Rawang Old Town vs New Town: Do commercial property prices vary widely?

- Both zones underscore the town’s evolution within the Klang Valley’s wider property ecosystem, a place balancing legacy charm with modern expansion.

PETALING JAYA (Oct 2): Rawang’s commercial property scene was playing out like a tale of two towns: the timeworn charm of Old Town around Jalan Maxwell versus the fresh energy of Bandar Baru Rawang.

However, although data from EdgeProp EPIQ showed there was a split in market dynamics, it was not a vast divide, with the two commercial areas showing some overlapping sale prices and rental rates.

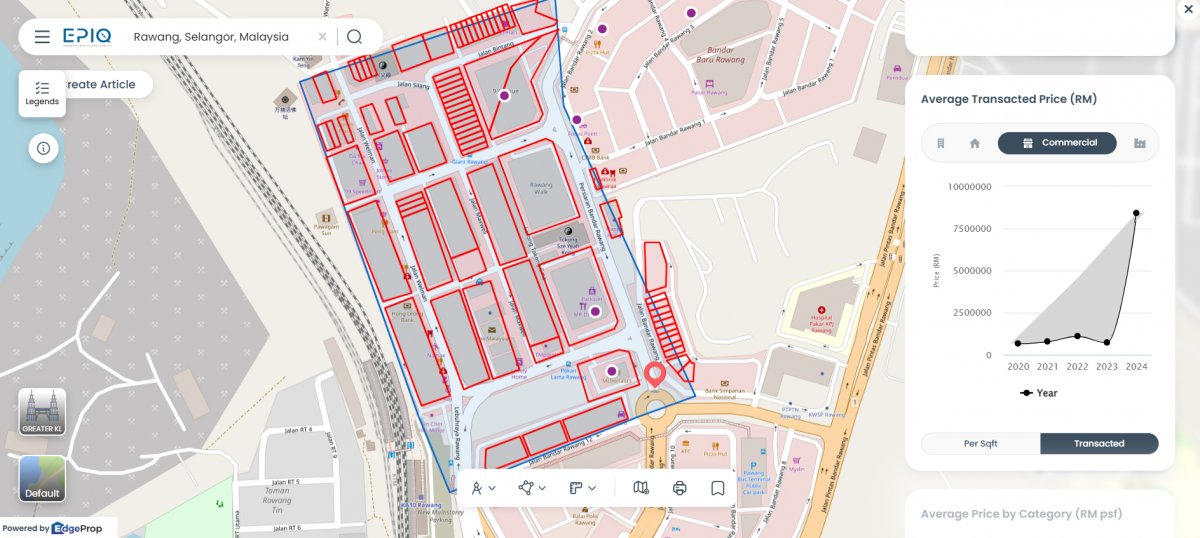

In the Old Town enclave along Jalan Maxwell and Jalan Welman, commercial units, mainly shoplots and office spaces, typically transacted between RM720,000 and RM1.58 million from April 2024 to April 2025 for *land areas between 1,633 and 1,634 sq ft, translating to psf prices of RM440.93 and RM967.24.

In the overall commercial category, EPIQ data shows an average transaction price of RM3.3 million, which was heavily skewed by an outlier of a RM67.9 million vacant land deal.

On the rental front, the Old Town offered relatively affordable rates, mostly below RM2.50 psf. Rents range between RM1,000 and RM5,500 a month for the older shoplots here with built-ups of 1,076–3,094 sq ft. Tenants such as 99 Speedmart, Hong Leong Bank, McDonald’s and Pos Malaysia showed that the area remained relevant despite its aging stock.

