A tale of two towers: Empire Remix 1 abandoned, Edumetro thrives

- Empire Remix 1 remains a cautionary tale, a stalled opportunity in an otherwise active and competitive USJ 1 property market.

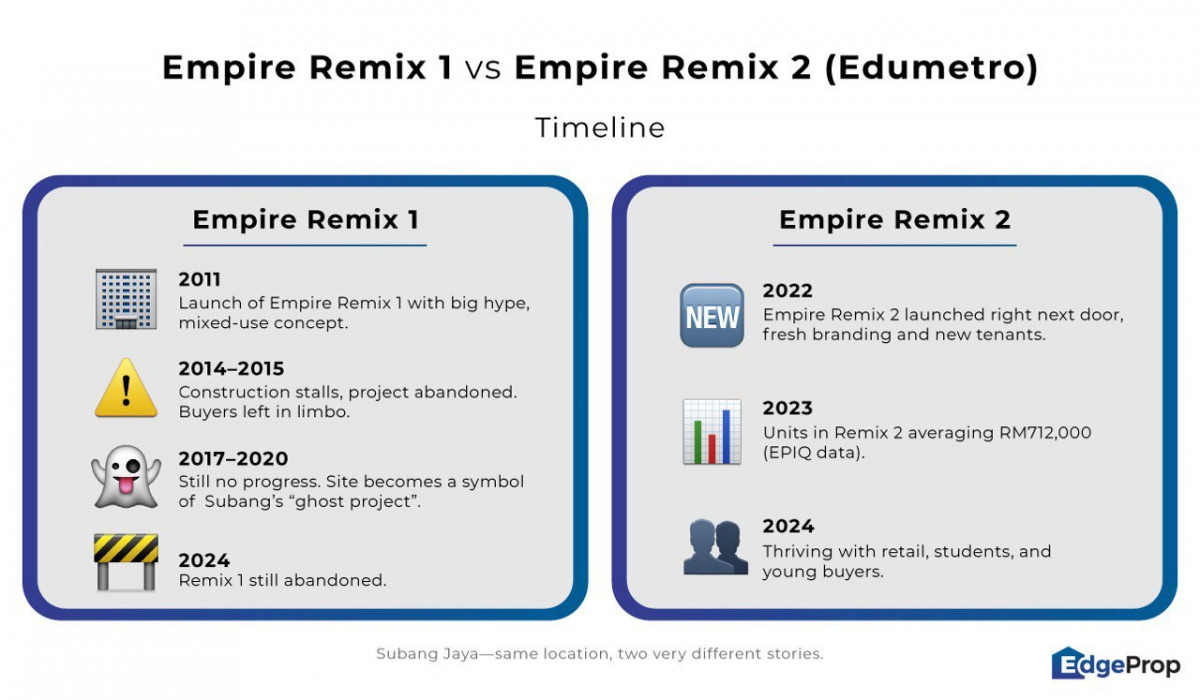

PETALING JAYA (Oct 6): Empire Remix 1 was meant to be USJ 1’s signature twin-tower development, a vibrant mix of homes, offices, and retail. Spanning 10.67 acres, it was launched in 2012, with development order obtained in 2014. But more than a decade later, the project by True Renaissance Sdn Bhd remains stuck at around 30% completion, and the developer was wound up in 2024. Since then, it has dragged down sentiment in the surrounding market.

Right beside it, however, Empire Remix 2 was rescued by HCK Capital Group Bhd, and is now rebranded as Edumetro. Completed in 2023, the units have been actively transacting.

