Housing demand post-MCO — back to basics

Demand, alongside supply, is the most fundamental aspect of the Economic Theory, referring to the ability and willingness of consumers to purchase a product or service.

Demand is said to be “latent” if a buyer needs or is willing to purchase a particular product or service, but does not have the ability to pay. Effective demand, on the other hand, is where a buyer’s income, perception and need correspond to result in an actual purchase rather than a mere desire to purchase.

Following the outbreak of Covid-19, a softer property market was observed in the first half of 2020. Sluggish sales and delay in construction progress have brought disruption to most developers’ cash flow. While leading developers are optimistic of achieving their 2020 sales targets — being backed by the unbilled sales during various phases of the Movement Control Order (MCO) — there is certainly a strong likelihood that their margins will be squeezed, and the market condition in the forthcoming months will still be affected by repercussions from the pandemic.

Developers nowadays are keen in offering more freebies than ever before, ranging from complimentary club memberships to subsidised maintenance fees, as well as discount vouchers, air-conditioners, water heaters, and others in order to push sales during the downturn.

Various incentives are being offered too, either in the form of easy homeownership schemes, additional discounts, rebates, and lower deposits or upfront, with the aim of lowering buyers’ entry level cost.

Such marketing strategies, to some extent, do work well in attracting and capturing the latent demand, but they do not necessarily help in generating more effective demand as the crucial needs of buyers are not fully cognisant.

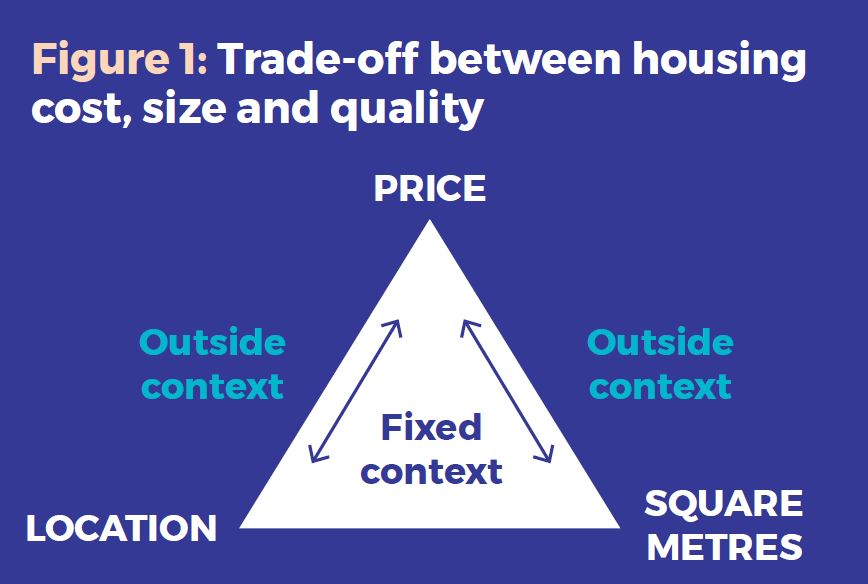

Buyers in the post-MCO era are expected to be more price-conscious, and will likely place more emphasis on housing locations that really benefit their quality of life in the long run. On this basis, a thorough understanding of the households’ income structure can really help developers better match their products with buyers’ demand. Instead of relying on market-spurring initiatives, developers should go back to the fundamental principles of property development — the dynamic trade-off relationship among house price, size and location (Figure 1) — when determining types of products to be released, and which groups of buyers they are targeting.

