IGB, IGB REIT climb to new record high on Johor Bahru deal

- At least four research houses upgraded the trust to ‘buy’ after raising their forecasts and target prices, betting that potential income from the mall, the trust’s first outside of the more mature Klang Valley, will offset the dilution to earnings per unit.

KUALA LUMPUR (June 25): IGB Real Estate Investment Trust (KL:IGBREIT) rose on Wednesday to a new record high following its plan to buy the Mid Valley Southkey Mall in Johor Bahru for RM2.65 billion in a cash-and-units deal.

At least four research houses upgraded the trust to ‘buy’ after raising their forecasts and target prices, betting that potential income from the mall, the trust’s first outside of the more mature Klang Valley, will offset the dilution to earnings per unit.

The deal is accretive on the basis of both earnings and dividend per unit, underpinned by the mall’s healthy occupancy, strong footfall and strategic location within the integrated Southkey development, said Maybank Investment Bank in upgrading the trust to ‘buy’ from ‘hold’.

“We are positive on the acquisition, which enhances IGB REIT’s income and geographical diversification profile,” the house said in a note.

Opened in 2019, the Mid Valley Southkey Mall’s net lettable area of 1.5 million sq ft is nearly fully occupied. The mall is located within an integrated mixed commercial development known as Mid Valley Southkey, which also includes two office towers and a four-star hotel.

The acquisition is also expected to help IGB REIT to tap the growing Johor Bahru market now benefiting from a slew of major developments such as the Johor Bahru-Singapore Rapid Transit System and Johor-Singapore Special Economic Zone.

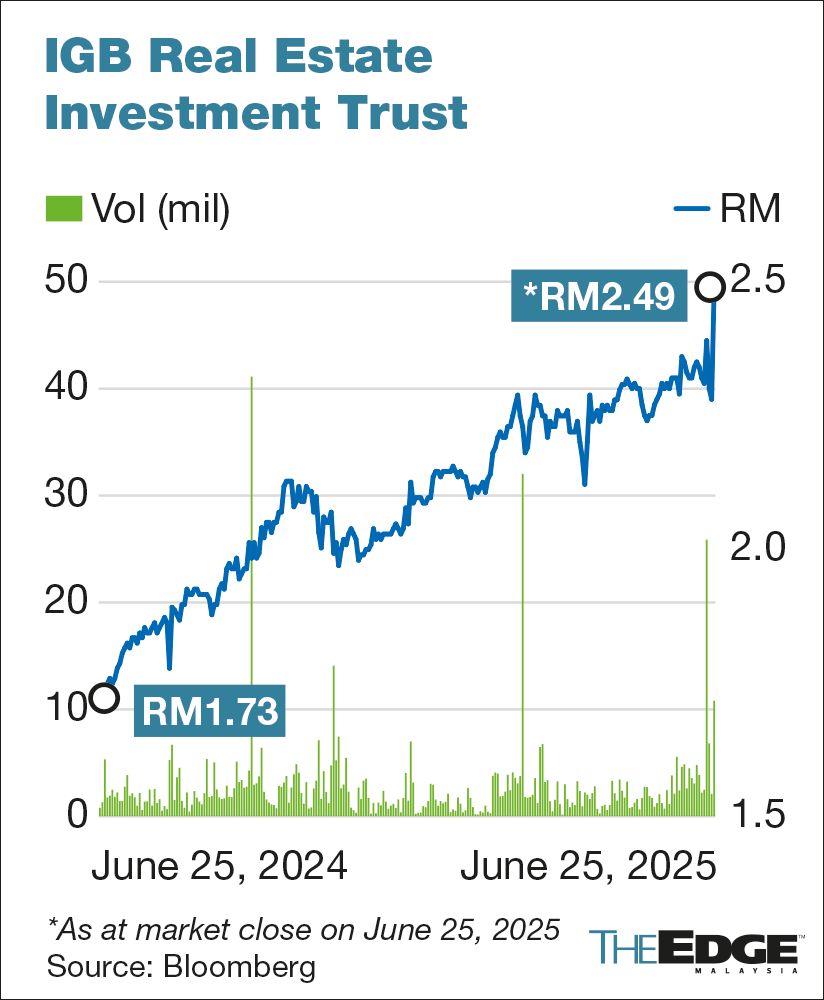

The trust rose as much as 11% to RM2.52, a new all-time high. IGB REIT ended Wednesday trading at RM2.49, after nearly 11 million units changed hands. At the last price, the trust had a market capitalisation of about RM9 billion.