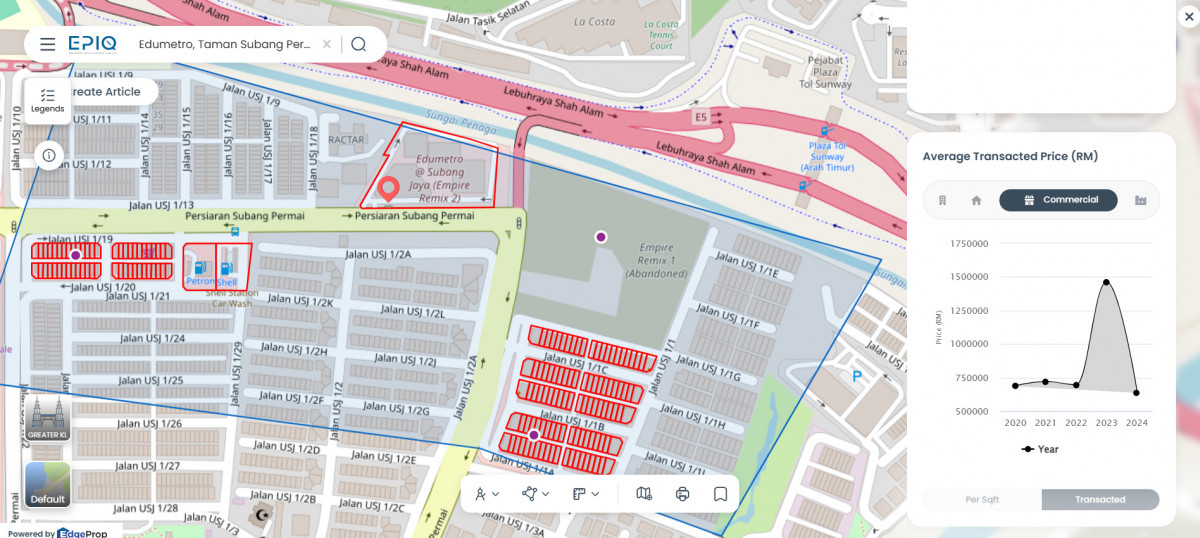

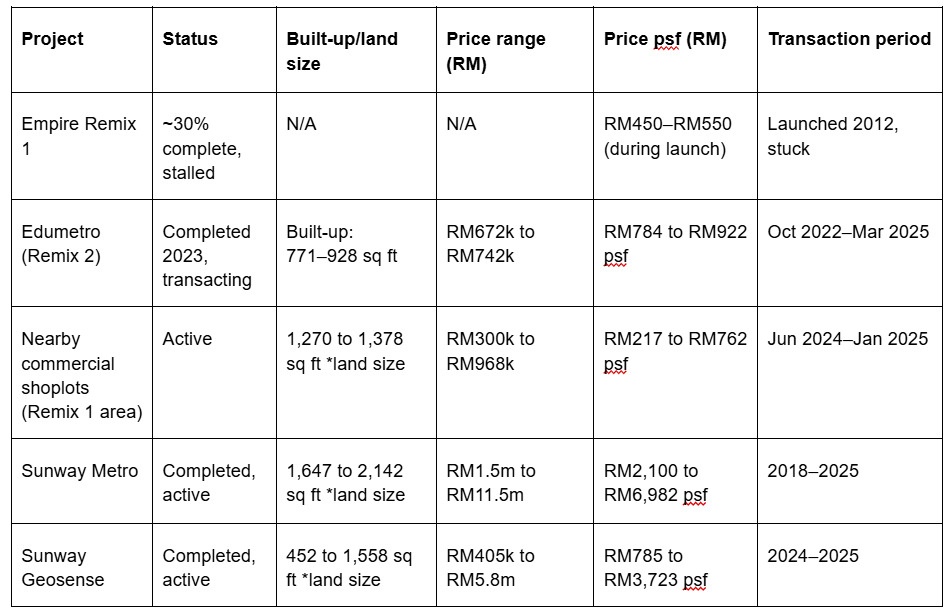

According to EdgeProp’s EPIQ data, Edumetro’s condo units, ranging from 771 to 928 sq ft, transacted between RM672,000 and RM742,000 (RM784.52 psf to RM922.27 psf) from October 2022 to March 2025.

In contrast, shoplots around Empire Remix 1 recorded transactions only between June 2024 and January 2025, at RM300,000 to RM968,000, or from RM217.74 psf to RM762.11 psf for *land areas spanning 1,270 to 1,378 sq ft.