Homeownership rate in Malaysia

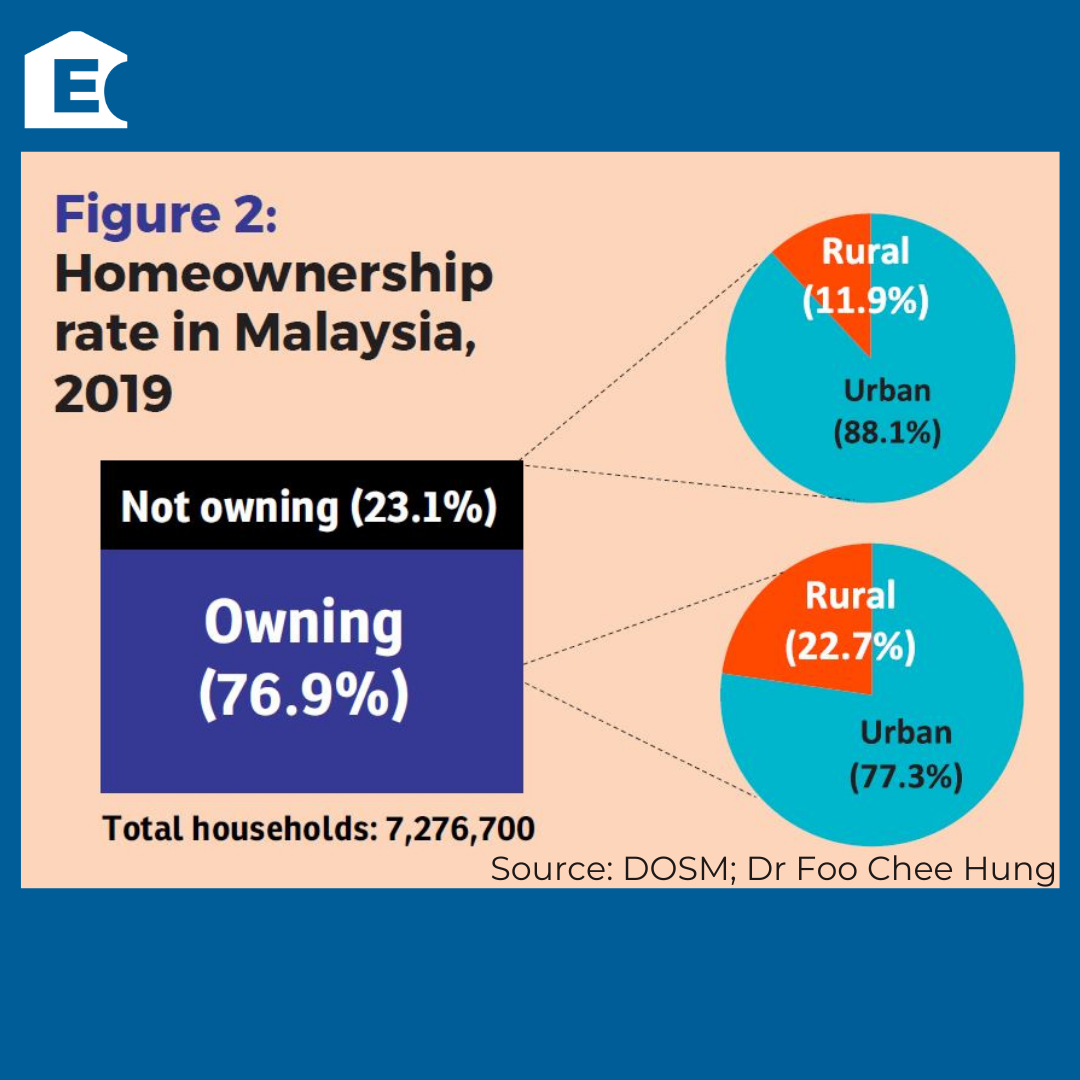

Based on the latest Household Income and Basic Amenities Survey Report 2019, the total number of households in the country was 7,276,700. The country’s homeownership rate in 2019 was 76.9% (or 5,595,782 households), an increase from 76.3% in 2016. There were still 23.1% of households in the country either renting (19.8%) or living in quarters (3.3%), and as high as 88.1% of these households resided in urban areas (Figure 2), which formed the pool of potential buyers for primary market housing.

