are anchored by its objective to draw the passenger traffic flow in airports (Main Terminal and klia2) to Mitsui Outlet Park. This include free shuttle buses every 20 minutes, flight information display systems around the mall, a flight check-in centre and free baggage storage services.

We opine these offerings add convenience for airport shopping visitors. We opine that the outlet park’s location is its unique competitive advantage in comparison with other outlet malls in Malaysia.

With regard to breakdown of visitors, the biggest portion of 65% comprises local visitors, while the remaining is foreign. On average, spending per visitor is around RM300 to RM500 per visit. Moving forward, the management of Mitsui is targeting to expand the percentage of foreign visitors to 40%. We believe this is possible given the growing trend of visitors from China, attributable to Malaysia’s visa relaxation programme. It is also important to note that Chinese tourists are ranked as the biggest spenders among tourists in Malaysia, with Taiwanese at second place. While the amount spent per customer is not disclosed, we believe that the arrival of foreign tourists is expected to stimulate more demand for outlet products.

Following MAHB’s venture into outlet malls with Mitsui, we noted that the revenue collection from rental is minimal, about RM3 million from lease collection. While the impact financially is minimal, we believe it enhances the long-term prospects of MAHB.

In our opinion, this development will bode well for the overall objective of MAHB’s Runway to Success initiatives, which are to build KLIA as a tourist destination itself. Following its strategic plan of mix development around the vicinity, this will enable MAHB to offer a more comprehensive airport experience to both domestic and international passengers.

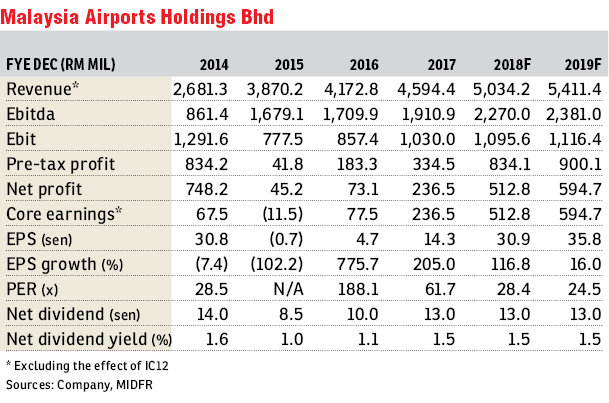

Mixed development around the land area of Malaysia airports will complement its extended function of becoming an airport city. Subsequently, we believe the company is moving in the right direction to provide more functions for travellers as well as locals who are seeking convenience. All in, our optimism about MAHB’s prospects still remains. In the short term, we believe the catalyst for MAHB is the robust passenger travel. Hence, we maintain our “buy” call on the company with TP of RM9.88. — MIDF Research, June 8

This article first appeared in The Edge Financial Daily, on June 11, 2018.

For more stories, download EdgeProp.my pullout here for free.