Property buying: It's all about the price post-MCO

Many wise people have said that there are always opportunities in a crisis. Indeed, many residential property investors and homebuyers in Malaysia believe so as a recent survey found that there are potential property buyers out there looking for a good ‘catch’ in the current down market which has worsened due to the Covid-19 pandemic.

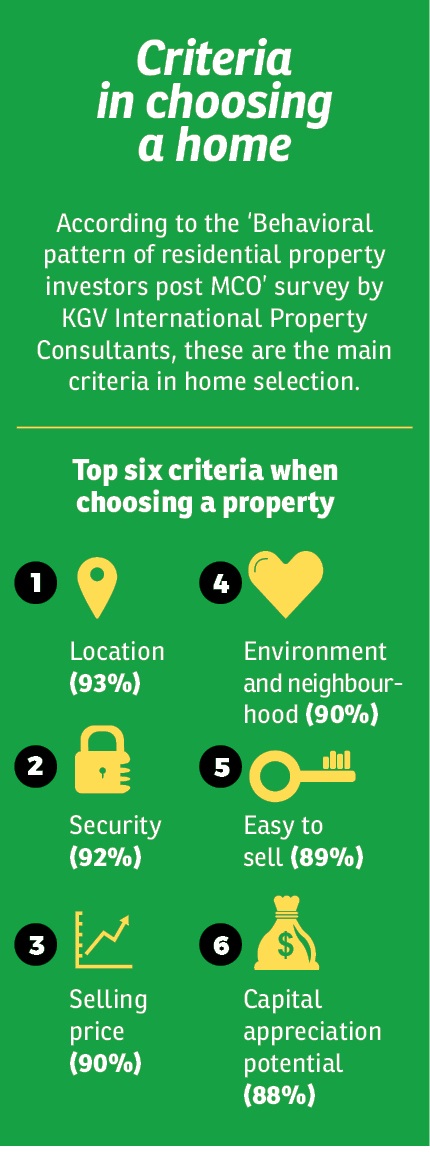

The survey on the ‘Behavioral pattern of residential property investors post MCO’ by KGV International Property Consultants also found that contrary to popular belief, potential homebuyers and investors are not panicking over the possible impact of the Covid-19 outbreak and the ensuing Movement Control Order (MCO) and conditional MCO.

“It was surprising to see that most potential buyers are not overly pessimistic despite the severe pandemic and the slew of other consequential economic shocks such as oil price crash and extremely volatile stock market,” the consultancy’s executive director Samuel Tan told EdgeProp.my.

Considering these homebuyers and investors are on the hunt for a bargain post MCO to take advantage of the strong buyers’ market, it is therefore no surprise that the main consideration in buying a property in the current environment is the price — the lower the price compared with previously, the better.

Main consideration post-MCO

Almost 70% of the survey respondents put pricing elements as their main consideration when deciding whether to buy a property post-MCO, followed some way behind by location (18.7%) and developers’ track record (1.8%).

If buying for investment, 60% of the respondents are looking for capital appreciation compared with 40% for recurring income.

On whether they preferred to purchase a primary or secondary property, 43% said they don’t mind either as long as it’s a good deal with good pricing and in a desirable location.

Nevertheless, 35% of the respondents said they would rather buy from developers while 16% chose the secondary market.

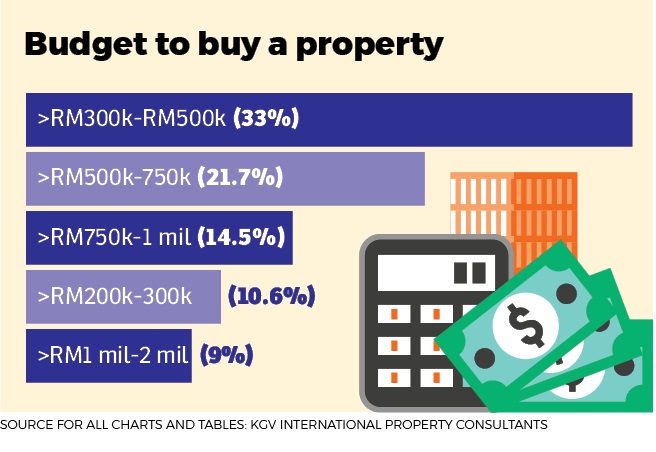

When it comes to budget, one-third of the respondents are looking at houses priced between RM300,001 to RM500,000 while about 22% wanted to buy houses ranging from RM500,001 to RM750,000. Another 14.5% have the budget to purchase property priced between RM750,001 to RM1 million.

“This is consistent with our view and observation so far that the most popular and saleable are houses priced from about half a million ringgit to about three-quarter million ringgit,” Tan explains.

Around 19% of the respondents are looking to buy affordable houses priced below RM300,000, while 11.3% of respondents have a budget of over RM1 million and above.

Although Malaysians are eager to get on the property ladder, the survey however, found that about 40% of the respondents require a loan margin of 90% and above to buy a home.

“This is a relatively high percentage which is not healthy and an indication of the tendency to be highly geared,” Tan notes.