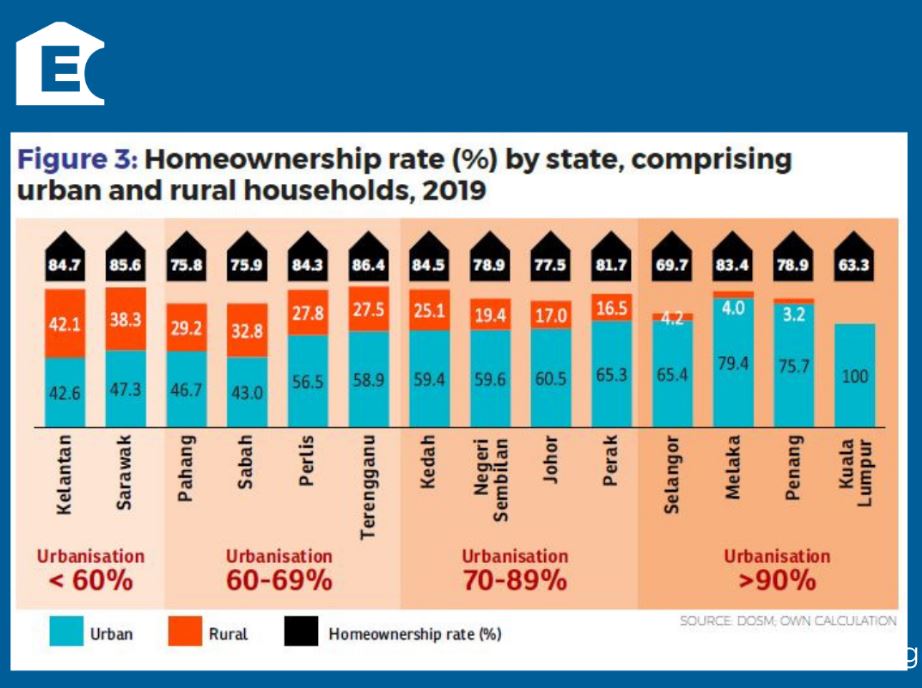

Homeownership rates at state levels were generally high at more than 70% except for Selangor and Kuala Lumpur (Figure 3). Most states — except for Melaka and Penang — saw homeownership rate decline with the increase in urbanisation.

For example, homeownership rates in Terengganu (86.4%), Sarawak (85.6%), Kelantan (84.7%), Kedah (84.5%) and Perlis (84.3%) were high but the respective urbanisation levels were below the national level (79.8%). A substantial portion of the homeownership rates in these states were attributed to households residing in rural areas.

A contrasting scenario was found in Selangor and KL, where the urbanisation levels were as high as 94.5% and 100% respectively, but the homeownership rates were among the lowest in the country at 69.7% and 63.3% respectively. This indicates that more potential buyers for primary market housing are concentrated in highly urbanised regions, and developers need to provide “right-priced” homes that can meet the preferences of these buyers.