New Town’s premium: growth and higher rents

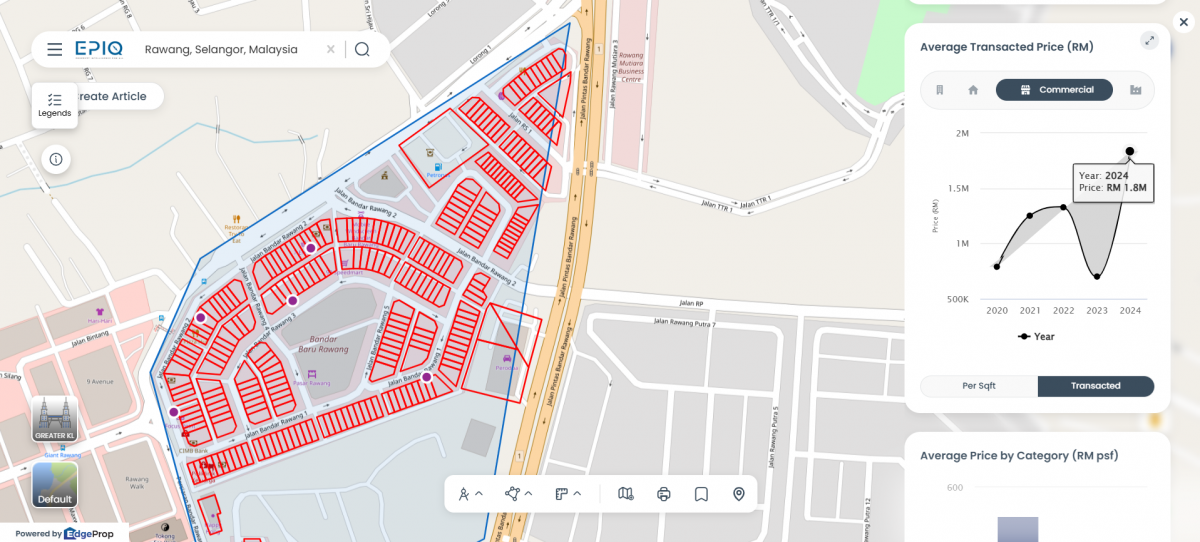

Move a few kilometers away to Bandar Baru Rawang, and the landscape changed slightly. Commercial properties here, mainly shoplots, transacted between RM1.05 million and RM1.8 million from January 2024 to April 2025, but with psf prices tightening to a band between RM554 and RM1,090 for *land areas of 1,604–1,894 sq ft, reflecting the area’s newer developments and improved infrastructure.

However, one office lot of 1,722 sq ft land size at Jalan Bandar Rawang 12 sold for RM210,000 or RM121.95 psf in August 2024. This anomaly pulled the average transaction price down to RM1.2 million.

Rentals in Bandar Baru Rawang commanded monthly rates ranging from RM1.00 psf to as high as RM4.86 psf. Most tenants paid between RM1,600 and RM8,000 monthly for modern shophouses and office lots.

This rental uplift is driven by fresh township planning, better amenities, and a growing population eager to support new businesses, comprising Maybank, 7-Eleven, Petronas, Klinik Mediviron, the Rawang market, and many more.

This data-driven snapshot highlights Rawang’s unique market duality. The Old Town offers stable, affordable entry points with deep roots and reliable tenants, while Bandar Baru Rawang presents an opportunity for investors chasing growth and higher yields.

Both zones underscore the town’s evolution within the Klang Valley’s wider property ecosystem, a place balancing legacy charm with modern expansion.

For investors and businesses eyeing Rawang, understanding this divide is key to aligning investment goals with market realities, whether it’s capitalising on steady income streams or betting on the next wave of commercial growth.

* Note: Shoplots are typically transacted by built-ups, not land sizes, as one transaction may involve two or more individual levels on the same land plot, but the data source does not provide information on built-ups, so the figures should be read with this in mind. As Penang girds itself towards the last lap of its Penang2030 vision, check out how the residential segment is keeping pace in EdgeProp’s special report: PENANG Investing Towards 2030.Follow Us

Follow our channels to receive property news updates 24/7 round the clock.

Telegram

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.