Developers looking at non-traditional commercial segments

PETALING JAYA (April 22): With the gloomy outlook for office and retail, alternative commercial properties such as student accommodation, senior living/retirement housing and co-living could become investments of choice, according to findings of Knight Frank Malaysia’s The Malaysia Commercial Real Estate Investment Sentiment Survey (CREISS) 2020 conducted in February 2020.

Read also

Logistics property to draw investment interest

“However, given Covid-19 social distancing, the co-living concept may come under scrutiny,” Knight Frank Malaysia Managing Director Sarkunan Subramaniam said in a statement released in conjunction with the survey report today.

Typically located within or in proximity of Transit Oriented Developments (TODs) and in higher education clusters, co-living/student accommodation are attractive to developers who are looking for recurring income as they typically exhibit steady cash flow, the real estate consultancy said in the survey report.

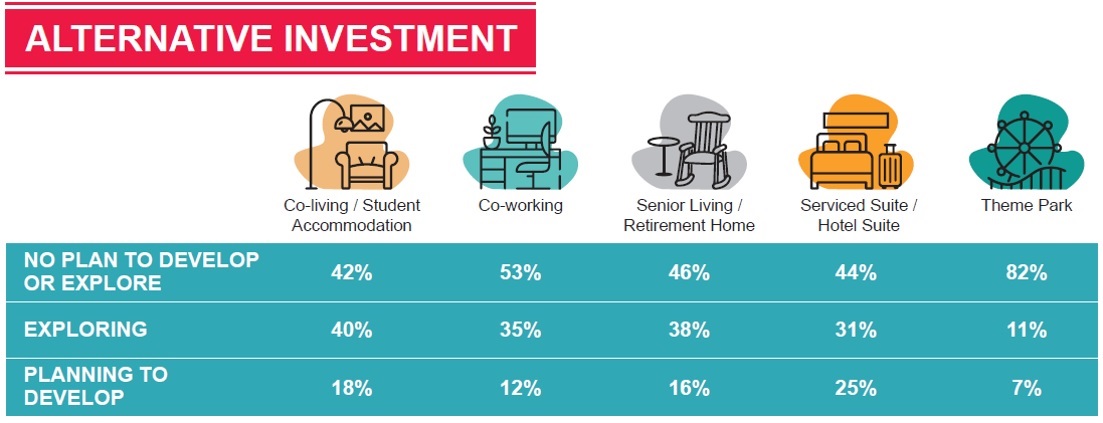

Nevertheless, whilst some are looking for alternative investment options, a large number of industry players remained cautious towards such investments, with at least 40% of the respondents being more comfortable with the conventional type of property assets. Survey respondents comprised senior management levels of industry players including developers, commercial lenders and fund/REIT managers.

The survey also found that even before the coronavirus outbreak was declared a pandemic in March, the majority of survey respondents had opined that it was the most unfavourable factor that would impact the commercial property sector in 2020. They also believed that recovery is unlikely to happen within the year.

To contain the spread of the deadly virus, the country is now in its third phase of the Movement-Control Order (MCO) which is scheduled to end on April 28, 2020.

Post Covid-19, the difficult business operating environment will put further pressure on the occupancy and rental levels of the office, retail and hotel / leisure sub-sectors. “Private healthcare businesses are also not spared as local patients delay non-urgent treatments while the entry of foreign patients are affected by travel restrictions,” said Sarkunan.

He added that there is a need for direct intervention in the commercial property market to help in the recovery process as the current measures are limited.

“It must be recognised that prior to the pandemic, the market was already lacklustre and with all non-essential services and businesses grinding to a halt during a six-week long MCO, it is bound to head further south.

“Property taxes such as quit rent and assessment for the second half of 2020 should be waived, and stamp duty reduced to cushion the impact of Covid-19 on the Malaysia property market. It is also timely for the government to lift the cooling measures to spur transactional activity and encourage long-term investment,” he stressed.

Stay calm. Stay at home. Keep updated on the latest news at www.EdgeProp.my #stayathome #flattenthecurve

Never miss out

Sign up to get breaking news, unique insights, event invites and more from EdgeProp.

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.