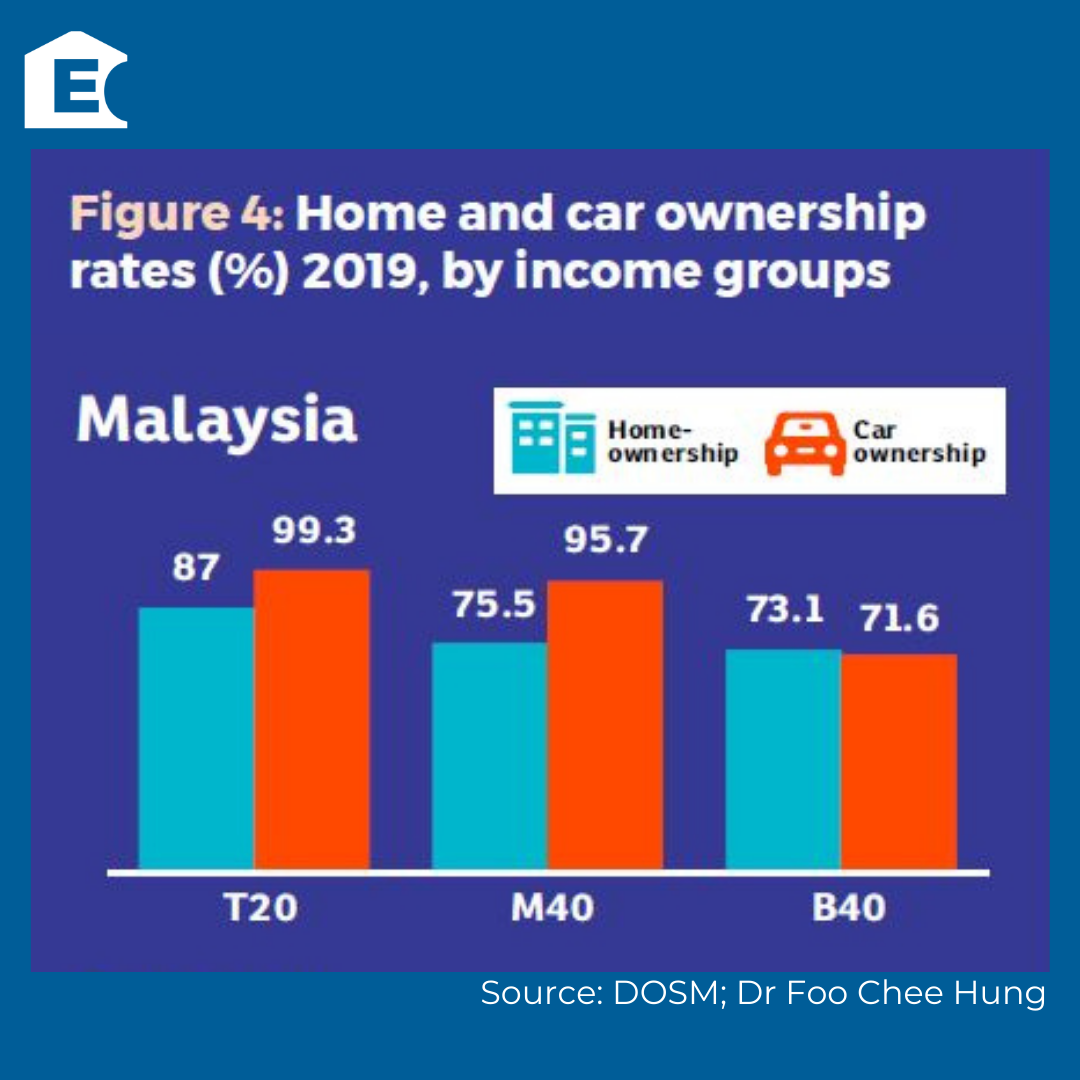

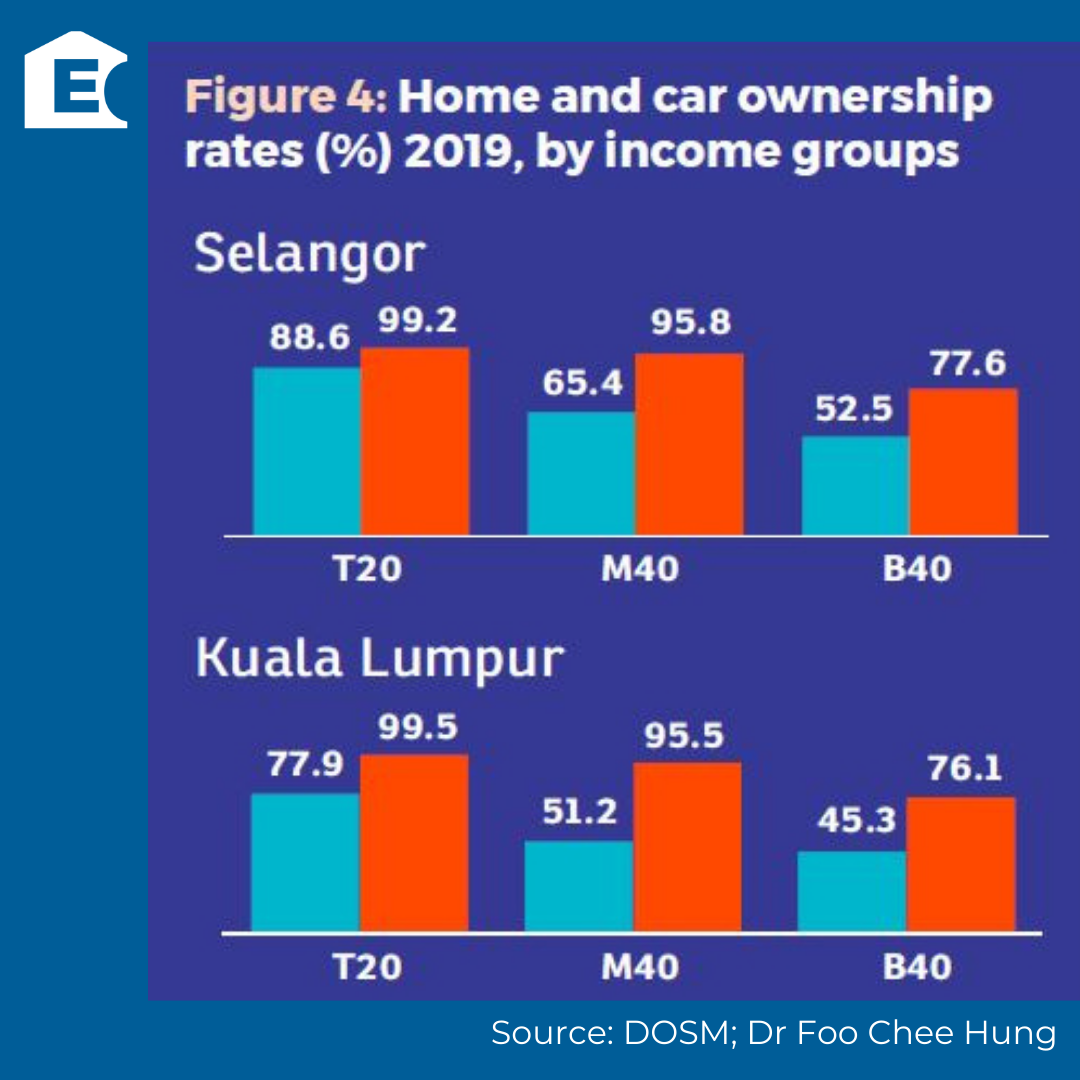

In terms of income groups, the homeownership rate for the B40 group was relatively lower. Notably, homeownership rates for the B40 in Selangor and KL were even lower, at 52.5% and 45.3% respectively.

