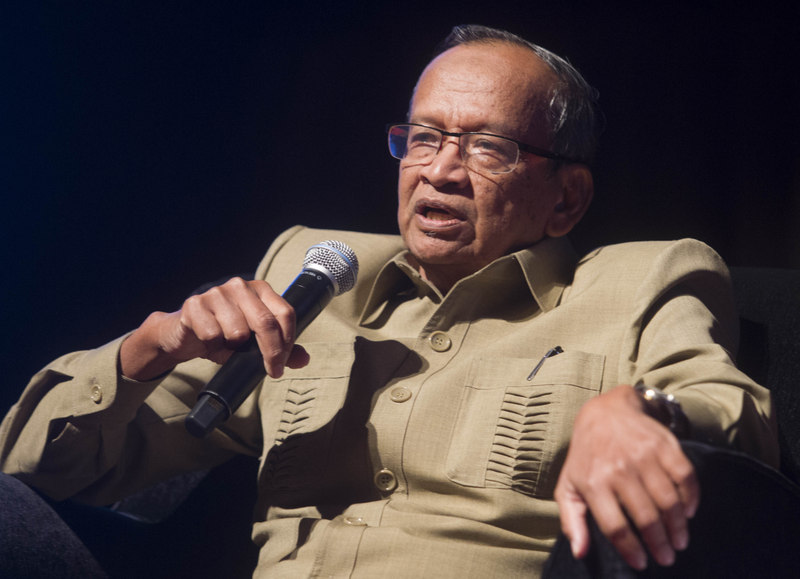

KUALA LUMPUR (Oct 31): Describing the audit of 1Malaysia Development Bhd (1MDB) as the most challenging task in his over 10 years of service as the country’s auditor-general, Tan Sri Ambrin Buang yesterday called the strategic investment firm a “disgrace”.

Ambrin, the auditor-general from February 2006 to February 2017, made this statement when addressing auditing professionals at the Asian Confederation of Institutes of Internal Auditors Conference 2018, where he posed this question to the floor: Is 1MDB a scandal or a wrong business model?

“Whether it’s a scandal or a wrong business model you can’t run away from the question of who is to blame. If it is a scandal let the criminal investigators prove it in court.

“And if it is a business model, the question is: why so much of recklessness from a government-owned company? Why so little due diligence done.

“[For example] for an oil and gas venture, did you [1MDB] seek help from Petronas? Did the directors [of 1MDB] have the expertise to handle international oil and gas business, which is a high-risk business? Why rival Petronas?

“Why rival Khazanah Nasional Bhd as a strategic investment firm? Khazanah has all the instruments of good governance, with checks and balances in place and an effective board with [sound] internal controls? This is something to reflect on.

“Personally, I think being a ministry of finance company, 1MDB should have been an example of good integrity and good governance, but really, I think the company is really a — can I use the word — disgrace?

“It is unfortunate for the government of Malaysia, and the people of Malaysia, to be burdened with so much of liabilities over a long period of time,” he said.

Kept under the Official Secrets Act by the previous regime, the Auditor-General’s report was declassified shortly after the new Pakatan Harapan government took Putrajaya in May.

The declassified report stated that 1MDB needed at last RM42.26 billion to pay its principal sum and interests on its loans, which are maturing between November 2015 and May 2039.

Meanwhile, in the session entitled 1MDB Audit Report: My Story, My Perspective, Ambrin shared the difficulties faced when his department was asked to verify 1MDB accounts, including the work of its external auditors.

“When people asked me what was my most challenging task [as auditor-general], my reply is 1MDB. Because there are so many factors. First, the huge sum of money involved, secondly the high-profile personalities involved, and third is the international transactions and verifying the work of external and internal auditors,” he said.

After commencing its work in March 2015, the department took a year to submit the final report on 1MDB in March 2016.

“Our practice in the national audit department is that we usually take four to five months to finish our audit report, but by the time we produced the final report [on 1MDB], it was almost a year.

“Why did it take so long? Simply because we had difficulty in obtaining certain vital documents such as bank statements, management accounts et cetera. We had to rely on the audited accounts, and that too up to April 2014 — and we were there in 2015 — so we looked at board minutes, cabinet papers and audit working papers,” he said.

No tampering of 1MDB audit report

During the session, Ambrin was also asked if there was “tampering” of the 1MDB audit report. Public Accounts Committee (PAC) deputy chairman Wong Kah Woh had on Monday alleged that the report had been amended following instructions from certain individuals.

“The media asked me this question (yesterday) afternoon and my answer was there was no tampering. I was in full control of my audit report and I take responsibility for it. I was supposed to meet PAC to clarify on this (on Monday) but the meeting was postponed,” he said.

This article first appeared in The Edge Financial Daily, on Oct 31, 2018.