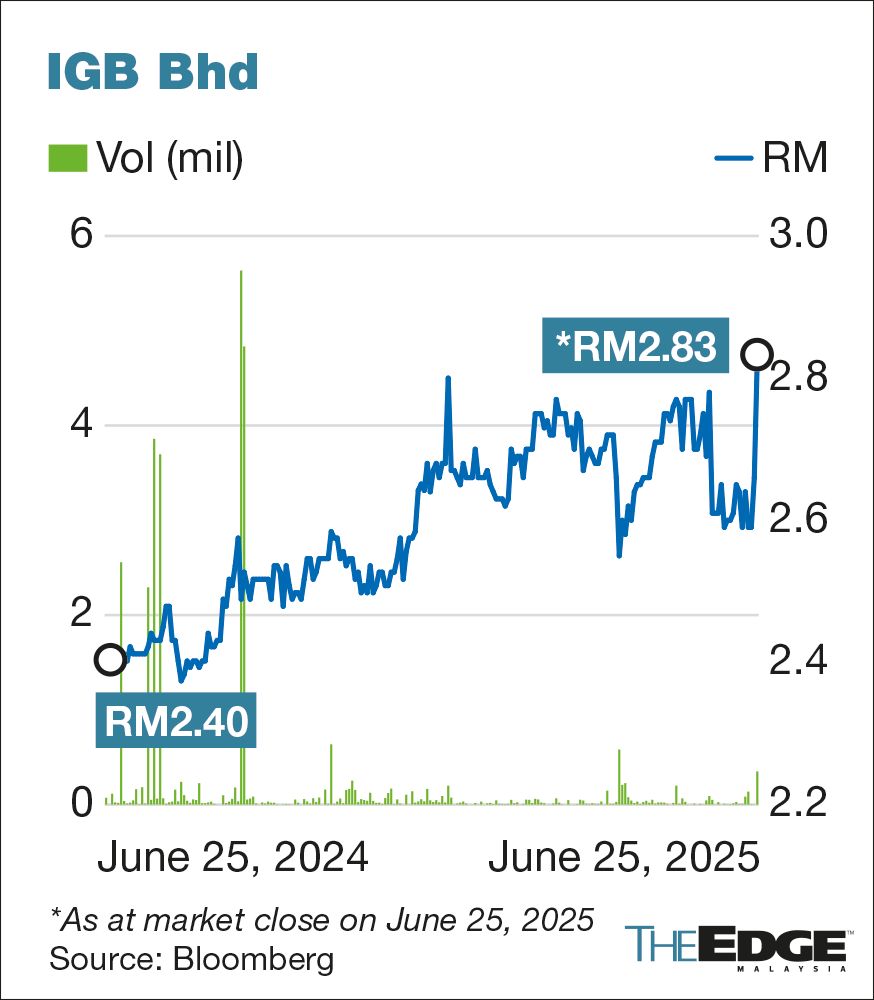

Shares of IGB Bhd (KL:IGBB), meanwhile, climbed more than 7% to RM2.85, also a fresh high since the property developer’s listing more than three decades ago on the planned sale to IGB REIT. Once the sale is done, IGB plans to distribute part of the proceeds as dividends to its shareholders.

For IGB, the loss of earnings from the mall is expected to be “minimal” as the gain is eliminated as unrealised gain upon consolidation, said Public Investment Bank, the sole research house covering the stock.

The price tag of RM2.65 billion, which is more than twice its net book value, allows the company to “streamline its asset holding structure by injecting the asset into the REIT while maintaining effective majority ownership in the REIT and improve the overall cost of capital of IGB”, the house said.

Does Malaysia have what it takes to become a Blue Zone, marked by health and longevity? Download a copy of EdgeProp’s Blueprint for Wellness to check out townships that are paving the path towards that.

Never miss out

Sign up to get breaking news, unique insights, event invites and more from EdgeProp.

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.