Industry experts call for faster approvals, clearer processes to boost industrial growth

- Rising project costs were a recurring theme, with several noting that higher electricity tariffs, operational expenses, labour constraints, and utility charges could erode Malaysia’s competitiveness against regional markets such as Vietnam and Indonesia.

PETALING JAYA (Nov 26): Industry experts and developers have urged closer coordination between government agencies, local councils, utility providers, and the private sector to strengthen Malaysia’s industrial development.

The call was made during the launching of the Industrial Special Report by EdgeProp in conjunction with the Industrial Real Estate: Closed-door Strategic Dialogue & Masterclass event organised by the Real Estate and Housing Developers’ Association (Rehda) Institute at Wisma Rehda here on Tuesday. Earlier, the report was soft-launched in Taipei, Taiwan in conjunction with Rehda Institute’s Taiwan Study Trip 2025—Industrial & Sustainability Study Tour on Nov 18–21.

Read also

Strategic clusters key to Malaysia’s industrial growth—LaBrooy

Semiconductor boom fuelled by local talent—Sidec

Industrial sector outlook remains stable amid evolving global dynamics, says Rehda past president

Speaking at a closed-door session organised by Rehda Institute, participants highlighted pressing challenges, including rising development costs, approval delays, infrastructure readiness, environmental, social, and governance (ESG) compliance, and uncertainties in upcoming regulations; noting that greater transparency and streamlined processes could boost investor confidence, and support sector growth.

Hurdles include cost, taxation, infrastructure, approval

Rising project costs were a recurring theme, with several noting that higher electricity tariffs, operational expenses, labour constraints, and utility charges could erode Malaysia’s competitiveness against regional markets such as Vietnam and Indonesia.

Tax-related uncertainties, and infrastructure readiness—particularly electricity supply and load availability—are among the main concerns raised by potential investors, said the developers.

Approval bottlenecks were cited across various local authorities and utilities. Some groups highlighted that while certain councils now provide clear online submission systems with defined response timelines, many agencies still rely on manual processes that slow progress.

Developers shared instances where delays from authorities or utility providers had stalled projects, blocked accounts, and triggered financial penalties, despite the delays not originating from the developers themselves.

Participants also pointed to zoning challenges, lengthy industrial land conversions, and the lack of a clear “determination body” when delays are caused by external agencies. The impact of new policies, including anticipated changes under the Real Property Development Act, added further uncertainty.

ESG expectations were acknowledged as increasingly mandatory, though participants noted the high initial cost of compliance and the difficulty of collecting Scope 1, 2 and 3 emissions data. Many opted for “low-hanging” measures such as basic green certifications, while expressing interest in technologies that offer practical value, including waste management tracking, and solar solutions. However, some developers observed that full-fledged smart park operations remain limited by cost sensitivities among tenants.

Infrastructure readiness—covering power, water and waste management—was identified as a national challenge. Several participants emphasised the need for clearer visibility on grid capacity to support planning for new industrial developments. Others suggested that greater transparency, faster approvals, and more standardised processes across authorities could help strengthen Malaysia’s competitiveness.

Ensure legal compliance to avoid losses

Halim Hong & Quek (HHQ) partner, Noelle Low Pui Voon highlighted the critical role of legal due diligence in Malaysia’s industrial land development. She explained the classifications of industrial land, corresponding regulations under the Industrial Coordination Act, and the importance of understanding land categories, zoning, and express conditions—especially for projects involving foreign investors.

Low warned that non-compliance, including failure to secure state consents, or land conversions, can lead to void contracts, forfeited agreements, and financial losses. She urged early engagement with authorities, landowners, and advisors to ensure regulatory compliance, mitigate risks, and support successful industrial development.

AJC Planning Consultants’ principal Julie Chok noted the symbiotic relationship between agriculture, logistics, and manufacturing, allowing on-site processing, contract farming, and integrated supply chains to improve efficiency, and local economic outcomes.

She pointed out the importance of smart and sustainable infrastructure, including phased road networks, utility access, water recovery systems, carbon sequestration, and smart farming technologies. These measures aim to enhance food production, optimise industrial land use, and improve the quality of life for surrounding communities, while providing a model for high-tech, resilient industrial-agro ecosystems.

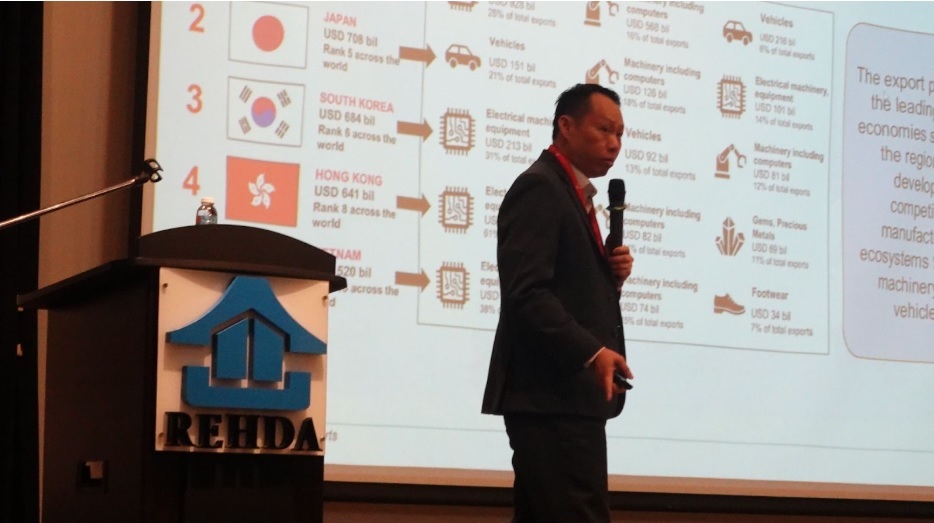

Asia’s performance in electronics export remains strong

Knight Frank Malaysia executive director Allan Sim said that global trade patterns in 2024 underscore Asia’s growing dominance in manufacturing and exports. The US remained the world’s largest importer, while China continued to lead global exports, supported by strong performance in electrical machinery, computers, and vehicles. Export structures across Asia have become increasingly aligned, reflecting the region’s competitiveness in electronics, machinery and automotive components, and reinforcing Asia’s expanding role in global supply chains.

At the same time, geopolitical tensions, tariff uncertainty, and reshoring policies in major economies are prompting manufacturers to reassess investment plans. Key sectors—including pharmaceuticals, automobiles, aerospace and electronics—face rising disruption, pushing companies to diversify production and reduce trade exposure. These shifts, combined with Asia’s large consumer base and resilient fundamentals, continue to position Southeast Asia as a strategic destination for future manufacturing and supply chain realignment.

Unlock Malaysia’s shifting industrial map. Track where new housing is emerging as talents converge around I4.0 industrial parks across Peninsular Malaysia. Download the Industrial Special Report now.

Follow Us

Follow our channels to receive property news updates 24/7 round the clock.

Telegram

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.