Sunway University expected to strengthen Sunway REIT’s earnings

Sunway Real Estate Investment Trust (Aug 1, RM1.90)

Maintain buy with a higher target price (TP) of RM2: We continue to like Sunway Real Estate Investment Trust (Sunway REIT), given the strong positioning of Sunway Pyramid mall, which contributed around 50% of its total revenue. Meanwhile, we believe the injection of Sunway University in April will strengthen the stability of its earnings ahead.

The retail segment is the largest segment for the REIT, contributing over 76% of net property income (NPI) in the first nine months of financial year 2019 (9MFY19). The segment’s NPI remained robust, rising 3% year-on-year (y-o-y) during 9MFY19 on higher contributions from Sunway Pyramid, although this was partially offset by Sunway Putra Mall. Average occupancy rate at the retail segment remained healthy at 97% in the third quarter of FY19 (3QFY19), with Sunway Pyramid enjoying close to full occupancy at 98.5%. Sunway Pyramid has a total of 383,000 sq ft of net lettable assets up for renewal in FY19. Thus far, 231,000 sq ft (equivalent to 60.3%) have been renewed or replaced at single-digit rental reversion rates.

Hotel segment contributed 12% of Sunway REIT’s NPI during 9MFY19. The segment’s NPI dropped 5% y-o-y despite the addition of Sunway Clio Hotel in 3QFY18. The lower NPI was mainly due to lower income at Sunway Resort Hotel & Spa and Sunway Putra Hotel. The average occupancy rate in Sunway Resort Hotel & Spa was affected by the overall soft market conditions and refurbishment of its grand ballroom and meeting rooms, which was completed in 2QFY19. In addition, overall business has been soft due to the decline in visitors from the Middle East.

The office segment contributed about 6.7% of total NPI during 9MFY19. It recorded an 8% increase in NPI in 9MFY19, reflecting the improved performance at Sunway Putra Tower and Wisma Sunway. The average occupancy rate for Sunway Putra Tower rose to 80.7% versus 48.5% last year, following the commencement of new tenants.

Meanwhile, Wisma Sunway’s occupancy rate also improved to 92% from 79% last year, following the expansion in space taken by existing tenants.

We expect Sunway REIT’s performance to improve marginally quarter-on-quarter (q-o-q) in 4QFY19, with new contributions from Sunway University after the completion of the acquisition in April. With the new addition, Sunway REIT’s portfolio size has increased to RM7.8 billion. The acquisition was partly funded by a RM10 billion perpetual note programme.

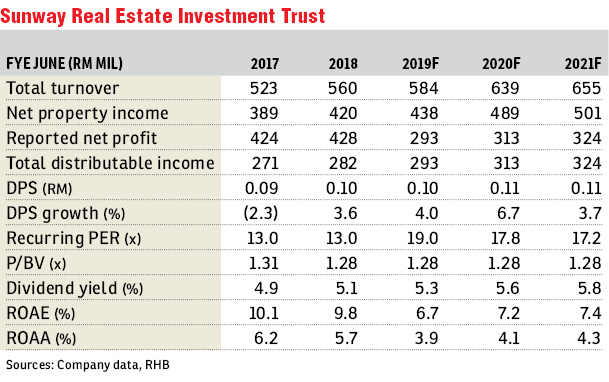

We trim FY19 forecasted (FY19F) to FY20F earnings by 3% to 4% to reflect lower-than-expected contributions from the hotel segment. Having said that, we raise our dividend discount model-based TP to RM2 from RM1.92 after factoring in a lower cost of equity arising from the overnight policy rate cut. We also believe that the injection of Sunway University will strengthen Sunway REIT’s earnings in the future. — RHB Research Institute, July 31

This article first appeared in The Edge Financial Daily, on Aug 2, 2019.

Click here for more property stories.

Follow Us

Follow our channels to receive property news updates 24/7 round the clock.

Telegram

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.