Another surprising result is that most respondents prefer the loan repayment period to be less than 20 years (31%) and 30 years (30%) respectively. Only 8% indicated a preferred loan repayment period of less than 40 years.

Market recovery

In the survey, the majority of residential property buyers/investors (61%) believe that the market will recover within the next two to three years while about 12% expect the market to recover after four years. Notably, 10% of the respondents expect the market to recover within a year. The remaining 13% could not say for sure when the market will recover.

What’s interesting is that about 30% are prepared to buy a property in the next one to two years despite uncertainties in the market. Another 5% of respondents planned to buy after three years.

On the other hand, about 20% of the respondents have no intention to purchase any property in the near future. The majority however, (37.8%) preferred to wait and see.

“The sentiment is cautious but not overly pessimistic. Despite unprecedented challenges and unpredictable outlook, some seasoned and savvy investors will start scouting for good buys whether for own-occupation as first home or for upgrading, or for investment,” says Tan.

He adds that the large number of respondents adopting a wait-and-see stance presents an opportunity for property developers and real estate agents.

“People believe there are opportunities in the current market, but they are also afraid of the uncertainties as well, hence, when and where have become the key questions for them in their purchase decision,” he says.

While many are looking at buying a property within the next two years, Tan says whether this will translate into actual sales will depend on the deals offered by sellers.

The pull and push factors

There are things the developers and government need to do to spur the buying sentiment, Tan reckons.

From the survey, the top five incentives that could encourage property purchases are larger discounts from developers (91%), reduced RPGT (90%), lower interest rate (89%), lower stamp duty rates (89%) and lower incidental costs (88%).

Tan stresses that affordability is the main concern currently, hence he urges developers and property owners to review their pricing strategies to meet buyers’ expectations and to make houses an “everyone can buy” item.

“The authorities may also need to consider suspending or tweaking the RPGT as it is indeed a deterrent to buyers,” he adds.

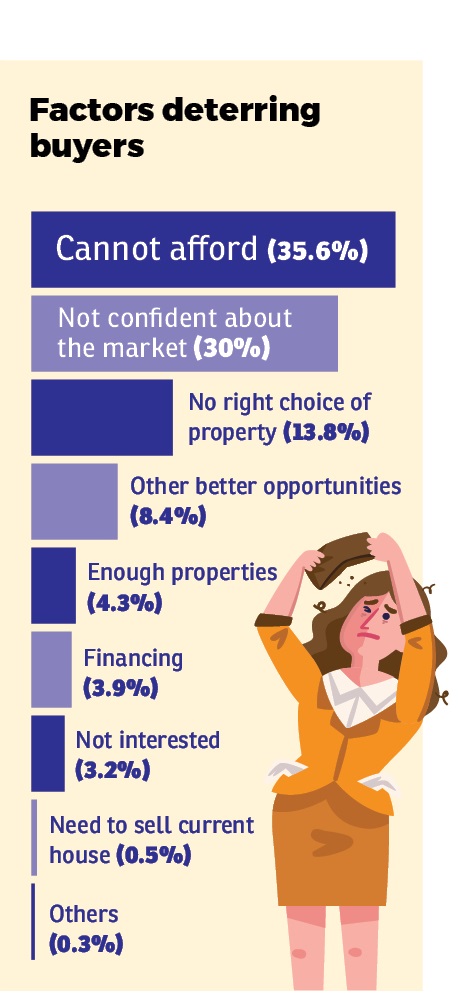

With pull factors, there are also push factors that deter the buyers from purchasing properties. The top reason for not purchasing is affordability (close to 36%).Other factors include lack of confidence in the Malaysian property market (30%) and lack of ideal choices in the market (13.8%).

About the survey

The two-week survey which began end-April garnered 621 respondents with the majority from Johor (53%), followed by Selangor (23%) and Kuala Lumpur (13%).

Most of the respondents were aged between 51 and 60 years-old (29%), while those aged 41 — 50 years and 31 — 40 years made up 24% and 21% respectively. About 18% were aged above 60 years while 8% were aged 30 years and below.