The same situation was also observed in the M40, with the respective homeownership rates at 65.4% and 51.2% for Selangor and KL (Figure 4). If this is to be interpreted together with car ownership rates, one may find that car ownership rates were generally higher (more than 70%) across income groups. Even for the B40 in Selangor and KL, the respective car ownership rates were as high as 77.6% and 76.1%. This indicates that cars are still an important transportation mode for those who live in urban areas; which can significantly impact urban household disposable incomes leading to lower levels of housing affordability.

While Covid-19 may have brought about a shift in buyers’ preference in the residential market, where they may prefer low-dense suburban landed properties with greenery and more spacious layouts which are convertible into home offices as working from home become the new normal, one should realise that high-dense vertical urban living is still attractive owing to its higher level of integration with the urban network. There are still takers for high-rise residential properties including serviced apartments, who would opt for a development that can enable them to stay in the urban core environment with lesser burden on mortgage, maintenance expenses and travelling time.

What developers have to do In order to meet the demand of potential buyers that largely fall under the B40 and M40 income groups, developers need to move away from defining housing affordability in terms of initial capital cost, but to take into account the total cost of owning a house over the term of ownership.

Thus, being able to supply attractively-priced housing products that not only put affordable housing and jobs in close proximity but also reduce the possibility of low-income households falling into a housing stress situation will be particularly crucial in stimulating effective demand.

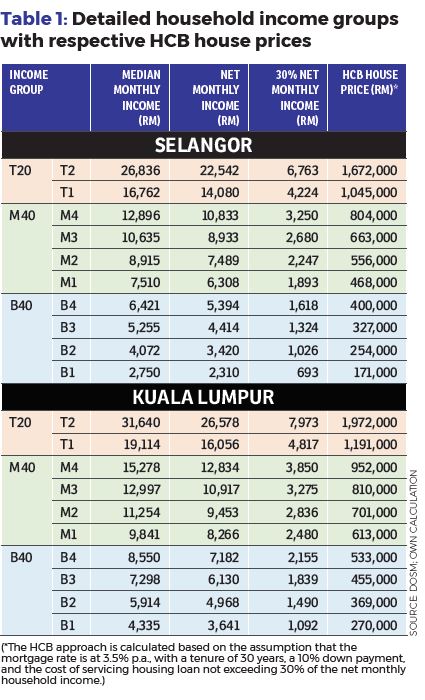

Speaking of affordability, developers need to be aware of the households’ income threshold in order to avoid supplying housing products that are beyond the households’ affordability level. For instance, by referring to the associated affordable house price for each individual income group — calculated through the Housing Cost Burden (HCB) approach — developers are able to have more targeted planning, thereby tailoring their projects to meet the demand of their targeted income groups (Table 1).

The market condition in the second half of 2020 will not be much different from the previous quarters, given that a possible second wave of Covid-19 outbreak could result in a second round of layoffs, negative sentiments on household incomes, GDP contraction, as well as the recent political instability and a potentially looming election which could cause investors and consumers to adopt a wait-and-see stance before committing to any big-ticket spending.

Location, accessibility and affordability are still the fundamentals. It is just that under the situation where the market is plagued by weak sentiments and oversupply of properties, developers need to be more specific in meeting the housing preferences of their target buyers in areas where the demand is underserved, so as to avoid building speculatively.

Besides, housing projects in the post-MCO era also need to avoid overleveraging advanced design features that can have “pass-on” effect on buyers such as fancy technological features that only lead to property prices rising beyond the mass housing buyers’ affordability.

Dr Foo Chee Hung is MKH Bhd manager of product research and development

This story first appeared in the EdgeProp.my e-Pub on Sept 4, 2020. You can access back issues here.

EdgeProp Malaysia Virtual Property Expo 2020 (VPEX 2020) is happening now! Find out more exclusive projects and exciting deals here

Stay safe. Keep updated on the latest news at www.EdgeProp.my

Click here for more property stories.

Never miss out

Sign up to get breaking news, unique insights, event invites and more from EdgeProp.

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.