Industrial sector outlook remains stable amid evolving global dynamics, says Rehda past president

- “People now see that Malaysia is an attractive destination,” he said, noting that companies have already diversified their risks, and will continue to value locations that offer stability, should similar disruptions recur.

PETALING JAYA (Nov 27): The outlook for Malaysia’s industrial sector next year remains stable, supported by a steady pipeline of enquiries, though a slower momentum is expected compared to the past two years.

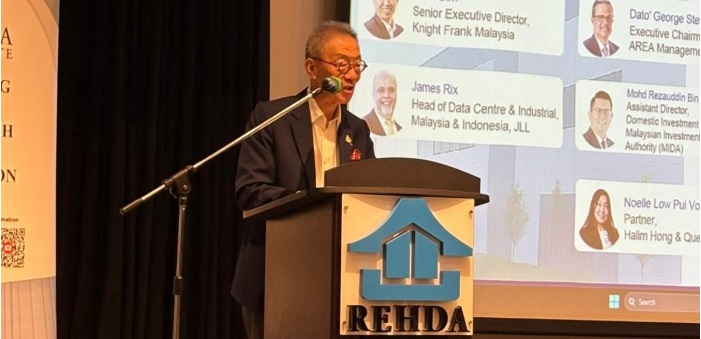

The projection was shared by the Real Estate and Housing Developers’ Association (Rehda)’s trustee, past president and patron national council member Datuk Seri Michael KC Yam during the “Industrial Real Estate: Closed-door Strategic Dialogue & Masterclass” event organised by the Rehda Institute at Wisma Rehda here on Tuesday.

Following his opening address, he told EdgeProp that the level of interest seen recently—particularly over the past two years—has been strong, driven in part by global geopolitical shifts.

Read also

Strategic clusters key to Malaysia’s industrial growth—LaBrooy

Semiconductor boom fuelled by local talent—Sidec

Industry experts call for faster approvals, clearer processes to boost industrial growth

“Based on the [current] pipeline and enquiries, there will still be a steady flow,” he said. “I can’t say whether it will accelerate at the rate we saw in the past two years though.”

He noted that the industrial demand has been significantly boosted by sectors such as data centres, which require large land parcels because of redundancy needs.

These data centres, he said, have been “gobblers of huge land”, contributing to the heightened market activity.

Much of the earlier spike in demand was shaped by geopolitical uncertainties, especially the sudden tariff policy imposed by the US under the Trump administration.

These factors created instability for manufacturers reliant on overseas markets. While purely domestic players were less affected, larger companies dependent on global trade faced tariff-related pressures that prompted them to rethink their risk exposure.

This situation led to two shifts, Yam explained. Companies seeking alternative locations as part of risk management, and firms that previously had not considered relocating, began to research new markets. In this environment, Malaysia emerged as an attractive option.

According to him, Malaysia’s ecosystem, legal framework, and available incentives have made it a compelling destination for companies reassessing their regional strategies. The country’s ability to facilitate market entry further strengthened its position during a period of global uncertainty.

Looking ahead, Yam believes interest will remain consistent even if geopolitical tensions ease and tariffs return to normal.

“People now see that Malaysia is an attractive destination,” he said, noting that companies have already diversified their risks, and will continue to value locations that offer stability, should similar disruptions recur.

While the extraordinary spike seen during the peak of global uncertainty may not recur next year, a sustained, steady pipeline suggests that Malaysia’s industrial sector will continue to benefit from the structural shifts already set in motion.

Unlock Malaysia’s shifting industrial map. Track where new housing is emerging as talents converge around I4.0 industrial parks across Peninsular Malaysia. Download the Industrial Special Report now.

Follow Us

Follow our channels to receive property news updates 24/7 round the clock.

Telegram

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.