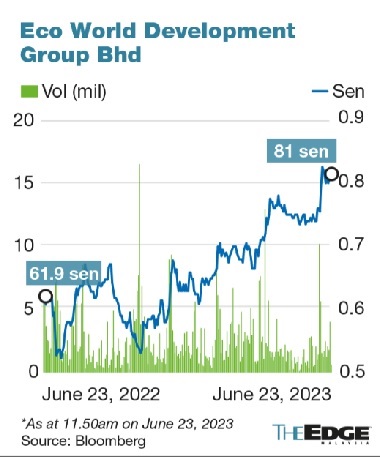

EcoWorld on track to achieve RM3.5 bil sales target in FY2023, say analysts

- PublicInvest Research, which maintained its “outperform” call on EcoWorld with a target price (TP) of 88 sen, said the current sales of RM2.4 billion is higher than RM2.17 billion recorded in the same period last year.

KUALA LUMPUR (June 23): Eco World Development Bhd (EcoWorld) is on track to meet its sales target of RM3.5 billion in the financial year 2023 (FY2023) as it has achieved 68.5% of the target, which is about RM2.4 billion secured in the first seven months of FY2023, according to analysts.

PublicInvest Research, which maintained its “outperform” call on EcoWorld with a target price (TP) of 88 sen, said the current sales of RM2.4 billion is higher than RM2.17 billion recorded in the same period last year.

“Unbilled sales improved to RM4.29 billion currently as compared to RM4.03 billion in the first quarter (1QFY2023). Group gross gearing level stands at 0.53 times and net gearing level at 0.31 times as at 2QFY2023,” PublicInvest analyst Tan Siang Hing said in a note on Friday (June 23).

Tan said EcoWorld’s net profit of RM62.7 million in the second quarter of 2023 (2QFY2023) was also within PublicInvest's expectation and analysts' consensus.

“We still believe that the group can continue with its sales momentum and offer attractive dividend yields of more than 6% at current share price,” he added.

Tan noted that EcoWorld’s total residential sales had exceeded RM1.22 billion, making up 51% of year-to-date (YTD) sales achieved, driven by higher-priced “upgrader” homes in the Klang Valley, Iskandar Malaysia and Penang.

“Elsewhere, the group’s commercial products contributed RM341 million YTD from new launches of various retail, shop and office units at its townships,” he said.

Meanwhile, Eco World International Bhd (EWI), in which EcoWorld owns a 27% stake, sold RM619 million in seven months and is also on track to meet its FY2023 sales target of RM1.4 billion.

“EWI will continue to focus on selling its completed stocks which have generated substantial cash (the group’s total cash, deposits and other investments have further increased to RM922 million or net cash of about RM652 million)," he added.

To recap, shareholders of EWI have approved the group’s proposed capital reduction exercise and the group aims to declare a first tranche dividend of at least RM300 million in the near term and the remaining RM600 million by the end of 2023.

Note that EWI recorded a loss before tax of RM2.12 million in 2QFY2023, from a pre-tax loss of RM66.5 million last year, mainly due to higher foreign exchange gains, higher interest income and lower finance costs.

Meanwhile, MIDF Research also maintained its “buy” call on EwoWorld with an unchanged TP of 87 sen as it expects stronger earnings in the coming quarters due to higher contribution from the group’s joint ventures (JVs).

“We remain positive on EcoWorld due to the stable new sales prospect which will be driven by its residential and industrial products.

“Besides, its balance sheet is healthy with net gearing of 0.3 times in 2QFY2023, while dividend yield is attractive at 6.1%,” said MIDF analyst Jessica Low Jze Tieng.

The analyst said the group’s higher earnings in the first half of 2023 (1HFY2023) of RM119 million, up 13.7% year-on-year, were mainly contributed by higher earnings from its JVs, namely Eco Grandeur, Eco Business Park V, Eco Ardence and Eco Horizon.

The higher earnings have mitigated the impact of higher finance costs, she said.

Kenanga Research has maintained an "outperform" call with a higher TP of RM1.03 (from 83 sen) on EcoWorld as the research house has ascribed a lower discount to its revised net asset value (RNAV) on its well-received projects pipeline.

"Despite market headwinds, the group believes it could still thrive with its affordable home offerings and rising demand for industrial products," it noted.

At the time of writing, shares in Eco World were down 1.5 sen or 1.83% to 80.5 sen, valuing the group at RM2.36 billion.

Never miss out

Sign up to get breaking news, unique insights, event invites and more from EdgeProp.

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.