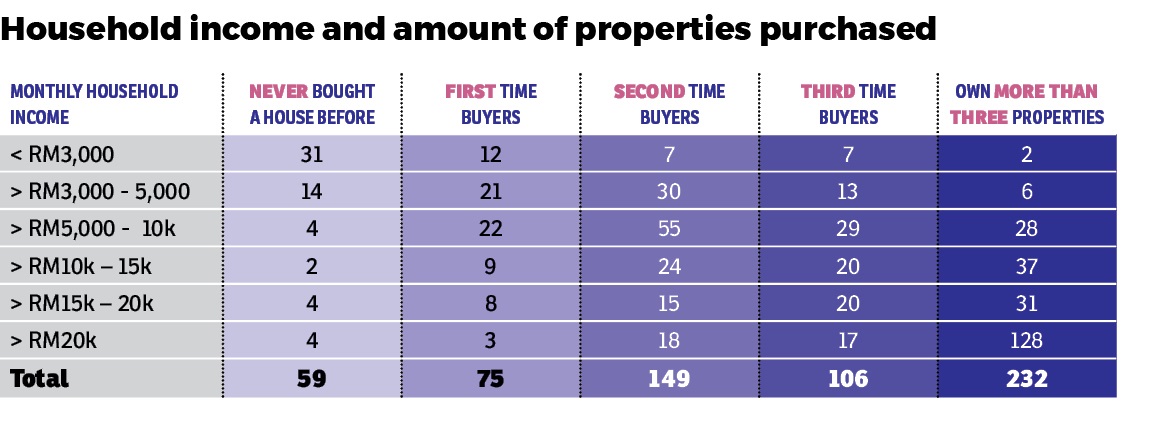

It is interesting to note that about one-third of the respondents (232) currently own more than three properties of whom eight of them have less than RM5,000 a month in household income.

Over half of the respondents (57%) are under employment while 29% are self-employed. Another 11% are retirees while 3% are unemployed.

Over half of the respondents (57%) are under employment while 29% are self-employed. Another 11% are retirees while 3% are unemployed.

In terms of household income, 38% of the respondents earn more than RM20,000 which means for a double-income household, this works out to about RM10,000 per month per person.

About 31% have a monthly household income of RM5,001 to RM10,000 while 32% earn a monthly household income of less than RM5,000 (13% earning less than RM3,000 and 19% earning a household income of RM3,001 to RM5,000).

The relatively high percentage of high income earners could be attributable to the seniority of the respondents.

As most of the survey respondents already owned at least one property, it is no wonder that an overwhelming 84% said they prefer to purchase rather than rent a property.

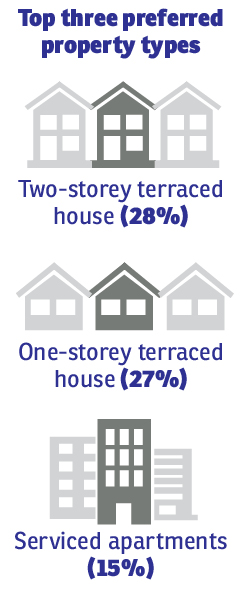

The type of property homebuyers want

Terraced houses remain the most popular choice of homebuyers as 57% of respondents selected them as their favourite property type of which 28% preferred two-storey ones and 27% preferred one-storey houses.

“Looks like one-storey homes are in demand but new supply is diminishing as developers are building less of them,” says Tan.

But Malaysians are not adverse to high-rises as a decent portion of respondents (15%) favoured serviced apartments and condominiums. “There will be takers for high-rise residential properties including serviced apartments where there is an oversupply in the market, but pricing must be attractive,”offers Tan.

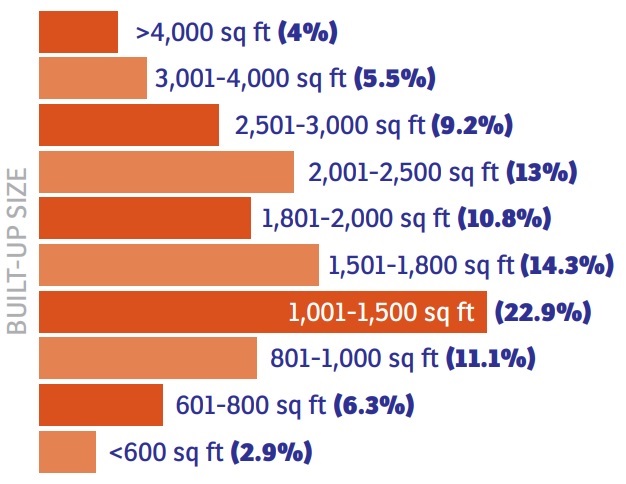

In terms of built-ups, 23% chose houses of 1,501 sq ft to 1,800 sq ft; 17% prefer a built-up area of between 601 and 1,000 sq ft while only 3% do not mind a built-up of less than 600 sq ft.

For other categories of bigger built-up areas of more than 1,501 sq ft, the percentage of respondents ranges from about 4% to 13%.

About 42% of respondents liked houses with land area sized between 1,540 sq ft and 2,500 sq ft, while 26.1% prefer land sizes of less than 1,540 sq ft (22 ft by 70 ft).

For number of BEDrooms, three-bedroom and four-bedroom units were the most popular choices at 36% and 32% respectively.

Meanwhile, a relatively high proportion of Bumiputra house buyers (29%) prefer to buy international or normal units compared with 24% who prefer to purchase Bumiputera lots. The majority 36% had no preference and 11% were unsure.

“From these findings, perhaps the government should relook at the Bumiputera quota policy to meet current needs as there were a relatively high percentage of Bumiputera buyers showing preference for international lots. This could be due to the relative ease of selling the international lots vis-à-vis Bumiputera lots on the secondary market,” says Tan.

Stay safe. Keep updated on the latest news at www.EdgeProp.my

This story first appeared in the EdgeProp.my e-Pub on May 22, 2020. You can access back issues here.

Follow Us

Follow our channels to receive property news updates 24/7 round the clock.

Telegram

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.