Paradigm REIT's IPO sees flat close amid broader market dip

- The trust is expected to offer an annualised distribution yield of over 7% for 2025.

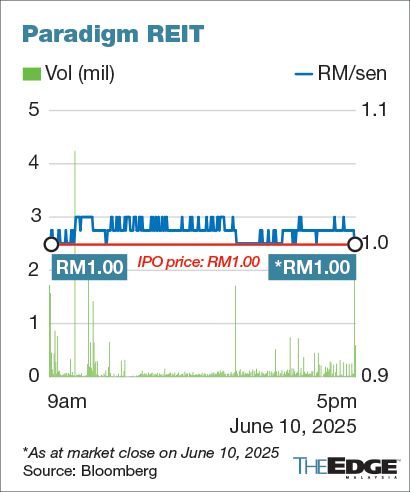

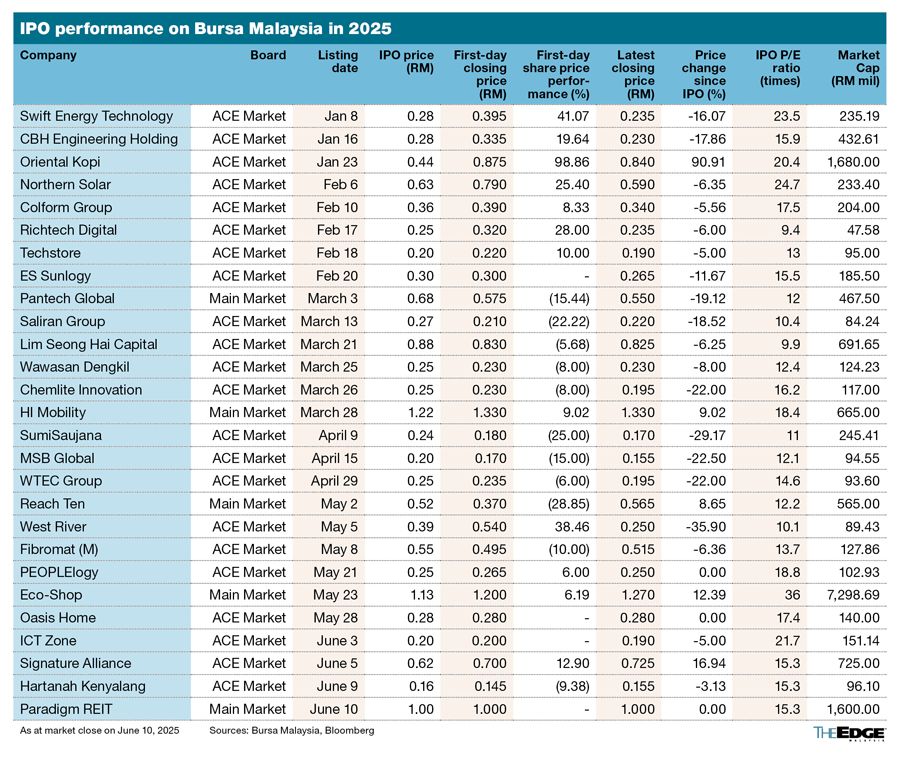

KUALA LUMPUR (June 10): Paradigm Real Estate Investment Trust (KL:PARADIGM) made a flat Main Market debut on Tuesday, as it closed at RM1, unchanged from its initial public offering price amid a softer broader market.

At the closing bell, the trust that was backed by WCT Holdings Bhd (KL:WCT) was valued at RM1.6 billion. Throughout the day, the stock traded within a tight range of between 99.5 sen and RM1.02. It saw 44.59 million units change hands.

The benchmark FBM KLCI slipped 0.16% on Tuesday, while the Bursa Malaysia REIT Index closed 0.06% lower.

“While we traded flat at RM1, we view this as a stable and encouraging start—especially in a market where volatility has become the norm,” said Paradigm REIT Management Sdn Bhd chairman and independent non-executive director Tan Sri Shahril Ridza Ridzuan.

“We remain focused on delivering consistent value to our unitholders and executing our strategy in making our assets more value-accretive,” said Shahril, who is also the chairman of government-linked private equity firm Ekuiti Nasional Bhd (Ekuinas).

Demand for Paradigm units was subdued ahead of listing, with a certain portion of the units undersubscribed by retail investors and reallocated to institutional investors.

The IPO involved no issuance of new units, meaning the trust itself did not receive any proceeds. The entire RM560 million raised from the IPO went to WCT, the sponsor of the REIT.

Paradigm owns and manages the Bukit Tinggi Shopping Centre, Paradigm Mall Petaling Jaya, and Paradigm Mall Johor Bahru. The three assets, worth a combined RM2.4 billion, are either fully or nearly fully occupied.

Paradigm REIT intends to distribute at least 90% of its distributable income, on a half yearly basis. The trust is expected to offer an annualised distribution yield of over 7% for FY2025, with a distribution of 7.16 sen per unit for the year, based on a payout of 100% of its distributable income.

Upon listing, property tycoon Tan Sri Desmond Lim Siew Choon will hold a 60.7% stake in Paradigm REIT via WCT.

Maybank Investment Bank is the principal adviser, sole managing underwriter, and lead bookrunner for the IPO. CGS International and AmInvestment Bank are joint underwriters and bookrunners, while RHB Investment Bank Bhd is a joint bookrunner.

Does Malaysia have what it takes to become a Blue Zone, marked by health and longevity? Download a copy of EdgeProp’s Blueprint for Wellness to check out townships that are paving the path towards that.

Never miss out

Sign up to get breaking news, unique insights, event invites and more from EdgeProp.

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.