KLCC Property Stapled Group (Aug 4, RM7.65)

Maintain hold with an unchanged target price (TP) of RM7.35: In conjunction with KLCC Property Stapled Group’s (KLCCPSG) first half ended June 30, 2016 (1HFY16) results release, we joined about 20 to 25 analysts and fund managers for an analyst briefing at Mandarin Oriental Hotel. The briefing was chaired by the company’s chief financial officer Annuar Marzuki, together with group chief executive officer Datuk Hashim Wahir who was also in attendance to respond to any questions raised. There were no major surprises, but we note that the management’s tone was conservative and it cautioned that the operating environment remained challenging for the group.

For the second quarter financial year 2016 (2QFY16), the Group maintained its 100% occupancy rates for its office segment. The management remains fairly confident in its outlook for its office division (despite the anticipated influx of office space supply) given that its tenants are all locked in long-term leases with the group. We gather that the conversion of atrium spaces will add an additional 39,000 sq ft to Menara Dayabumi’s net lettable area, and the management is in the midst of negotiating a triple net lease which will be fully tenanted by Petroliam Nasional Bhd.

While the Group’s hotel segment’s revenue increased 7.6% year-on-year (y-o-y) for 1HFY16, profit before tax sank into a loss of RM4.6 million, but this was amplified by the RM2.5 million write-off of furniture and fittings of Sultan’s Lounge and Casbah in Mandarin Oriental. The management expects demand for the luxury hotel segment to remain lacklustre in the near term, and foresees occupancy rates hovering at 65% to 67% as the supply of hotel rooms is expected to increase by 7,700 rooms by 2020.

As for Suria KLCC, rental reversion rates remained healthy at about +3% to 4% (y-o-y) and averaged about RM30 per sq ft as at 2QFY16. While 2QFY16 occupancy rates fell to 96% (versus 1QFY16: 98%), we suspect that this was due to the reconfiguration of the mall’s Level 1 to a men’s luxury precinct and we expect occupancy rates to climb back up as new brands come on board (that includes Omega, Hugo Boss, Rolex and Dunhill). Notably, retail sales increased at a healthy +8% y-o-y, despite the overall weaker consumer spending environment.

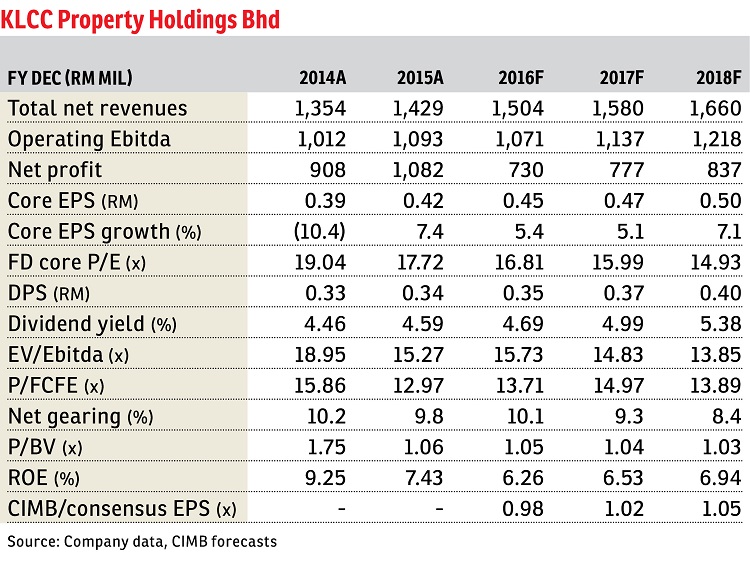

Post-analyst briefing, we keep our “hold” call with an unchanged 12-month dividend discount model-based TP, given the lack of strong rerating catalysts. Though the hotel segment’s outlook will remain difficult, we expect the group’s earnings to be kept afloat by healthy rental reversion from Suria KLCC, as well as its stable office segment given their long-term leases.

Upside risk includes stronger-than-expected consumer sentiment, while downside risk is an intensified competitive landscape for its office and hotel segments.— CIMB Research, Aug 3

Want to know the price trends of a development? Click here.

This article first appeared in The Edge Financial Daily, on Aug 5, 2016. Subscribe to The Edge Financial Daily here.