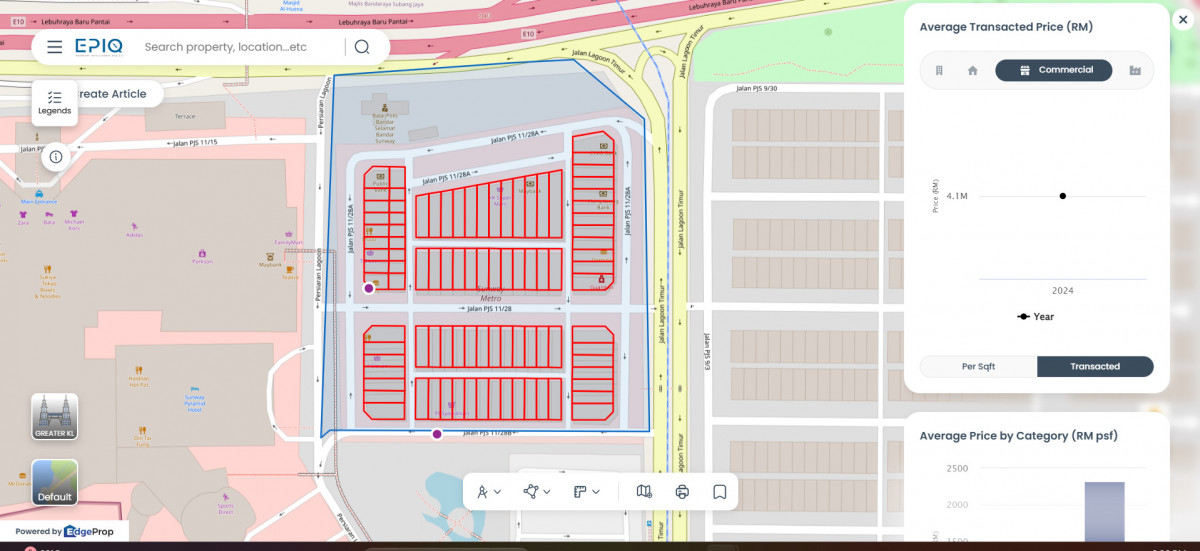

Just across the road, projects like Sunway Metro and Sunway Geosense tell a different story. Commercial properties comprising shoplots in Sunway Metro transacted between 2018 and 2025 recorded prices from RM1.5 million to RM11.5 million, translating to RM2,100.82–RM6,982.91 psf for.*land areas of 1,647–2,142 sq ft.

