Global survey finds improvement in real estate market sentiments

PETALING JAYA (April 23): Sentiments on the outlook for real estate markets globally have improved slightly as at April 15 according to a survey by real estate services provider Savills.

According to the Savills Global Market Sentiment Survey, 19% of countries reported a severe negative impact on their real estate markets due to the Covid-19 pandemic which was an improvement compared with 29% in the previous survey on March 31.

Meanwhile, 74% of countries described a moderate negative impact compared with 67% at the end of March.

Head of Savills World research team Sophie Chick said in a statement today that some clarity is emerging as many countries have reached peaks in the numbers of new infections.

The internal survey was based on the views of Savills research heads in their respective geographic locations covering 31 countries and regions.

According to the survey, China held a ‘slightly positive’ sentiment, as the country saw some real estate activity resume after infection rates were brought under control. In the first half of April, the country’s retail and office leasing activities increased moderately.

Meanwhile, South Korea and Vietnam, which have seen rapid falls in infection levels, were ‘neutral’.

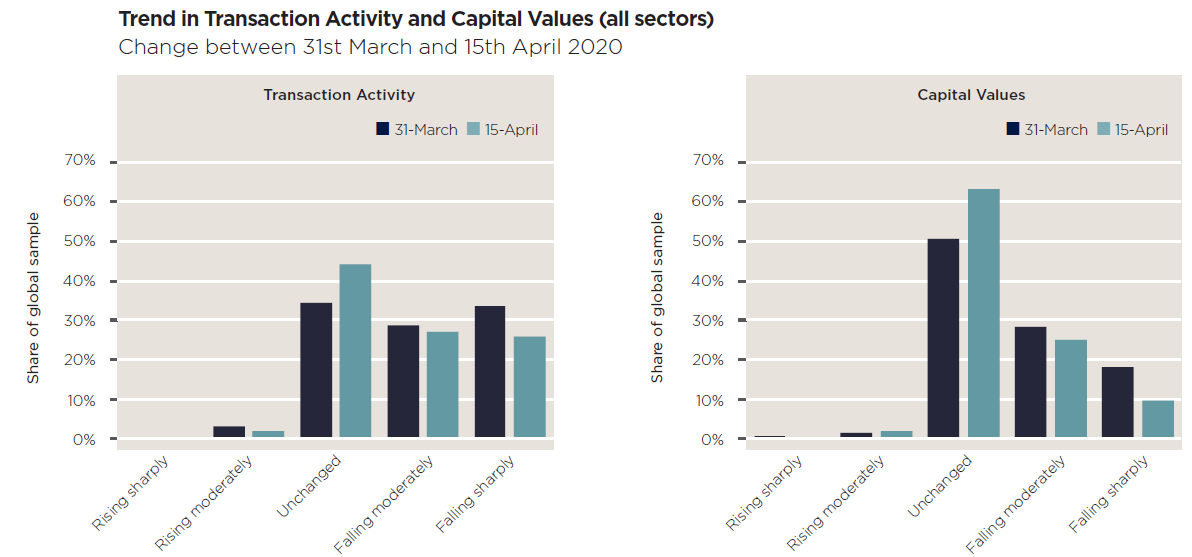

Globally, capital values continue to be largely unaffected with 63% of countries surveyed reporting unchanged values, albeit on thin volumes. Logistics and healthcare are holding up well, with 87% and 95% of countries respectively, reporting unchanged or increased capital values.

Transaction volumes in the first half of April have decreased, but no longer falling as sharply as in March. In the first 15 days of April, 44% of countries recorded no change in transaction volumes.

Rents globally remained unchanged across 60% of sectors and countries. Specifically for office rents, 71% of countries were unchanged, partly supported by extensive concessions.

Government intervention, such as reduced property taxation or temporary bans on evictions, were reported in 59% of the countries surveyed. The retail sector has received the greatest aid, with some kind of government assistance seen in 75% of countries surveyed.

In Malaysia, property prices are expected to take a hit although it is not as sensitive or liquid as the stock markets, said Savills Malaysia managing director Datuk Paul Khong.

“If a global recession were to set in after this, it will take a direct toll on the real estate markets throughout the entire world with our local market included,” he added.

On another note, Chick pointed out that the value of having access to a private outside space or a large public outdoor space, as well as good Wi-Fi and a home office, are now being realised by many. “Health and wellbeing are at the forefront of people’s minds. These changes in the way we live and work will have an impact on real estate markets worldwide,” she noted.

Stay calm. Stay at home. Keep updated on the latest news at www.EdgeProp.my #stayathome #flattenthecurve

Never miss out

Sign up to get breaking news, unique insights, event invites and more from EdgeProp.

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.