UEMS, E&O earnings below expectations

Property sector

Maintain neutral: Out of eight property developers under our coverage, two (UEM Sunrise Bhd [UEMS] and Eastern & Oriental Bhd [E&O]) reported earnings below expectations. UEMS experienced slower-than-expected work progress for Arcoris and Aurora Melbourne Central. Its profit before tax margin was affected as interest cost increased by 68% year-on-year (y-o-y) to RM21.3 million on higher debts.

As for E&O, its weaker results were due to lower-than-expected progress billings of property projects and higher expenses. Only Glomac Bhd managed to beat our estimates due to higher-than-expected billings as the Reflection Residences project had entered its final stages. Overall, first quarter of 2016 (1Q16) earnings were mixed with two underperforming expectations and one exceeding expectations.

According to the latest preliminary Property Market Report released by the National Property Information Centre, Malaysia’s property market transaction value declined by 18% y-o-y to RM32 billion in 1Q16. The negative growth in transaction value was consistent with a decline of 14% in transaction volume to 80,029 units in 1Q16.

Further analysis of the data suggests market preference towards affordable housing at below RM500,000. As it is, transaction value for properties below RM500,000 declined 11% y-o-y, compared with a 23% decline for properties worth RM500,000 to RM1 million, and a 20% decline for properties worth RM1 million and above.

Property demand (as measured by “applied loans for purchase of property” by Bank Negara Malaysia) increased for the first time in 16 months, after increasing 2% y-o-y to RM25.79 billion in May 2016.

It also improved by 5% month-on-month. This was a small positive surprise as it could signal a recovery in loan demand if the trend persists. Cumulative five months ended May 2016 (5M16) applied loans were still 6% lower y-o-y against 5M15 due to weak performance in the first four months (4M16: down 8% y-o-y). Having said that, “approved loans for purchase of property” were still lower by 13% y-o-y at RM9.91 billion, suggesting that a tighter lending environment had more than offset the slight recovery in demand. We will continue to monitor the increase in demand to see whether it is a sustained change in trend.

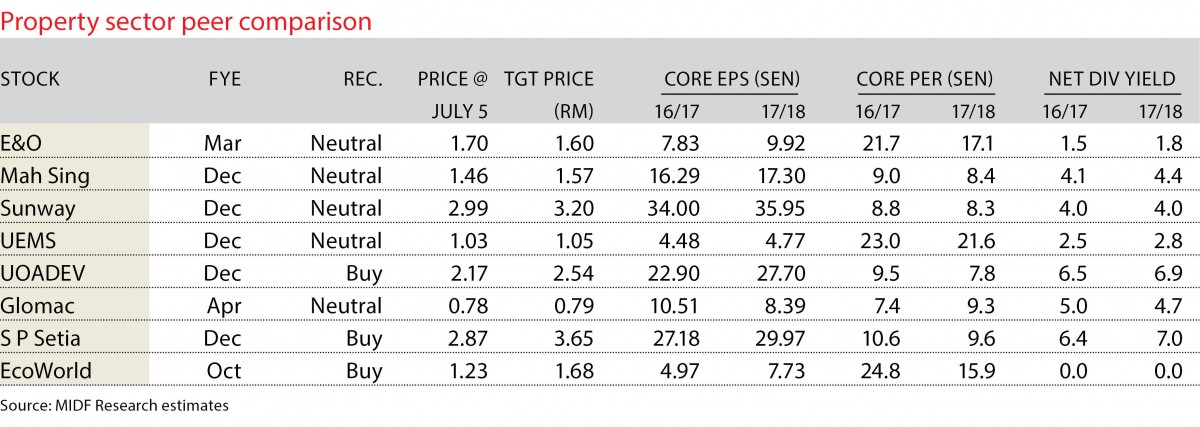

We maintain our “neutral” call on the property sector, with UOA Development Bhd as our top pick with a target price of RM2.54. — MIDF Research, July 8

This article first appeared in The Edge Financial Daily, on July 11, 2016. Subscribe to The Edge Financial Daily here.

Follow Us

Follow our channels to receive property news updates 24/7 round the clock.

Telegram

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.