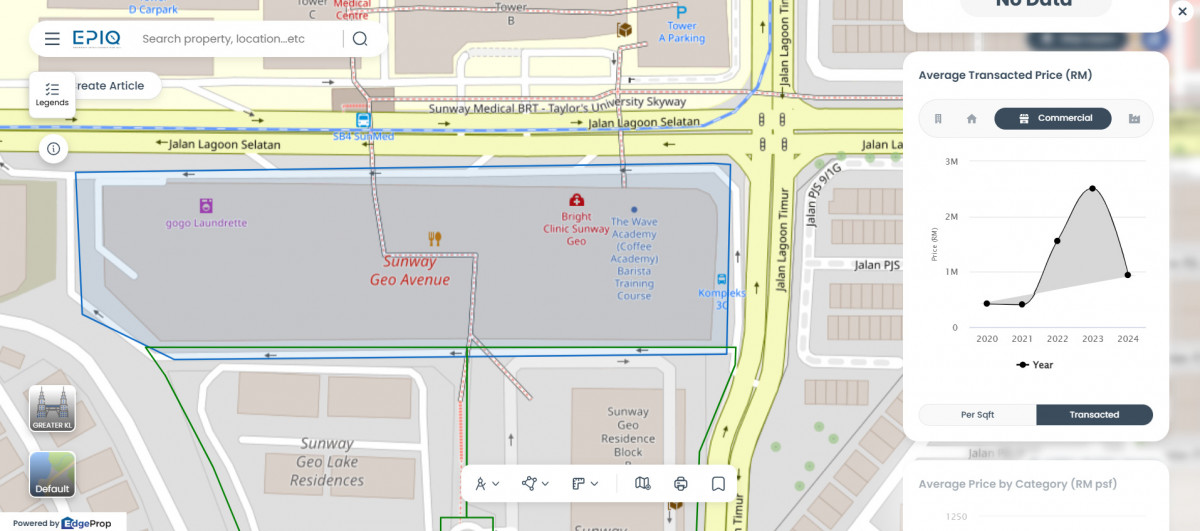

Meanwhile, shoplots and office lots in Sunway Geosense saw sales from 2024 to 2025, with units priced between RM405,000 and RM5.8 million. *Land sizes ranged from 452 sq ft to 1,558 sq ft, translating into RM785.45–RM3,723.80 psf.

The table below illustrates how Empire Remix 1 compares with surrounding projects. As the table below shows, while Remix 1 remains stalled, surrounding projects such as Edumetro, Sunway Metro and Geosense have been completed and continue to transact actively at rising price points.

Legal setbacks stall revival

In 2022, HCK Capital Group’s Subang Sentral Development was appointed as a “white knight” to rescue Empire Remix 1 via a court-sanctioned corporate voluntary arrangement (CVA). Backed by 90.7% of debt-holding buyers, the plan was intended to pave the way for completion.

However, in July 2023, the Kuala Lumpur High Court quashed the CVA after 467 purchasers challenged its validity, arguing that CVAs under the Companies Act 2016 were designed for struggling companies, not abandoned projects. The ruling left Remix 1 in legal limbo, with its future hanging in the balance.

Nawawi Tie Leung Real Estate Consultants managing director Eddy Wong explained that reviving a stalled project typically requires either a white knight or government intervention.

“The government is usually reluctant to get involved in what is essentially a private sector project, as it can be viewed as a bailout with political implications. So, a white knight is the typical solution. Otherwise, the project will remain stalled,” he told EdgeProp.

Buyers’ gamble and what lies ahead

Around 2,500 purchasers have collectively invested an estimated RM500 million (excluding down payments and interest) into Remix 1’s SoHo units, originally priced between RM450 and RM550 psf.

Today, comparable completed units in USJ 1 command between RM850 and RM950 psf, highlighting the significant opportunity cost faced by buyers stuck in limbo.

“The buyers and investors are caught in a ‘double whammy’ situation where they do not get the delivery of the property they purchased, and neither are they able to obtain a refund. If they have taken a bank mortgage, they must continue servicing it.

“Banks typically do not unwind loans once disbursed unless the full amount is repaid. It is unlikely the bank will offer a moratorium on repayments unless a revival plan is already in motion,” Wong said.

Ripple effects on the local market

The unfinished towers not only burden buyers but also weigh on surrounding projects.

“The stalled project may also depress the resale values of properties located nearby,” Wong added.

It was previously reported that should HCK step in, it may have to pump in as much as RM900 million for construction and infrastructure to complete Remix 1. Yet, beyond deep funding, success would hinge on alignment between developers, landowners, financiers, and purchasers, backed by a solid legal framework to prevent further disputes.

Looking at Edumetro’s success beside the abandoned Remix 1, Wong urged buyers to remain prudent.

“Be cautious with big-ticket purchases such as properties; do not overstretch your finances, as the best-laid plans can sometimes go awry. Always buy from reputable developers with a proven track record,” he said.

Until then, Empire Remix 1 remains a cautionary tale, a stalled opportunity in an otherwise active and competitive USJ 1 property market.

* Note: Shoplots are typically transacted by built-ups, not land sizes, as one transaction may involve two or more individual levels on the same land plot, but the data source does not provide information on built-ups, so the figures should be read with this in mind.

As Penang girds itself towards the last lap of its Penang2030 vision, check out how the residential segment is keeping pace in EdgeProp’s special report: PENANG Investing Towards 2030.

Never miss out

Sign up to get breaking news, unique insights, event invites and more from EdgeProp.

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.